In this assignment, you are provided with a case that includes data relating to static budget, flexible budget, and variance analysis. You will transcribe the data from the case and create a: Static budget Actual budget Flexible budget Static budget variance Flexible budget variance Variance analysis You will also write a memo regarding possible unethical practices during budget preparation

CASE: Sparkling Clean Services (SCS) is a local business in the Tri-cities area. It provides cleaning services to residential households and commercial establishments. Both households and businesses sign contracts with SCS. As the contractor, SCS dispatches its crew to the locations. The crew performs the cleaning as per the contracts and reports back to the company main desk. The main desk then prepares the invoice and sends them to the clients. Clients have one day to pay the invoice. Sales volume can vary from one quarter to the next. In terms of expenses, the main expense for SCS relates to labour. They pay crew members competitive wages and benefits. The wage rate is calculated on an hourly basis and is fixed for the entire year. The next expense item is cleaning supplies. SCS accounts for cleaning supplies relative to the hours worked. For example, they estimate that cleaning supplies are consumed at a rate of 0.2 litres per labour hour. This is a good measure because the longer it takes for a site to be cleaned, the more the consumption of cleaning supplies. Cleaning supplies are procured from a prominent vendor and the cost is fixed for the entire year. Sometimes clients are not happy about the cleaning services and register a complaint. In that case, the crew is dispatched again for a second cleaning. The hours accruing from such scenarios are not billed to the clean as this constitutes a service recovery. However, the crew is paid for such hours. SCS maintains a record of these hours and classifies them as unproductive hours, or unbilled hours. This is calculated as a percentage of revenue earning hours (e.g., 10% of revenue generating hours). For the purpose of this assignment, assume that there is no consumption of cleaning materials when this second cleaning is being done

