Answered step by step

Verified Expert Solution

Question

1 Approved Answer

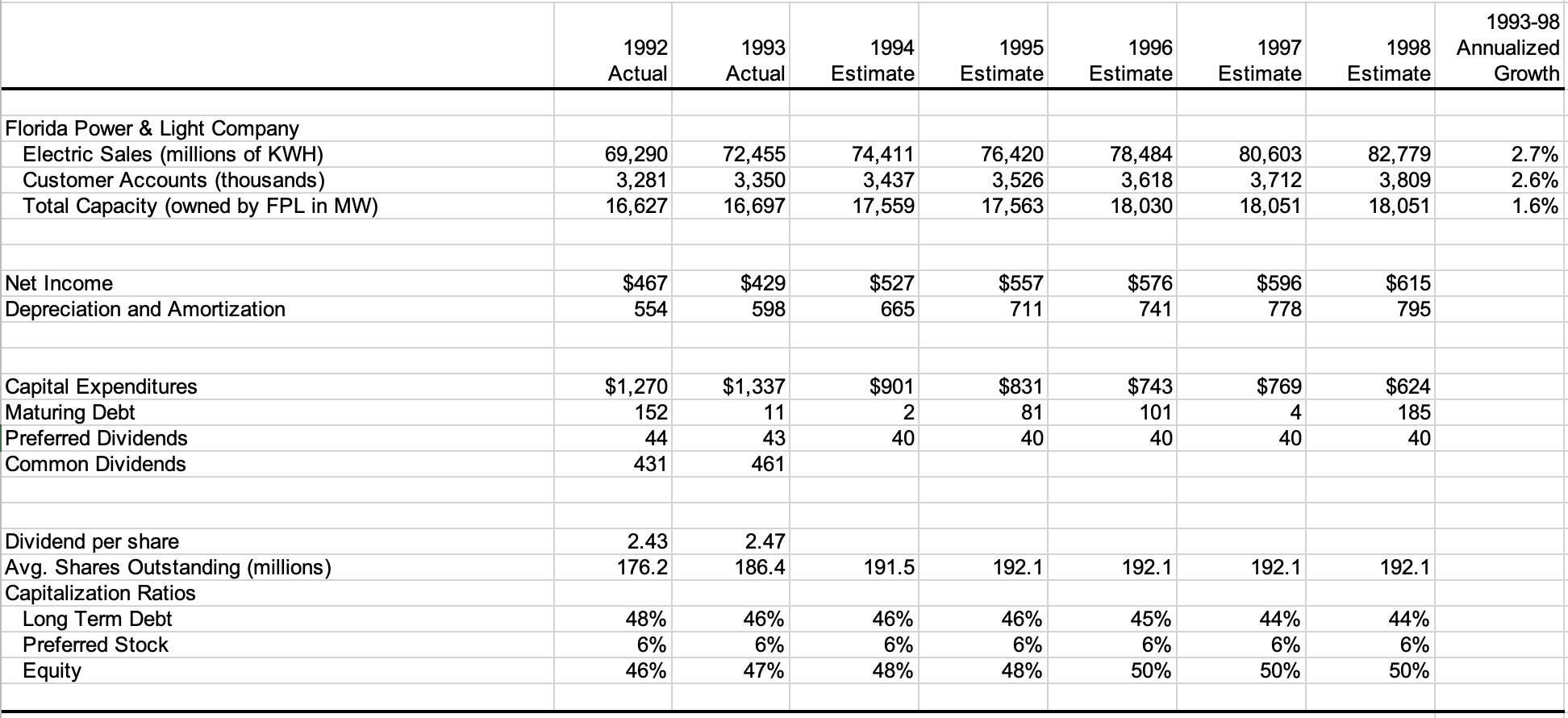

in this case, do you expect FPL will generate sufficiently high cash flows to finance dividend increases of 1 percent a year internally by 1998?

in this case, do you expect FPL will generate sufficiently high cash flows to finance dividend increases of 1 percent a year internally by 1998?

2. How do you expect the debt ratio will evolve by 1998?

1993-98 1992 Actual 1993 Actual 1994 Estimate 1995 Estimate 1996 Estimate 1997 Estimate 1998 Annualized Estimate Growth Florida Power & Light Company Electric Sales (millions of KWH) 69,290 72,455 74,411 76,420 78,484 80,603 82,779 2.7% Customer Accounts (thousands) 3,281 3,350 3,437 3,526 3,618 3,712 3,809 2.6% Total Capacity (owned by FPL in MW) 16,627 16,697 17,559 17,563 18,030 18,051 18,051 1.6% Net Income Depreciation and Amortization Capital Expenditures Maturing Debt Preferred Dividends Common Dividends $467 554 $429 $527 $557 $576 $596 $615 598 665 711 741 778 795 $1,270 $1,337 $901 $831 $743 $769 $624 152 11 2 81 101 4 185 44 43 40 10 40 40 40 40 431 461 Dividend per share 2.43 2.47 Avg. Shares Outstanding (millions) 176.2 186.4 191.5 192.1 192.1 192.1 192.1 Capitalization Ratios Long Term Debt 48% 46% 46% 46% 45% 44% 44% Preferred Stock 6% 6% 6% 6% 6% 6% 6% Equity 46% 47% 48% 48% 50% 50% 50%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started