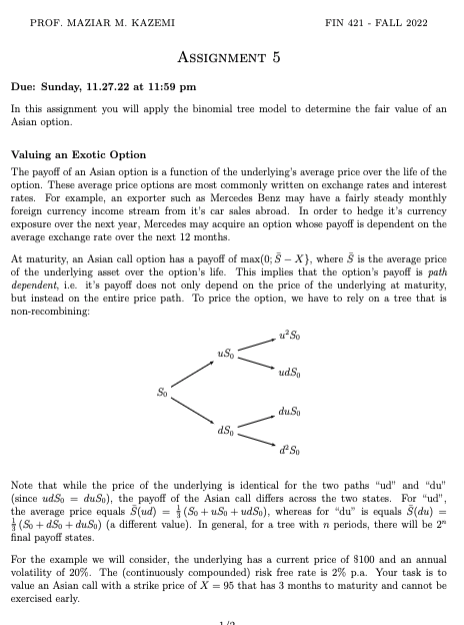

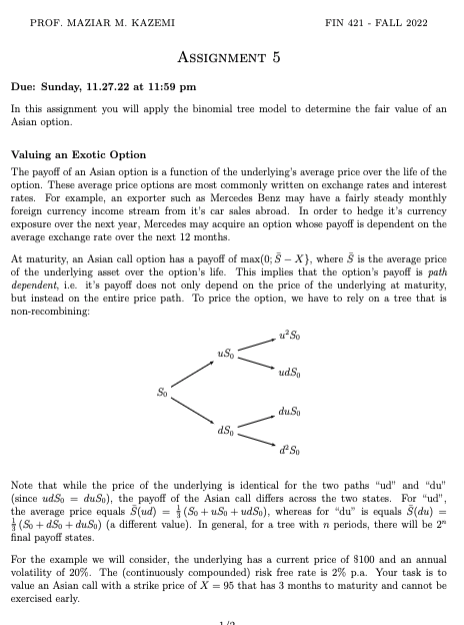

In this assignment you will apply the binomial tree model to determine the fair value of an Asian option. Valuing an Exotic Option The payoff of an Asian option is a function of the underlying's average price over the life of the option. These average price options are most commonly written on exchange rates and interest rates, For example, an exporter such as Mercedes Benz may have a fairly steady monthly foreign currency income stream from it's car sales abroad. In order to hedge it's currency exposure over the next year, Mercedes may acquire an option whose payoff is dependent on the average exchange rate over the next 12 months. At maturity, an Asian call option has a payoff of max(0;SX}, where S is the average price of the underlying asset over the option's life. This implies that the option's payoff is path dependent, i.e. it's payoft does not only depend on the price of the underlying at maturity, but instead on the entire price path. To price the option, we have to rely on a tree that is non-recombining: Note that while the price of the underlying is identical for the two paths "ud" and "du" (since udS0=duS0 ), the payoff of the Asian call differs across the two states. For "ud", the average price equals S(ud)=31(S0+uS0+udS0), whereas for "du" is equals S(du)= 81(S0+dS0+duS0) (a different value). In general, for a tree with n periods, there will be 2n final payoff states. For the example we will consider, the underlying has a current price of 8100 and an annual volatility of 20%. The (continuously compounded) risk free rate is 2% p.a. Your task is to value an Asian call with a strike price of X=95 that has 3 months to maturity and cannot be exercised early. 1. You will need 4 trees: (1) underlying S (2) Asian call C (3) hedge ratio (4) cash account B. 2. Begin by setting up the tree for the underlying. While it is possible to write this tree as recombining (as in the examples we considered in lecture 10), it will be easier for the subsequent analysis to write the tree of the underlying as non-recombining (as in the illustration above). 3. Next, set up the tree for the Asian call and compute its' payoffs in the final period. 4. Then, set up trees for the hedge ratio and the cash account and work your way from the last period back as usual. 5. All trees should be non-recombining as in the illustration above. Questions: 1. Based on a 2 period tree, what is the no arbitrage price of the Asian call? 2. Based on the same tree, describe in detail the trades necessary for implementing the dynamic trading strategy that replicates the Asian call's payoff. How many shares of the underlying to you buy/sell at each point in time and in each state (at each node in the treo)? What cash flow (in dollars) is generated by these trades? How much risk-free debt do you take out or repay at each point in time and in each state? In this assignment you will apply the binomial tree model to determine the fair value of an Asian option. Valuing an Exotic Option The payoff of an Asian option is a function of the underlying's average price over the life of the option. These average price options are most commonly written on exchange rates and interest rates, For example, an exporter such as Mercedes Benz may have a fairly steady monthly foreign currency income stream from it's car sales abroad. In order to hedge it's currency exposure over the next year, Mercedes may acquire an option whose payoff is dependent on the average exchange rate over the next 12 months. At maturity, an Asian call option has a payoff of max(0;SX}, where S is the average price of the underlying asset over the option's life. This implies that the option's payoff is path dependent, i.e. it's payoft does not only depend on the price of the underlying at maturity, but instead on the entire price path. To price the option, we have to rely on a tree that is non-recombining: Note that while the price of the underlying is identical for the two paths "ud" and "du" (since udS0=duS0 ), the payoff of the Asian call differs across the two states. For "ud", the average price equals S(ud)=31(S0+uS0+udS0), whereas for "du" is equals S(du)= 81(S0+dS0+duS0) (a different value). In general, for a tree with n periods, there will be 2n final payoff states. For the example we will consider, the underlying has a current price of 8100 and an annual volatility of 20%. The (continuously compounded) risk free rate is 2% p.a. Your task is to value an Asian call with a strike price of X=95 that has 3 months to maturity and cannot be exercised early. 1. You will need 4 trees: (1) underlying S (2) Asian call C (3) hedge ratio (4) cash account B. 2. Begin by setting up the tree for the underlying. While it is possible to write this tree as recombining (as in the examples we considered in lecture 10), it will be easier for the subsequent analysis to write the tree of the underlying as non-recombining (as in the illustration above). 3. Next, set up the tree for the Asian call and compute its' payoffs in the final period. 4. Then, set up trees for the hedge ratio and the cash account and work your way from the last period back as usual. 5. All trees should be non-recombining as in the illustration above. Questions: 1. Based on a 2 period tree, what is the no arbitrage price of the Asian call? 2. Based on the same tree, describe in detail the trades necessary for implementing the dynamic trading strategy that replicates the Asian call's payoff. How many shares of the underlying to you buy/sell at each point in time and in each state (at each node in the treo)? What cash flow (in dollars) is generated by these trades? How much risk-free debt do you take out or repay at each point in time and in each state