Question

In this exercise you will build and simulate a Multi-stage Discounted Cash Flow (DCF) Model for MSFT Inc. The MSFT Inc currently has after-tax free

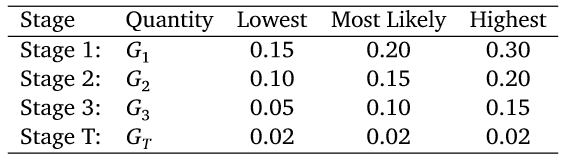

In this exercise you will build and simulate a Multi-stage Discounted Cash Flow (DCF) Model for MSFT Inc. The MSFT Inc currently has after-tax free cash-ow to the rm of $10 billions. To implement the model, please assume that MSFTs after-tax free cash-ow will grow as follows: During therst-stage, cash-ow will grow at G1 rate for 15 years,where G1 is unknown and follows certain probability distributions.

During the second-stage, cash-ow will grow at G2 rate for 10 years, where G2 is unknown and follows certain probability distributions.

During the Third-stage,cash-ow will grow at G3 rate for 5 years,where G3 is unknown and follows certain probability distributions.

After the third-stage,cash-ow is likely to grow at the rate of GT forever.

Please assume that G1, G2, G3,and GT follow the following scenarios:

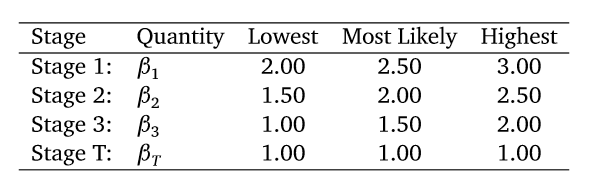

Since MSFT has zero debt, you can use the Capital Asset Pricing Model (CAPM) to discount your cash-ow for this model. You observe the risk-free rate of 5% and the average market risk premium of 6%. Please assume the following scenarios for , the proxy for systematic risk:

Based on the information above, determine the cash-ow of MSFT and discount them to today to nd the value of MSFT Inc. Then simulate your model 1000 times and provide the distribution of the MSFT value today. Show the mean,median,5th percentile, 95th percentile,minimum,maximum, and 5% VaR of your valuation of MSFT after 1000 simulation.

Stage Quantity Lowest Most Likely Highest Stage 1: G 0.15 0.20 0.30 Stage 2: G2 0.10 0.15 0.20 Stage 3: G3 0.05 0.10 0.15 Stage T: GT 0.02 0.02 0.02 Stage Quantity Lowest Most Likely Highest Stage 1: B 2.00 2.50 3.00 Stage 2: B2 1.50 2.00 2.50 Stage 3: B3 1.00 1.50 2.00 Stage T: BT 1.00 1.00 1.00 Stage Quantity Lowest Most Likely Highest Stage 1: G 0.15 0.20 0.30 Stage 2: G2 0.10 0.15 0.20 Stage 3: G3 0.05 0.10 0.15 Stage T: GT 0.02 0.02 0.02 Stage Quantity Lowest Most Likely Highest Stage 1: B 2.00 2.50 3.00 Stage 2: B2 1.50 2.00 2.50 Stage 3: B3 1.00 1.50 2.00 Stage T: BT 1.00 1.00 1.00Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started