Please answer

Please answer

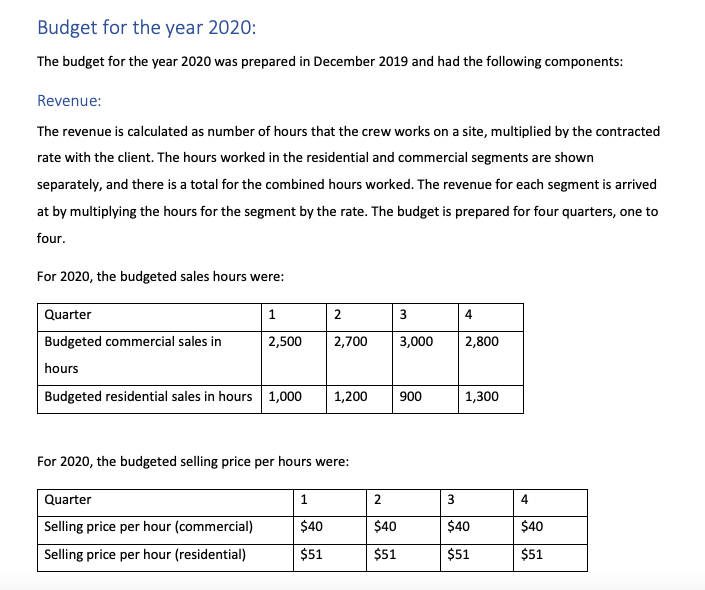

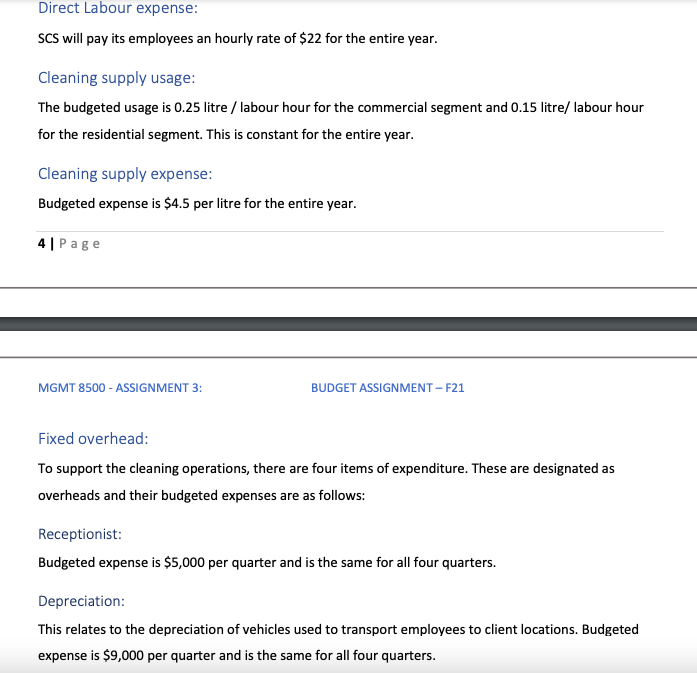

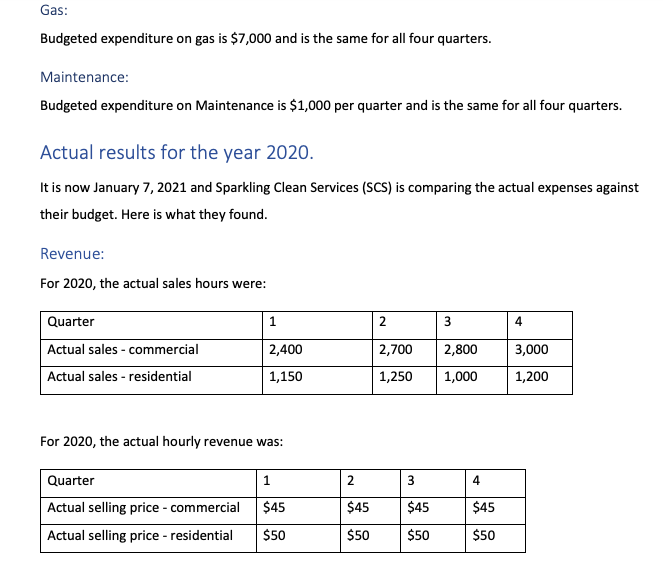

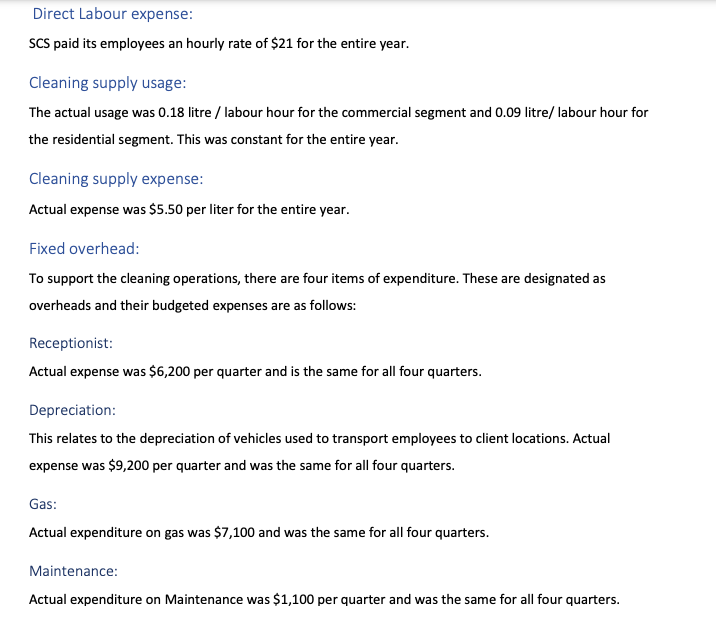

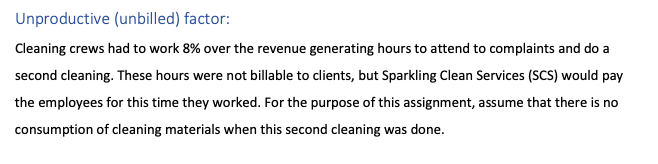

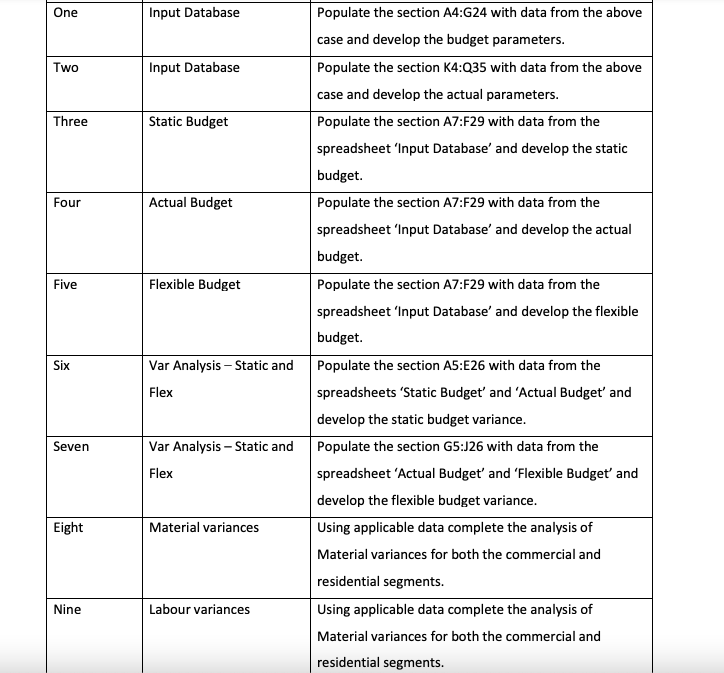

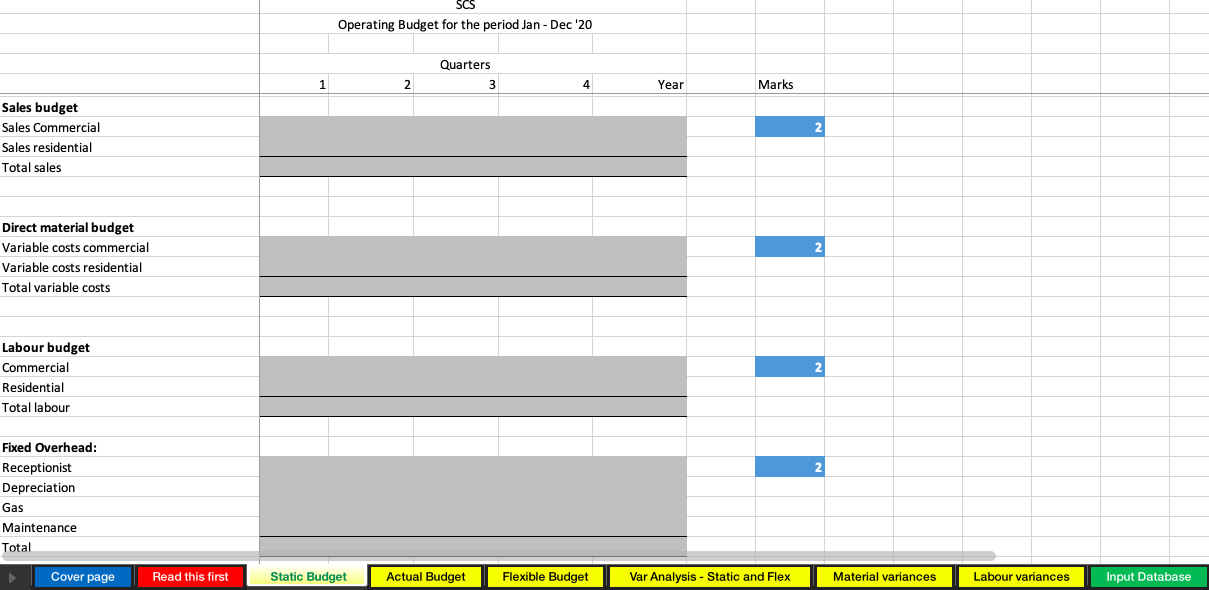

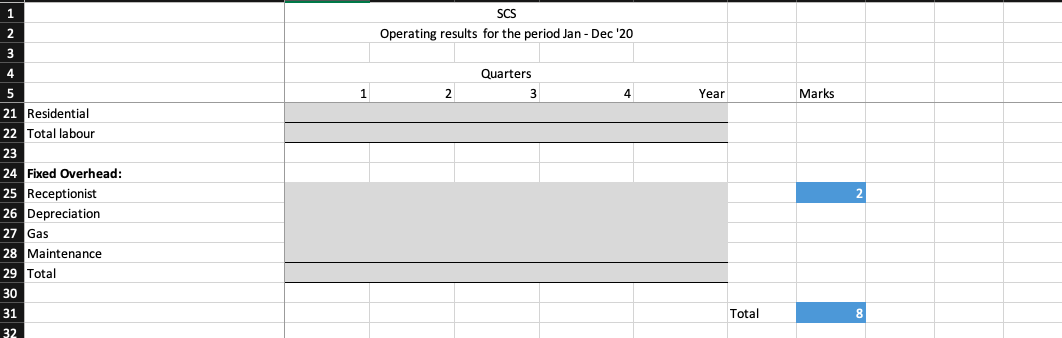

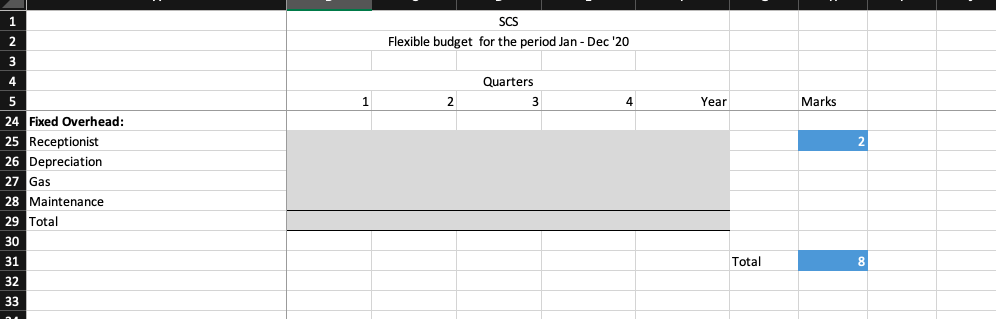

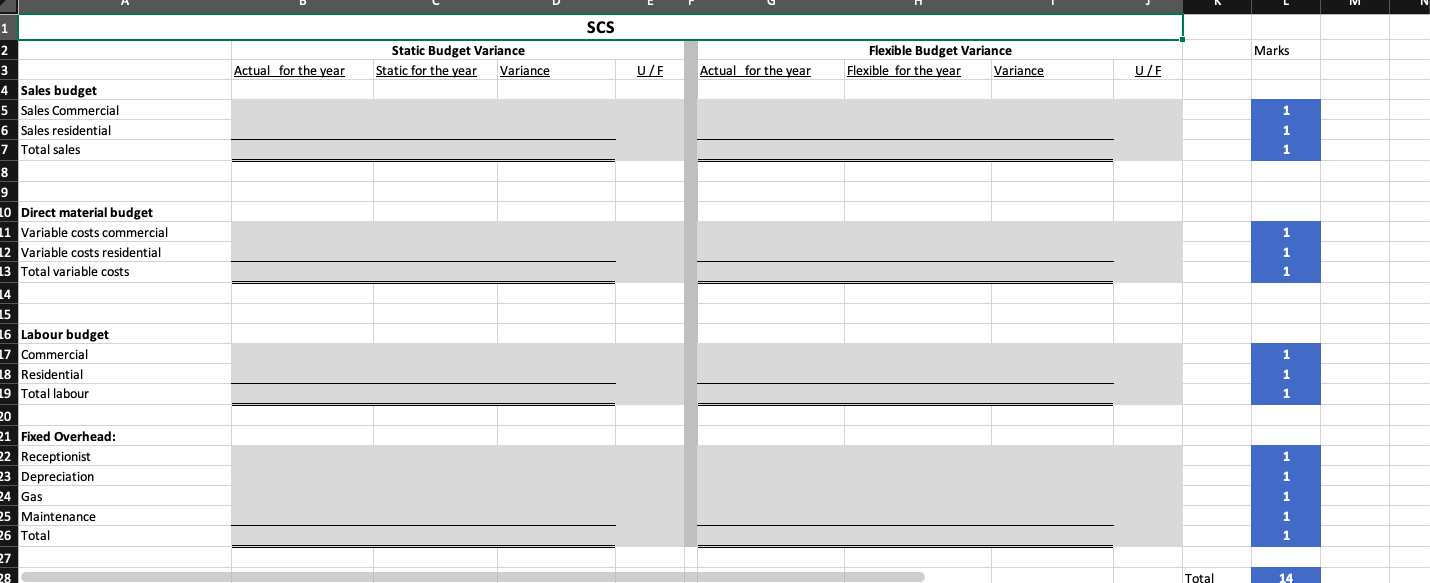

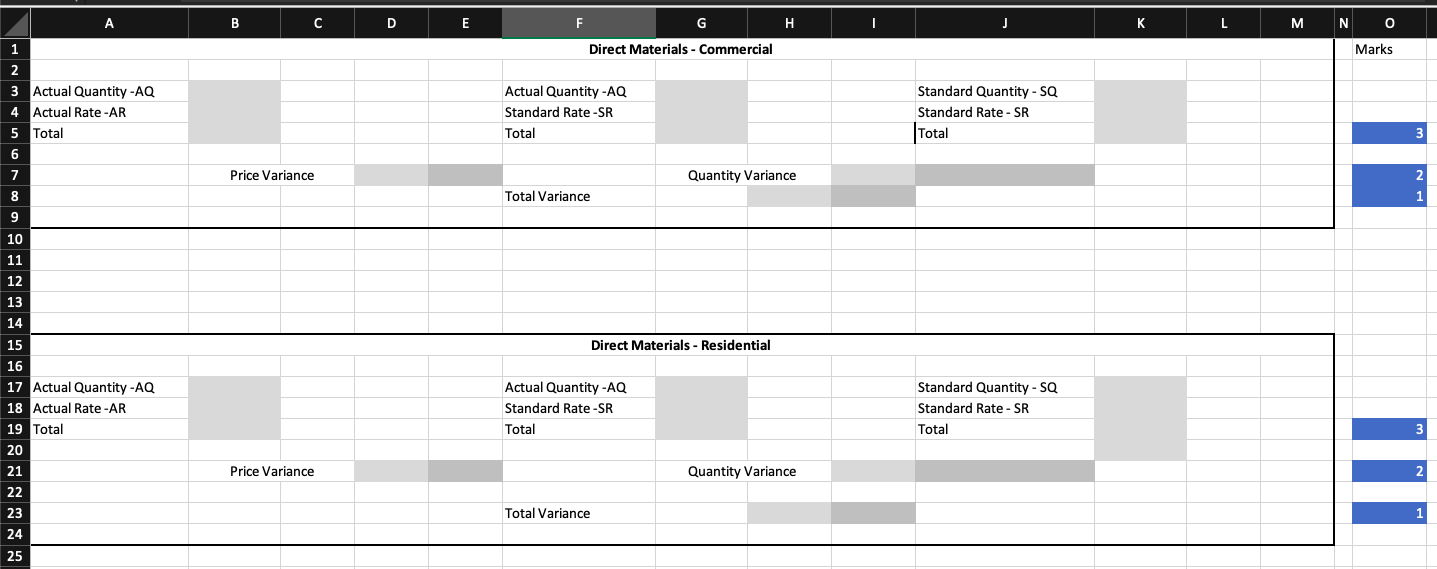

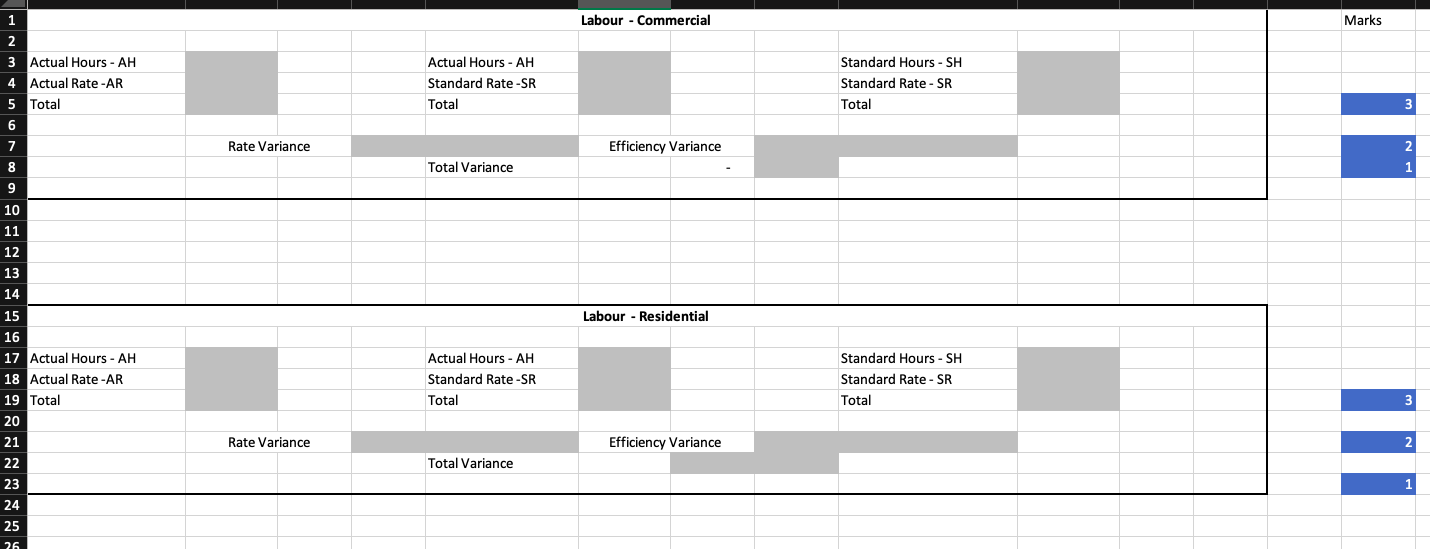

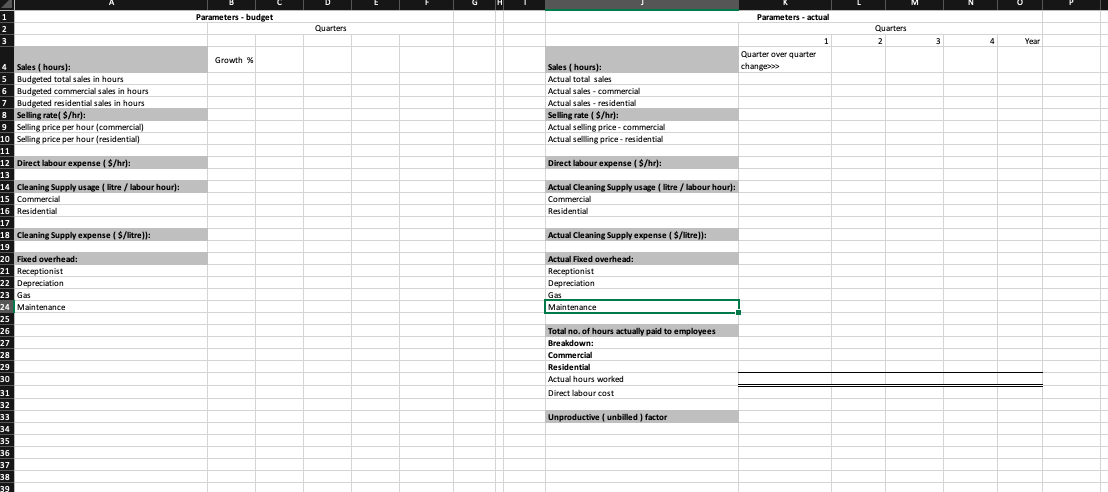

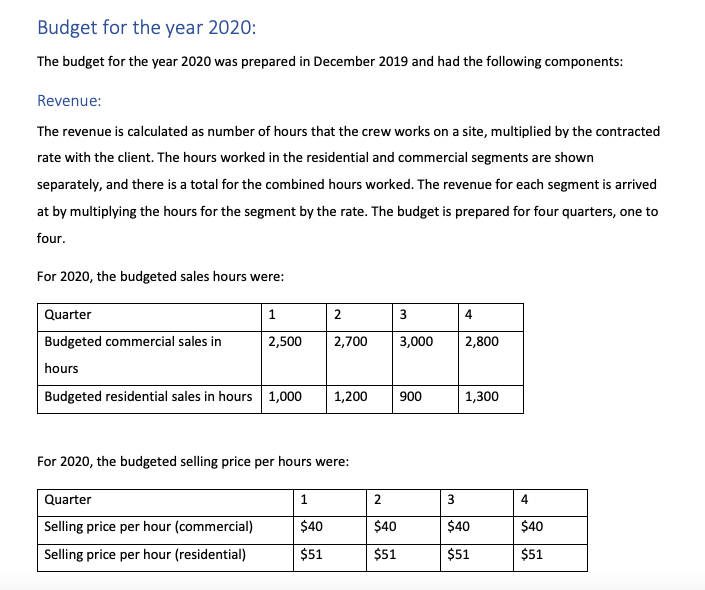

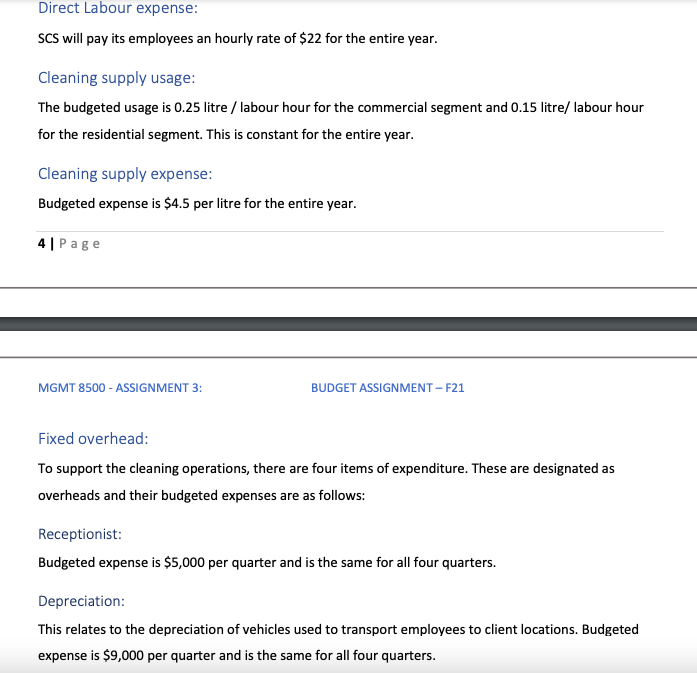

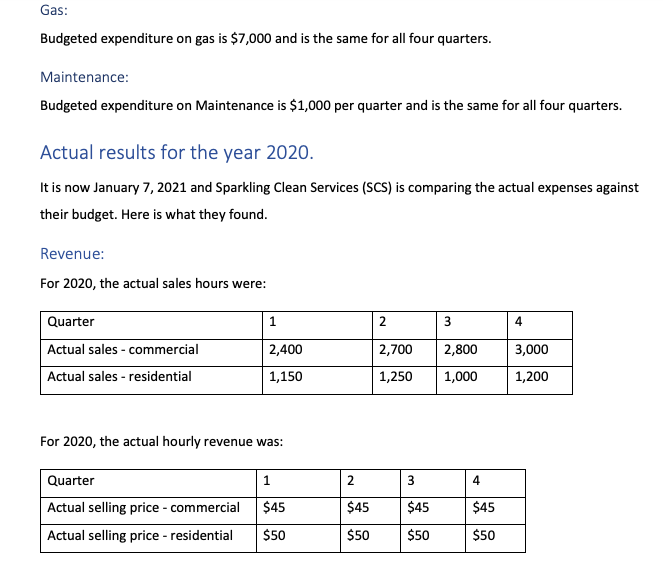

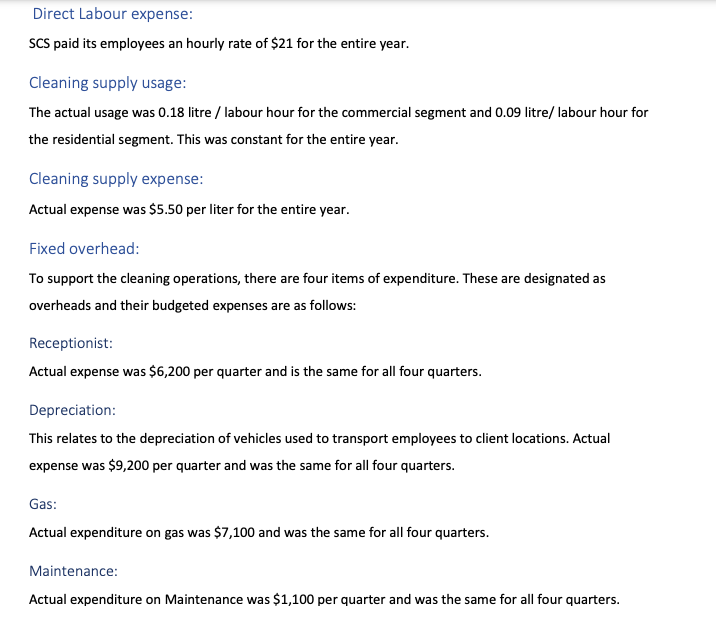

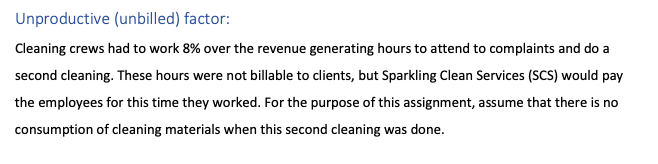

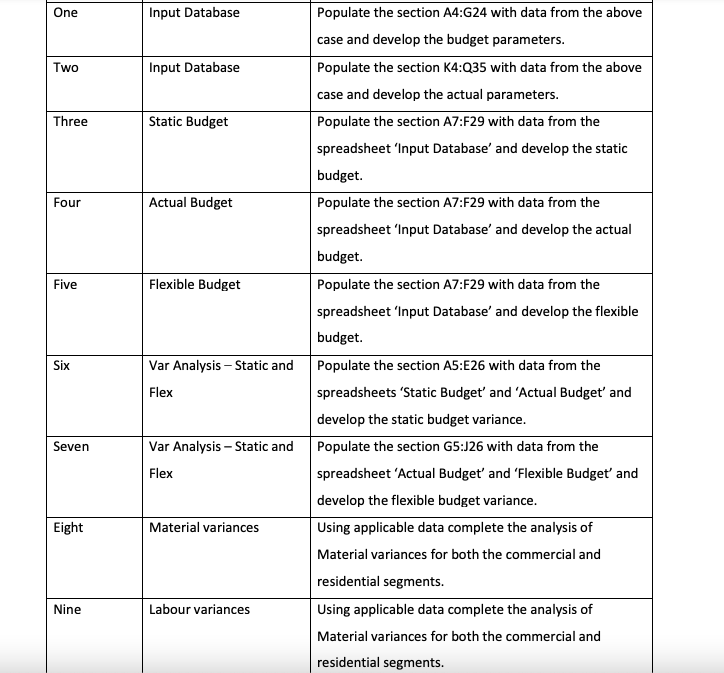

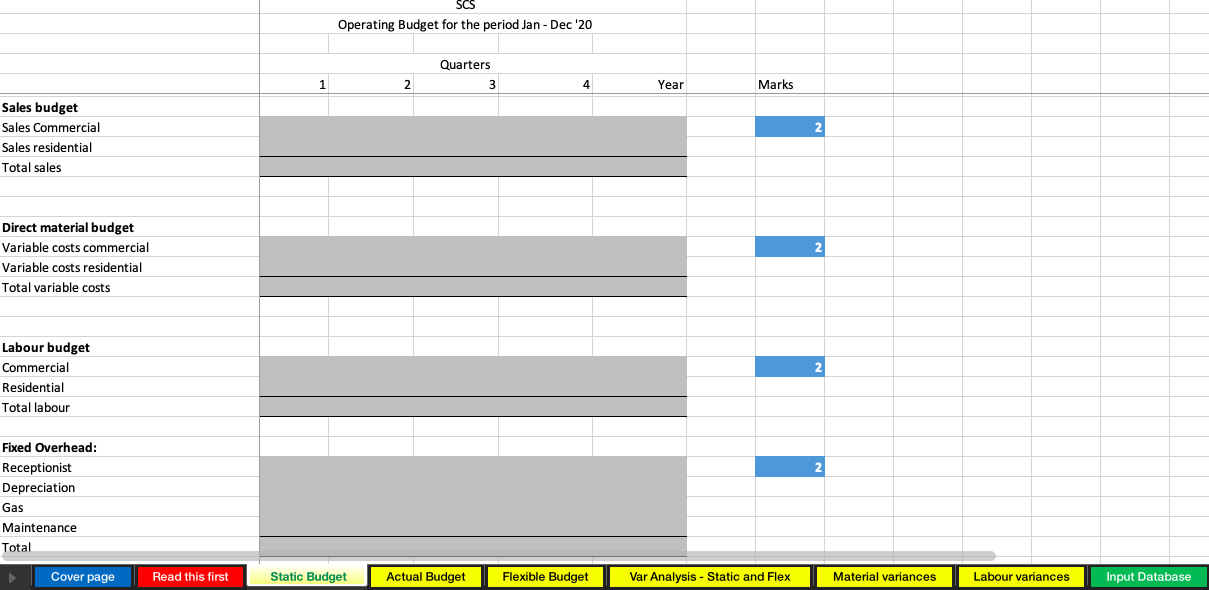

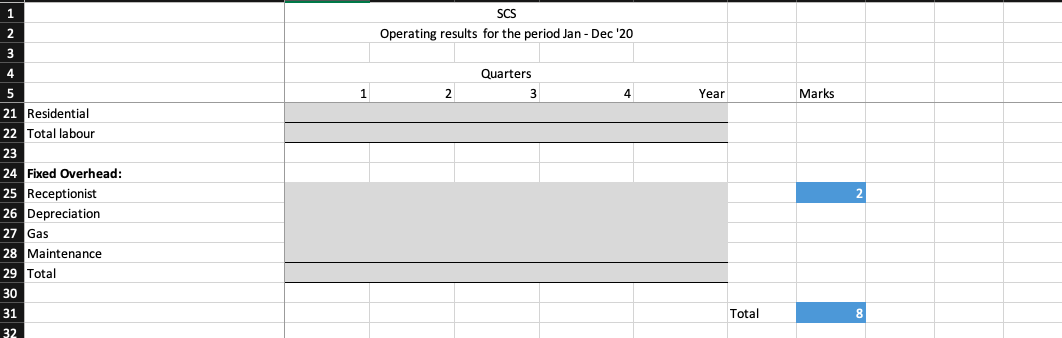

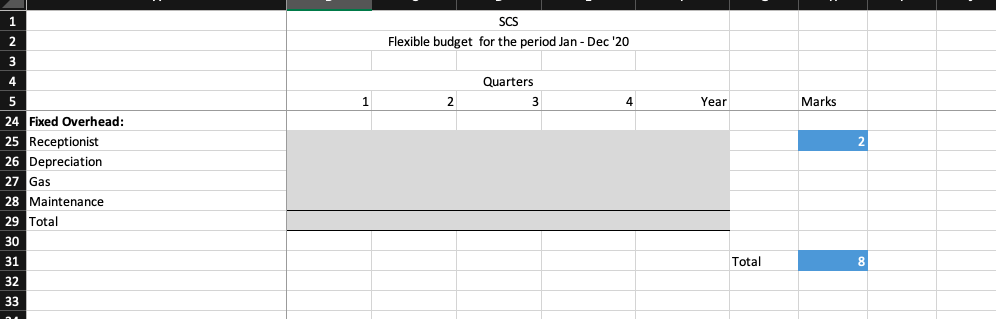

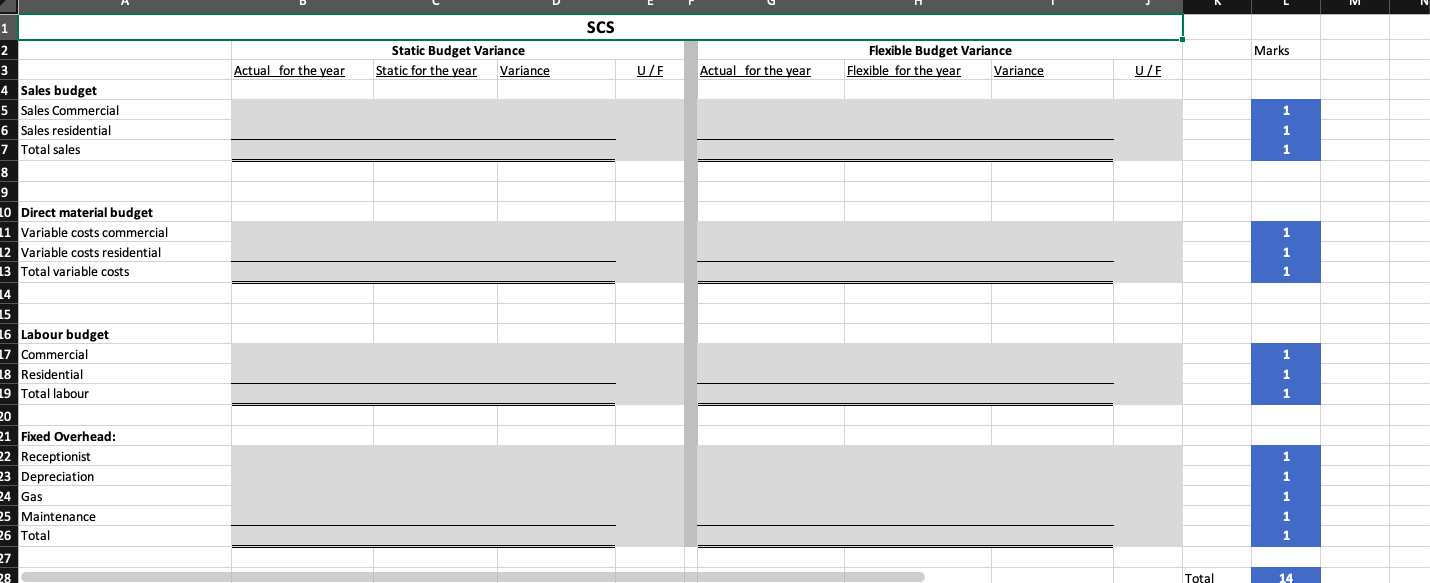

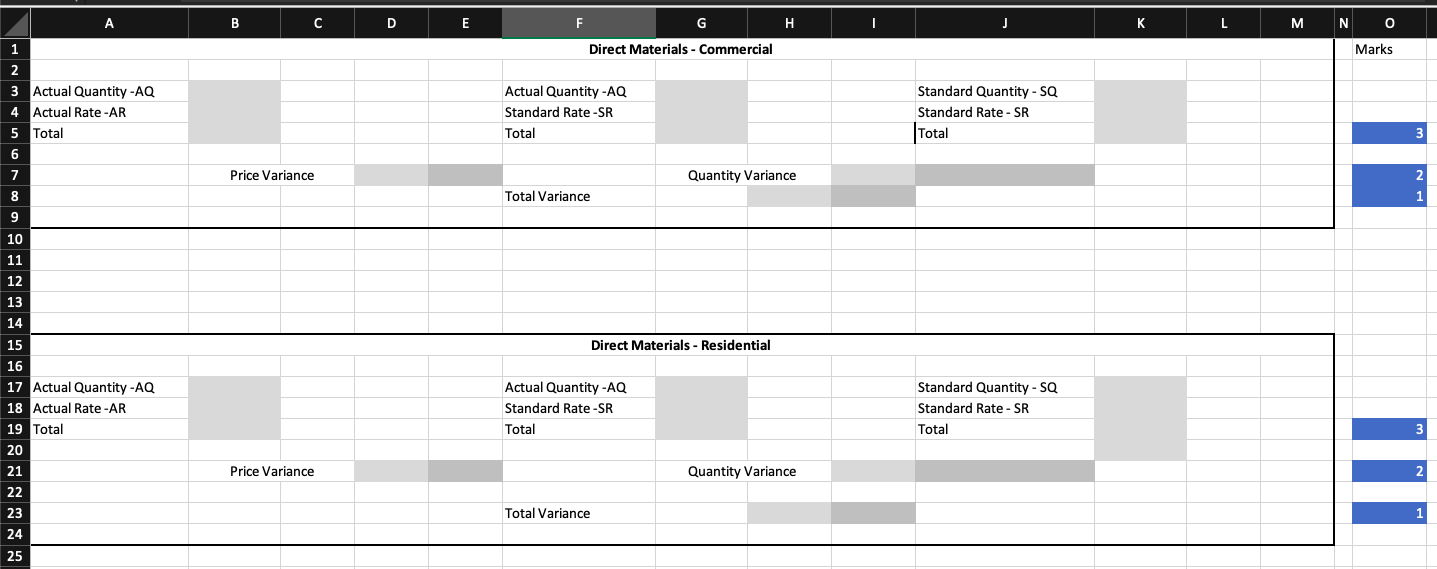

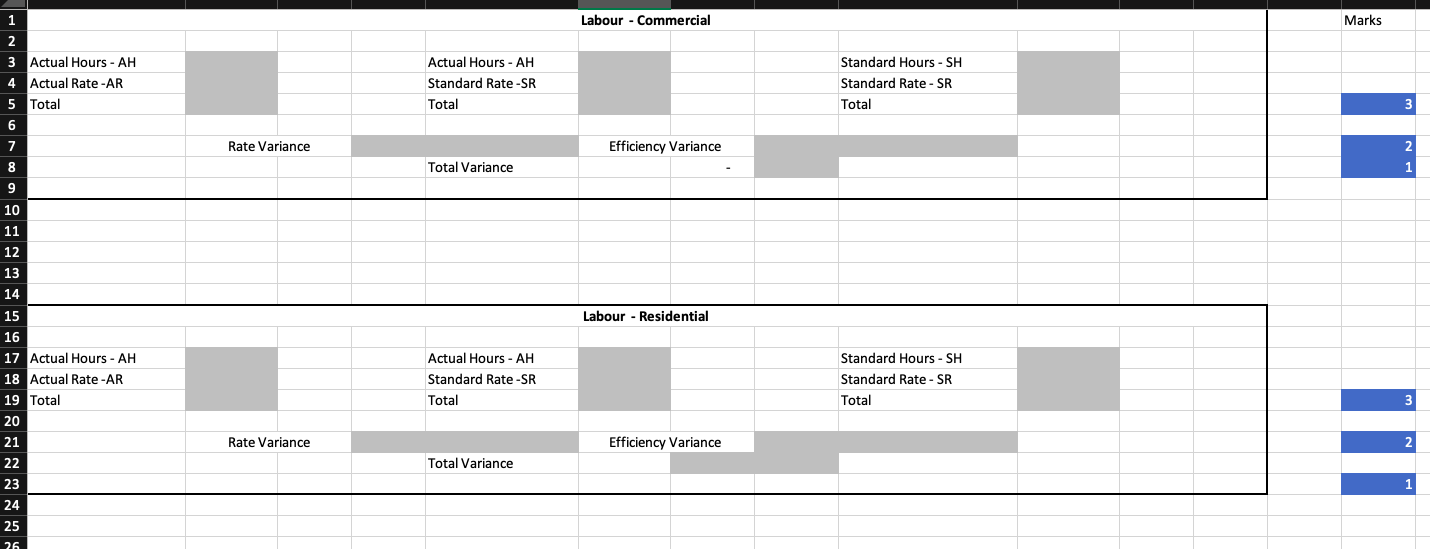

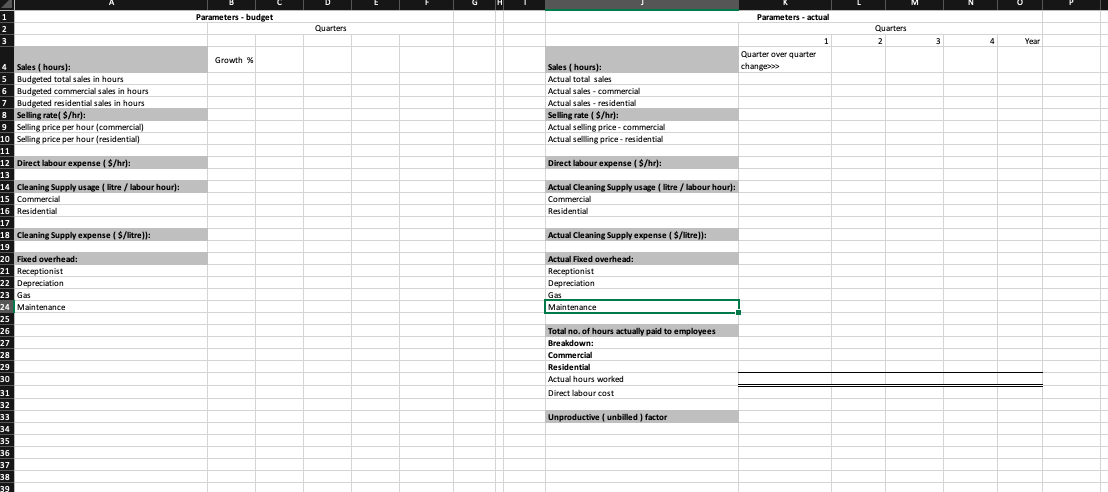

Budget for the year 2020: The budget for the year 2020 was prepared in December 2019 and had the following components: Revenue: The revenue is calculated as number of hours that the crew works on a site, multiplied by the contracted rate with the client. The hours worked in the residential and commercial segments are shown separately, and there is a total for the combined hours worked. The revenue for each segment is arrived at by multiplying the hours for the segment by the rate. The budget is prepared for four quarters, one to four. For 2020, the budgeted sales hours were: 1 2 3 4 Quarter Budgeted commercial sales in 2,500 2,700 3,000 2,800 hours Budgeted residential sales in hours 1,000 1,200 900 1,300 For 2020, the budgeted selling price per hours were: 1 2 3 4 Quarter Selling price per hour (commercial) Selling price per hour (residential) $40 $40 $40 $40 $51 $51 $51 $51 Direct Labour expense: SCS will pay its employees an hourly rate of $22 for the entire year. Cleaning supply usage: The budgeted usage is 0.25 litre / labour hour for the commercial segment and 0.15 litre/ labour hour for the residential segment. This is constant for the entire year. Cleaning supply expense: Budgeted expense is $4.5 per litre for the entire year. 4 Page MGMT 8500 - ASSIGNMENT 3: BUDGET ASSIGNMENT-F21 Fixed overhead: To support the cleaning operations, there are four items of expenditure. These are designated as overheads and their budgeted expenses are as follows: Receptionist: Budgeted expense is $5,000 per quarter