Question

In this case study, you are a financial advisor. You will be required to advise a client on the performance of their investment in equity

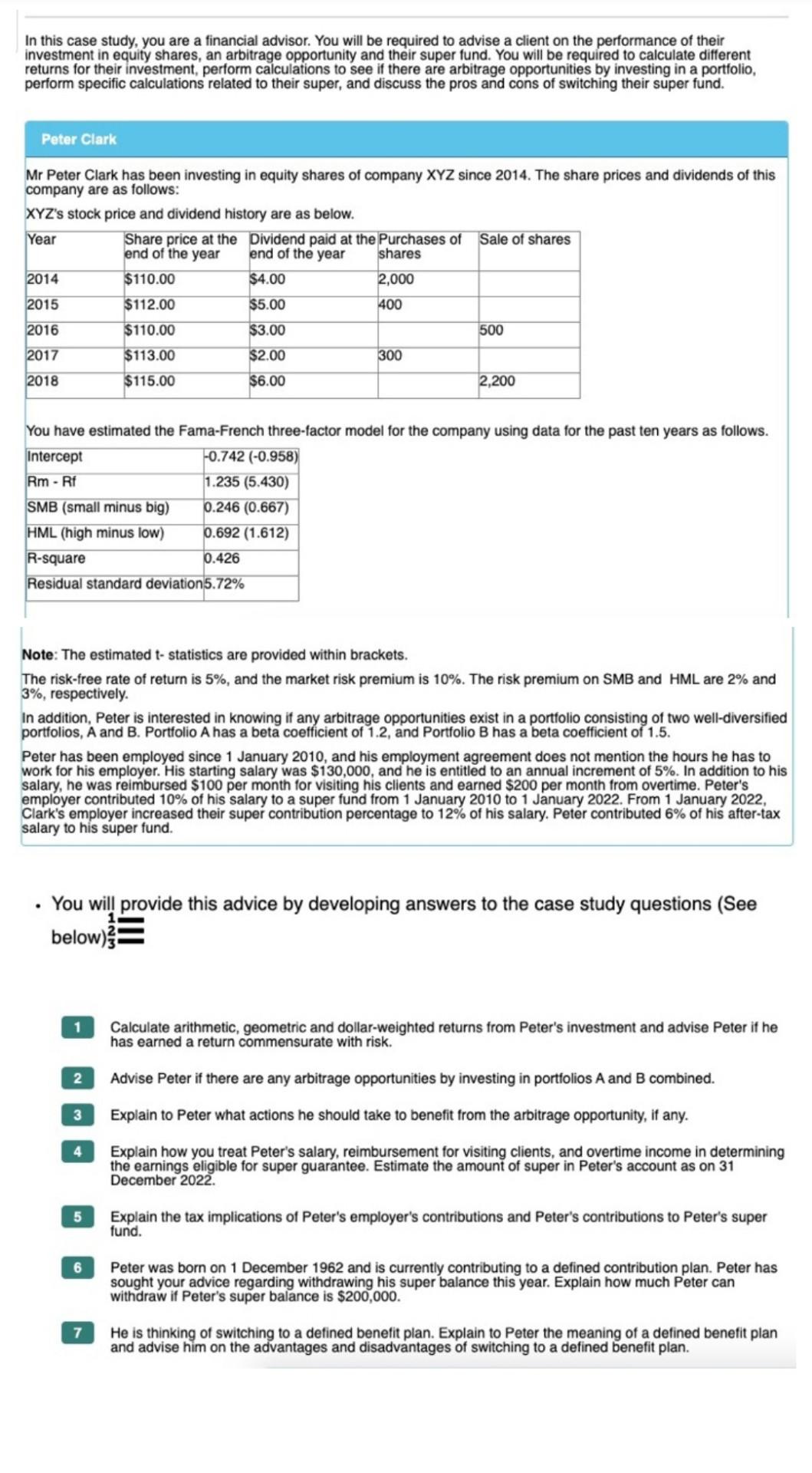

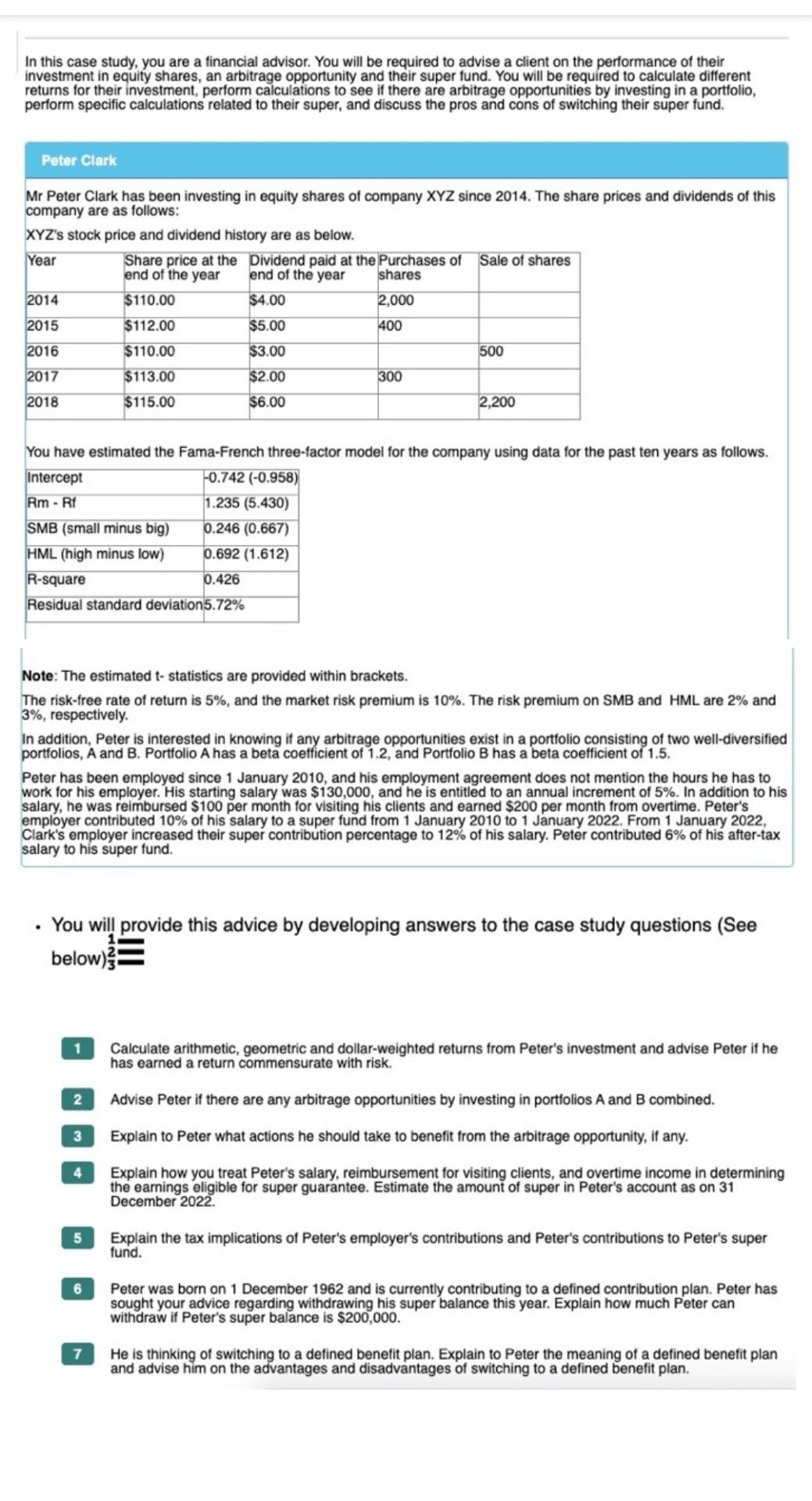

In this case study, you are a financial advisor. You will be required to advise a client on the performance of their investment in equity shares, an arbitrage opportunity and their super fund. You will be required to calculate different returns for their investment, perform calculations to see if there are arbitrage opportunities by investing in a portfolio, perform specific calculations related to their super, and discuss the pros and cons of switching their super fund. Peter Clark Mr Peter Clark has been investing in equity shares of company XYZ since 2014. The share prices and dividends of this company are as follows: XYZ's stock price and dividend history are as below. Year Share price at the end of the year 2014 2015 2016 2017 2018 Intercept Rm-Rf SMB (small minus big) HML (high minus low) R-square Residual standard deviation5.72% You have estimated the Fama-French three-factor model for the company using data for the past ten years as follows. -0.742 (-0.958) 1.235 (5.430) 0.246 (0.667) 0.692 (1.612) 0.426 $110.00 $112.00 $110.00 $113.00 $115.00 1 Note: The estimated t- statistics are provided within brackets.

