Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In this example,i found PW by using 35 year. But if both projects have the salvage value in this question,how should i approach to question?

In this example,i found PW by using 35 year. But if both projects have the salvage value in this question,how should i approach to question?

Question-4

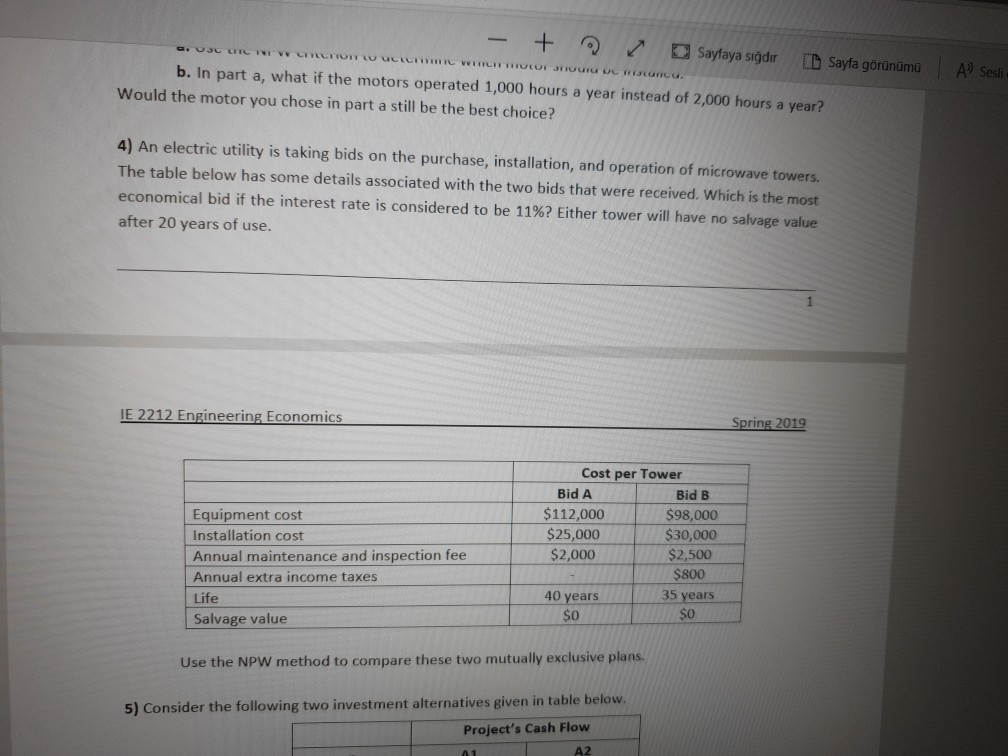

- +oy rD Sayfa grunamo A b. In part a, what if the motors operated 1,000 hours a year instead of 2,000 hours a year? Sesli Would the motor you chose in part a still be the best choice? 4) An electric utility is taking bids on the purchase, installation, and operation of microwave towers. The table below has some details associated with the two bids that were received. Which is the most economical bid if the interest rate is considered to be 11%? Either tower will have no salvage value after 20 years of use. E 2212 Engineering Economics Spring 2019 Cost per Tower Bid A Bid B Equipment cost $112,000 $98,000 $30,000 $25,000 Installation cost $2,000 Annual maintenance and inspection fee $2,500 $800 Annual extra income taxes 35 years 40 years Life So Salvage value Use the NPW method to compare these two mutually exclusive plans. 5) Consider the following two investment alternatives given in table below. Project's Cash Flow A2Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started