and is the same for all four quarters. Depreciation: This relates to the depreciation of vehicles used to transport employees to client locations. Budgeted expense is $9,000 per quarter and is the same for all four quarters. Gas: Budgeted expenditure on gas is $7,000 and is the same for all four quarters. Maintenance: Budgeted expenditure on Maintenance is $1,000 per quarter and is the same for all four quarters. Actual results for the year 2020. It is now January 7, 2021 and Sparkling Clean Services (SCS) is comparing the actual expenses against their budget. Here is what they found. Revenue: For 2020, the actual sales hours were: 1 2 3 4 Quarter Actual sales - commercial Actual sales - residential 2,700 2,800 2,400 1,150 3,000 1,200 1,250 1,000 For 2020, the actual hourly revenue was: 1 2 3 4 Quarter Actual selling price - commercial Actual selling price - residential $45 $45 $45 $45 $50 $50 $50 $50 Direct Labour expense: SCS paid its employees an hourly rate of $21 for the entire year. Cleaning supply usage: The actual usage was 0.18 litre / labour hour for the commercial segment and 0.09 litre/ labour hour for the residential segment. This was constant for the entire year. Cleaning supply expense: Actual expense was $5.50 per liter for the entire year. Fixed overhead: To support the cleaning operations, there are four items of expenditure. These are designated as overheads and their budgeted expenses are as follows: Receptionist: Actual expense was $6,200 per quarter and is the same for all four quarters. Depreciation: This relates to the depreciation of vehicles used to transport employees to client locations. Actual expense was $9,200 per quarter and was the same for all four quarters. Gas: Actual expenditure on gas was $7,100 and was the same for all four quarters. Maintenance: Actual expenditure on Maintenance was $1,100 per quarter and was the same for all four quarters. Unproductive (unbilled) factor: Cleaning crews had to work 8% over the revenue generating hours to attend to complaints and do a second cleaning. These hours were not billable to clients, but Sparkling Clean Services (SCS) would pay the employees for this time they worked. For the purpose of this assignment, assume that there is no consumption of cleaning materials when this second cleaning was done. One Two Three Four Five Input Database Populate the section A4:G24 with data from the above case and develop the budget parameters. Input Database Populate the section K4:Q35 with data from the above case and develop the actual parameters. Static Budget Populate the section A7:F29 with data from the spreadsheet 'Input Database' and