The risk-free rate of return is 5%, and the market risk premium is 10%. The risk premium on SMB and HML are 2% and 3%, respectively. 2 In addition, Peter is interested in knowing if any arbitrage opportunities exist in a portfolio consisting of two well-diversified portfolios, A and B. Portfolio A has a beta coefficient of 1.2, and Portfolio B has a beta coefficient of 1.5. 3 Dividend paid at the Purchases of Sale of shares end of the year shares $4.00 2,000 $5.00 400 $3.00 $2.00 $6.00 Peter has been employed since 1 January 2010, and his employment agreement does not mention the hours he has to work for his employer. His starting salary was $130,000, and he is entitled to an annual increment of 5%. In addition to his salary, he was reimbursed $100 per month for visiting his clients and earned $200 per month from overtime. Peter's employer contributed 10% of his salary to a super fund from 1 January 2010 to 1 January 2022. From 1 January 2022, Clark's employer increased their super contribution percentage to 12% of his salary. Peter contributed 6% of his after-tax salary to his super fund. 4 300 . You will provide this advice by developing answers to the case study questions (See below) 5 500 6 2,200 7 Calculate arithmetic, geometric and dollar-weighted returns from Peter's investment and advise Peter if he has earned a return commensurate with risk. Advise Peter if there are any arbitrage opportunities by investing in portfolios A and B combined. Explain to Peter what actions he should take to benefit from the arbitrage opportunity, if any. Explain how you treat Peter's salary, reimbursement for visiting clients, and overtime income in determining the earnings eligible for super guarantee. Estimate the amount of super in Peter's account as on 31 December 2022. Explain the tax implications of Peter's employer's contributions and Peter's contributions to Peter's super fund. Peter was born on 1 December 1962 and is currently contributing to a defined contribution plan. Peter has sought your advice regarding withdrawing his super balance this year. Explain uch Peter can withdraw if Peter's super balance is $200,000. He is thinking of switching to a defined

benefit plan. Explain to Peter the meaning of a defined benefit plan and advise him on the advantages and disadvantages of switching to a defined benefit plan.

In this case study, you are a financial advisor. You will be required to advise a client on the performance of their investment in equity shares, an arbitrage opportunity and their super fund. You will be required to calculate different returns for their investment, perform calculations to see if there are arbitrage opportunities by investing in a portfolio, perform specific calculations related to their super, and discuss the pros and cons of switching their super fund. Peter Clark Mr Peter Clark has been investing in equity shares of company XYZ since 2014. The share prices and dividends of this company are as follows: XYZ's stock price and dividend history are as below. You have estimated the Fama-French three-factor model for the company using data for the past ten years as follows. Note: The estimated t- statistics are provided within brackets. The risk-free rate of return is 5%, and the market risk premium is 10%. The risk premium on SMB and HML are 2% and 3%, respectively. In addition, Peter is interested in knowing if any arbitrage opportunities exist in a portfolio consisting of two well-diversified portfolios, A and B. Portfolio A has a beta coefficient of 1.2, and Portfolio B has a beta coefficient of 1.5. Peter has been employed since 1 January 2010, and his employment agreement does not mention the hours he has to work for his employer. His starting salary was $130,000, and he is entitled to an annual increment of 5%. In addition to his salary, he was reimbursed $100 per month for visiting his clients and earned $200 per month from overtime. Peter's employer contributed 10% of his salary to a super fund from 1 January 2010 to 1 January 2022 . From 1 January 2022 , Clark's employer increased their super contribution percentage to 12% of his salary. Peter contributed 6% of his after-tax salary to his super fund. - You will provide this advice by developing answers to the case study questions (See below) )32= Calculate arithmetic, geometric and dollar-weighted returns from Peter's investment and advise Peter if he has earned a return commensurate with risk. Advise Peter if there are any arbitrage opportunities by investing in portfolios A and B combined. Explain to Peter what actions he should take to benefit from the arbitrage opportunity, if any. Explain how you treat Peter's salary, reimbursement for visiting clients, and overtime income in determining the earnings eligible for super guarantee. Estimate the amount of super in Peter's account as on 31 December 2022. Explain the tax implications of Peter's