develop the static budget. Actual Budget Populate the section A7:F29 with data from the spreadsheet 'Input Database' and develop the actual budget Flexible Budget Populate the section A7:F29 with data from the spreadsheet 'Input Database' and develop the flexible budget. Var Analysis - Static and Populate the section A5:E26 with data from the Flex spreadsheets 'Static Budget' and 'Actual Budget' and develop the static budget variance. Var Analysis - Static and Populate the section G5:326 with data from the Flex spreadsheet 'Actual Budget' and 'Flexible Budget' and develop the flexible budget variance. Material variances Using applicable data complete the analysis of Material variances for both the commercial and residential segments. Labour variances Using applicable data complete the analysis of Material variances for both the commercial and residential segments. Six Seven Eight Nine Operating Budget for the period Jan-Dec '20 Quarters 1 2 4 Year Marks 2 Sales budget Sales Commercial Sales residential Total sales 2 Direct material budget Variable costs commercial Variable costs residential Total variable costs 2 Labour budget Commercial Residential Total labour 2 Fixed Overhead: Receptionist Depreciation Gas Maintenance Total Cover page Read this first Static Budget Actual Budget Flexible Budget Var Analysis - Static and Flex Material variances Labour variances Input Database 1 SCS Operating results for the period Jan-Dec '20 2 3 Quarters 3 1 2 4 Year Marks 2 4 5 21 Residential 22 Total labour 23 24 Fixed Overhead: 25 Receptionist 26 Depreciation 27 Gas 28 Maintenance 29 Total 30 31 32 Total 1 SCS Flexible budget for the period Jan-Dec '20 2 3 4 Quarters 3 1 2 4 Year Marks 2 5 24 Fixed Overhead: 25 Receptionist 26 Depreciation 27 Gas 28 Maintenance 29 Total 30 31 Total 8 32 33 SCS Marks Static Budget Variance Static for the year Variance Flexible Budget Variance Flexible for the year Variance Actual for the year U/F Actual for the year U/E 1 2 3 4 Sales budget 5 Sales Commercial 6 Sales residential 7 Total sales 1 1 1 1 1 8 9 10 Direct material budget 11 Variable costs commercial 12 Variable costs residential 13 Total variable costs 14 15 16 Labour budget 17 Commercial 18 Residential 19 Total labour 20 21 Fixed Overhead: 22 Receptionist 23 Depreciation 24 Gas 25 Maintenance 26 Total 1 1 1 1 1 27 28 Total 14 B C D E F G H I J K L . N 0 Direct Materials - Commercial Marks Actual Quantity -AQ Standard Rate -SR Total Standard Quantity - SQ Standard Rate - SR Total 3 Price Variance Quantity Variance 2 Total Variance 1 2 3 Actual Quantity -AQ 4 Actual Rate -AR 5 Total 6 7 8 9 10 11 12 13 14 15 16 17 Actual Quantity -AQ 18 Actual Rate -AR 19 Total 20 21 Direct Materials - Residential Actual Quantity -AQ Standard Rate -SR Total Standard Quantity - SQ Standard Rate - SR Total 3 Price Variance Quantity Variance 22 23 Total Variance 24 25 1 Labour - Commercial Marks 2 3 Actual Hours - AH 4 Actual Rate -AR 5 Total 6 7 8 Actual Hours - AH Standard Rate -SR Total Standard Hours - SH Standard Rate - SR Total 3 Rate Variance Efficiency Variance 2 Total Variance 1 9 10 11 12 13 14 Labour - Residential Actual Hours - AH Standard Rate -SR Total Standard Hours - SH Standard Rate - SR Total 3 15 16 17 Actual Hours - AH 18 Actual Rate -AR 19 Total 20 21 22 23 24 25 Rate Variance Efficiency Variance 2 Total Variance 1 26 M Parameters - budget Parameters - actual 1 2 3 Quarters Quarters 2 1 3 Year Growth % Quarter over quarter change>>> Sales (hours): Actual total sales Actual sales - commercial Actual sales - residential Selling rate (/hr): Actual selling price-commercial Actual selling price-residential Direct labour expense (/hr): Actual Cleaning Supply usage ( litre / labour hour): ): Commercial Residential Actual Cleaning Supply expense ($/litre)); 4 Sales (hours): 5 Budgeted total sales in hours 6 Budgeted commercial sales in hours 7 Budgeted residential sales in hours 8 Selling rate $/hr): 9 Selling price per hour (commercial) 10 Selling price per hour (residential) 11 12 Direct labour expense ($/hr): 13 14 Cleaning Supply usage ( litre / labour hour): 15 Commercial 16 Residential 17 18 Cleaning Supply expense ($/litre)): 19 20 Fixed overhead: 21 Receptionist 22 Depreciation 23 Gas 24 Maintenance 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 Actual Fixed overhead: Receptionist Depreciation Gas Maintenance Total no. of hours actually paid to employees Breakdown: Commercial Residential Actual hours worked Direct labour cost Unproductive (unbilled) factor Budget for the year 2020: The budget for the year 2020 was prepared in December 2019 and had the following components: Revenue: The revenue is calculated as number of hours that the crew works on a site, multiplied by the contracted rate with the client. The hours worked in the residential and commercial segments are shown separately, and there is a total for the combined hours worked. The revenue for each segment is arrived at by multiplying the hours for the segment by the rate. The budget is prepared for four quarters, one to four. For 2020, the budgeted sales hours were: 1 2 3 4 Quarter Budgeted commercial sales in 2,500 2,700 3,000 2,800 hours Budgeted residential sales in hours 1,000 1,200 900 1,300 For 2020, the budgeted selling price per hours were: 1 2 3 4 Quarter Selling price per hour (commercial) Selling price per hour (residential) $40 $40 $40 $40 $51 $51 $51 $51 Direct Labour expense: SCS will pay its employees an hourly rate of $22 for the entire year. Cleaning supply usage: The budgeted usage is 0.25 litre / labour hour for the commercial segment and 0.15 litre/ labour hour for the residential segment. This is constant for the entire year. Cleaning supply expense: Budgeted expense is $4.5 per litre for the entire year. 4 Page MGMT 8500 - ASSIGNMENT 3: BUDGET ASSIGNMENT-F21 Fixed overhead: To support the cleaning operations, there are four items of expenditure. These are designated as overheads and their budgeted expenses are as follows: Receptionist: Budgeted expense is $5,000 per quarter and is the same for all four quarters. Depreciation: This relates to the depreciation of vehicles used to transport employees to client locations. Budgeted expense is $9,000 per quarter and is the same for all four quarters. Gas: Budgeted expenditure on gas is $7,000 and is the same for all four quarters. Maintenance: Budgeted expenditure on Maintenance is $1,000 per quarter and is the same for all four quarters. Actual results for the year 2020. It is now January 7, 2021 and Sparkling Clean Services (SCS) is comparing the actual expenses against their budget. Here is what they found. Revenue: For 2020, the actual sales hours were: 1 2 3 4 Quarter Actual sales - commercial Actual sales - residential 2,700 2,800 2,400 1,150 3,000 1,200 1,250 1,000 For 2020, the actual hourly revenue was: 1 2 3 4 Quarter Actual selling price - commercial Actual selling price - residential $45 $45 $45 $45 $50 $50 $50 $50 Direct Labour expense: SCS paid its employees an hourly rate of $21 for the entire year. Cleaning supply usage: The actual usage was 0.18 litre / labour hour for the commercial segment and 0.09 litre/ labour hour for the residential segment. This was constant for the entire year. Cleaning supply expense: Actual expense was $5.50 per liter for the entire year. Fixed overhead: To support the cleaning operations, there are four items of expenditure. These are designated as overheads and their budgeted expenses are as follows: Receptionist: Actual expense was $6,200 per quarter and is the same for all four quarters. Depreciation: This relates to the depreciation of vehicles used to transport employees to client locations. Actual expense was $9,200 per quarter and was the same for all four quarters. Gas: Actual expenditure on gas was $7,100 and was the same for all four quarters. Maintenance: Actual expenditure on Maintenance was $1,100 per quarter and was the same for all four