employer's contributions and Peter's contributions to Peter's super fund. Peter was born on 1 December 1962 and is currently contributing to a defined contribution plan. Peter has sought your advice regarding withdrawing his super balance this year. Explain how much Peter can withdraw if Peter's super balance is $200,000. He is thinking of switching to a defined benefit plan. Explain to Peter the meaning of a defined benefit plan and advise him on the advantages and disadvantages of switching to a defined benefit plan. In this case study, you are a financial advisor. You will be required to advise a client on the performance of their investment in equity shares, an arbitrage opportunity and their super fund. You will be required to calculate different returns for their investment, perform calculations to see if there are arbitrage opportunities by investing in a portfolio, perform specific calculations related to their super, and discuss the pros and cons of switching their super fund. Peter Clark Mr Peter Clark has been investing in equity shares of company XYZ since 2014. The share prices and dividends of this company are as follows: XYZ's stock price and dividend history are as below. You have estimated the Fama-French three-factor model for the company using data for the past ten years as follows. Note: The estimated t- statistics are provided within brackets. The risk-free rate of return is 5%, and the market risk premium is 10%. The risk premium on SMB and HML are 2% and 3%, respectively. In addition, Peter is interested in knowing if any arbitrage opportunities exist in a portfolio consisting of two well-diversified portfolios, A and B. Portfolio A has a beta coefficient of 1.2, and Portfolio B has a beta coefficient of 1.5. Peter has been employed since 1 January 2010, and his employment agreement does not mention the hours he has to work for his employer. His starting salary was $130,000, and he is entitled to an annual increment of 5%. In addition to his salary, he was reimbursed $100 per month for visiting his clients and earned $200 per month from overtime. Peter's employer contributed 10% of his salary to a super fund from 1 January 2010 to 1 January 2022 . From 1 January 2022 , Clark's employer increased their super contribution percentage to 12% of his salary. Peter contributed 6% of his after-tax salary to his super fund. - You will provide this advice by developing answers to the case study questions (See below) )32= Calculate arithmetic, geometric and dollar-weighted returns from Peter's investment and advise Peter if he has earned a return commensurate with risk. Advise Peter if there are any arbitrage opportunities by investing in portfolios A and B combined. Explain to Peter what actions he should take to benefit from the arbitrage opportunity, if any. Explain how you treat Peter's salary, reimbursement for visiting clients, and overtime income in determining the earnings eligible for super guarantee. Estimate the amount of super in Peter's account as on 31 December 2022. Explain the tax implications of Peter's employer's contributions and Peter's contributions to Peter's super fund. Peter was born on 1 December 1962 and is currently contributing to a defined contribution plan. Peter has sought your advice regarding withdrawing his super balance this year. Explain how much Peter can withdraw if Peter's super balance is $200,000. He is thinking of switching to a defined benefit plan. Explain to Peter the meaning of a defined benefit plan and advise him on the advantages and disadvantages of switching to a defined benefit plan. In this case study, you are a financial advisor. You will be required to advise a client on the performance of their investment in equity shares, an arbitrage opportunity and their super fund. You will be required to calculate different returns for their investment, perform calculations to see if there are arbitrage opportunities by investing in a portfolio, perform specific calculations related to their super, and discuss the pros and cons of switching their super fund. Peter Clark Mr Peter Clark has been investing in equity shares of company XYZ since 2014. The share prices and dividends of this company are as follows: XYZ's stock price and dividend history are as below. You have estimated the Fama-French three-factor model for the company using data for the past ten years as follows. Note: The estimated t- statistics are provided within brackets. The risk-free rate of return is 5%, and the market risk premium is 10%. The risk premium on SMB and HML are 2% and 3%, respectively. In addition, Peter is interested in knowing if any arbitrage opportunities exist in a portfolio consisting of two well-diversified portfolios, A and B. Portfolio A has a beta coefficient of 1.2, and Portfolio B has a beta coefficient of 1.5. Peter has been employed since 1 January 2010, and his employment agreement