quarters. Unproductive (unbilled) factor: Cleaning crews had to work 8% over the revenue generating hours to attend to complaints and do a second cleaning. These hours were not billable to clients, but Sparkling Clean Services (SCS) would pay the employees for this time they worked. For the purpose of this assignment, assume that there is no consumption of cleaning materials when this second cleaning was done. One Two Three Four Five Input Database Populate the section A4:G24 with data from the above case and develop the budget parameters. Input Database Populate the section K4:Q35 with data from the above case and develop the actual parameters. Static Budget Populate the section A7:F29 with data from the spreadsheet 'Input Database' and develop the static budget. Actual Budget Populate the section A7:F29 with data from the spreadsheet 'Input Database' and develop the actual budget Flexible Budget Populate the section A7:F29 with data from the spreadsheet 'Input Database' and develop the flexible budget. Var Analysis - Static and Populate the section A5:E26 with data from the Flex spreadsheets 'Static Budget' and 'Actual Budget' and develop the static budget variance. Var Analysis - Static and Populate the section G5:326 with data from the Flex spreadsheet 'Actual Budget' and 'Flexible Budget' and develop the flexible budget variance. Material variances Using applicable data complete the analysis of Material variances for both the commercial and residential segments. Labour variances Using applicable data complete the analysis of Material variances for both the commercial and residential segments. Six Seven Eight Nine Operating Budget for the period Jan-Dec '20 Quarters 1 2 4 Year Marks 2 Sales budget Sales Commercial Sales residential Total sales 2 Direct material budget Variable costs commercial Variable costs residential Total variable costs 2 Labour budget Commercial Residential Total labour 2 Fixed Overhead: Receptionist Depreciation Gas Maintenance Total Cover page Read this first Static Budget Actual Budget Flexible Budget Var Analysis - Static and Flex Material variances Labour variances Input Database 1 SCS Operating results for the period Jan-Dec '20 2 3 Quarters 3 1 2 4 Year Marks 2 4 5 21 Residential 22 Total labour 23 24 Fixed Overhead: 25 Receptionist 26 Depreciation 27 Gas 28 Maintenance 29 Total 30 31 32 Total 1 SCS Flexible budget for the period Jan-Dec '20 2 3 4 Quarters 3 1 2 4 Year Marks 2 5 24 Fixed Overhead: 25 Receptionist 26 Depreciation 27 Gas 28 Maintenance 29 Total 30 31 Total 8 32 33 SCS Marks Static Budget Variance Static for the year Variance Flexible Budget Variance Flexible for the year Variance Actual for the year U/F Actual for the year U/E 1 2 3 4 Sales budget 5 Sales Commercial 6 Sales residential 7 Total sales 1 1 1 1 1 8 9 10 Direct material budget 11 Variable costs commercial 12 Variable costs residential 13 Total variable costs 14 15 16 Labour budget 17 Commercial 18 Residential 19 Total labour 20 21 Fixed Overhead: 22 Receptionist 23 Depreciation 24 Gas 25 Maintenance 26 Total 1 1 1 1 1 27 28 Total 14 B C D E F G H I J K L . N 0 Direct Materials - Commercial Marks Actual Quantity -AQ Standard Rate -SR Total Standard Quantity - SQ Standard Rate - SR Total 3 Price Variance Quantity Variance 2 Total Variance 1 2 3 Actual Quantity -AQ 4 Actual Rate -AR 5 Total 6 7 8 9 10 11 12 13 14 15 16 17 Actual Quantity -AQ 18 Actual Rate -AR 19 Total 20 21 Direct Materials - Residential Actual Quantity -AQ Standard Rate -SR Total Standard Quantity - SQ Standard Rate - SR Total 3 Price Variance Quantity Variance 22 23 Total Variance 24 25 1 Labour - Commercial Marks 2 3 Actual Hours - AH 4 Actual Rate -AR 5 Total 6 7 8 Actual Hours - AH Standard Rate -SR Total Standard Hours - SH Standard Rate - SR Total 3 Rate Variance Efficiency Variance 2 Total Variance 1 9 10 11 12 13 14 Labour - Residential Actual Hours - AH Standard Rate -SR Total Standard Hours - SH Standard Rate - SR Total 3 15 16 17 Actual Hours - AH 18 Actual Rate -AR 19 Total 20 21 22 23 24 25 Rate Variance Efficiency Variance 2 Total Variance 1 26 M Parameters - budget Parameters - actual 1 2 3 Quarters Quarters 2 1 3 Year Growth % Quarter over quarter change>>> Sales (hours): Actual total sales Actual sales - commercial Actual sales - residential Selling rate (/hr): Actual selling price-commercial Actual selling price-residential Direct labour expense (/hr): Actual Cleaning Supply usage ( litre / labour hour): ): Commercial Residential Actual Cleaning Supply expense ($/litre)); 4 Sales (hours): 5 Budgeted total sales in hours 6 Budgeted commercial sales in hours 7 Budgeted residential sales in hours 8 Selling rate $/hr): 9 Selling price per hour (commercial) 10 Selling price per hour (residential) 11 12 Direct labour expense ($/hr): 13 14 Cleaning Supply usage ( litre / labour hour): 15 Commercial 16 Residential 17 18 Cleaning Supply expense ($/litre)): 19 20 Fixed overhead: 21 Receptionist 22 Depreciation 23 Gas 24 Maintenance 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 Actual Fixed overhead: Receptionist Depreciation Gas Maintenance Total no. of hours actually paid to employees Breakdown: Commercial Residential Actual hours worked Direct labour cost Unproductive (unbilled) factor

Please answer

Please answer