does not mention the hours he has to work for his employer. His starting salary was $130,000, and he is entitled to an annual increment of 5%. In addition to his salary, he was reimbursed $100 per month for visiting his clients and earned $200 per month from overtime. Peter's employer contributed 10% of his salary to a super fund from 1 January 2010 to 1 January 2022 . From 1 January 2022 , Clark's employer increased their super contribution percentage to 12% of his salary. Peter contributed 6% of his after-tax salary to his super fund. - You will provide this advice by developing answers to the case study questions (See below) )32= Calculate arithmetic, geometric and dollar-weighted returns from Peter's investment and advise Peter if he has earned a return commensurate with risk. Advise Peter if there are any arbitrage opportunities by investing in portfolios A and B combined. Explain to Peter what actions he should take to benefit from the arbitrage opportunity, if any. Explain how you treat Peter's salary, reimbursement for visiting clients, and overtime income in determining the earnings eligible for super guarantee. Estimate the amount of super in Peter's account as on 31 December 2022. Explain the tax implications of Peter's employer's contributions and Peter's contributions to Peter's super fund. Peter was born on 1 December 1962 and is currently contributing to a defined contribution plan. Peter has sought your advice regarding withdrawing his super balance this year. Explain how much Peter can withdraw if Peter's super balance is $200,000. He is thinking of switching to a defined benefit plan. Explain to Peter the meaning of a defined benefit plan and advise him on the advantages and disadvantages of switching to a defined benefit plan. In this case study, you are a financial advisor. You will be required to advise a client on the performance of their investment in equity shares, an arbitrage opportunity and their super fund. You will be required to calculate different returns for their investment, perform calculations to see if there are arbitrage opportunities by investing in a portfolio, perform specific calculations related to their super, and discuss the pros and cons of switching their super fund. Peter Clark Mr Peter Clark has been investing in equity shares of company XYZ since 2014. The share prices and dividends of this company are as follows: XYZ's stock price and dividend history are as below. You have estimated the Fama-French three-factor model for the company using data for the past ten years as follows. Note: The estimated t- statistics are provided within brackets. The risk-free rate of return is 5%, and the market risk premium is 10%. The risk premium on SMB and HML are 2% and 3%, respectively. In addition, Peter is interested in knowing if any arbitrage opportunities exist in a portfolio consisting of two well-diversified portfolios, A and B. Portfolio A has a beta coefficient of 1.2, and Portfolio B has a beta coefficient of 1.5. Peter has been employed since 1 January 2010, and his employment agreement does not mention the hours he has to work for his employer. His starting salary was $130,000, and he is entitled to an annual increment of 5%. In addition to his salary, he was reimbursed $100 per month for visiting his clients and earned $200 per month from overtime. Peter's employer contributed 10% of his salary to a super fund from 1 January 2010 to 1 January 2022 . From 1 January 2022 , Clark's employer increased their super contribution percentage to 12% of his salary. Peter contributed 6% of his after-tax salary to his super fund. - You will provide this advice by developing answers to the case study questions (See below) )32= Calculate arithmetic, geometric and dollar-weighted returns from Peter's investment and advise Peter if he has earned a return commensurate with risk. Advise Peter if there are any arbitrage opportunities by investing in portfolios A and B combined. Explain to Peter what actions he should take to benefit from the arbitrage opportunity, if any. Explain how you treat Peter's salary, reimbursement for visiting clients, and overtime income in determining the earnings eligible for super guarantee. Estimate the amount of super in Peter's account as on 31 December 2022. Explain the tax implications of Peter's employer's contributions and Peter's contributions to Peter's super fund. Peter was born on 1 December 1962 and is currently contributing to a defined contribution plan. Peter has sought your advice regarding withdrawing his super balance this year. Explain how much Peter can withdraw if Peter's super balance is $200,000. He is thinking of switching to a defined benefit plan. Explain to Peter the meaning of a defined benefit plan and advise him on the advantages and disadvantages of switching to a defined benefit planStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started