Question

In this note, I will introduce you the famous Modigliani-Miller Irrelevance Theorem. Modigliani & Miller (1958) is one of the first and nowadays still one

-

In this note, I will introduce you the famous Modigliani-Miller Irrelevance Theorem. Modigliani & Miller (1958) is one of the first and nowadays still one of the most important papers that asks the ultimate question in the study of corporate finance: What is the optimal capital structure?

-

In plain words, this question asks if a firms capital structure, the composition of this firms debt and equity, affects its firm value. And if it does, is there an optimal way to construct the capital structure that maximizes firm value?

-

The short answer: In a Frictionless World, there is no optimal capital structure. In fact, capital structure has no effect on firm value at all in this vacuum-tube-like frictionless setting.

-

Just to remind you, this is not saying capital structure does not affect firm value in the real world. This frictionless setting is rather a vacuum-tube-like benchmark that helps us tear apart all kind of possible forces that have effect on firm value through the channel of capital structure. After introducing why in a frictionless world, capital structure has no effect on firm value, we shall put back the frictions one at a time to see how they each influence firm value.

-

To begin, lets explicitly discuss about the frictionless assumptions and show you some notations.

-

Assumptions:

The market is competitive and complete: This implies that individual investors and firms are both price takers. This also implies that all kinds of replication and short-selling are allowed.

There is no tax! There is no bankruptcy or other administrative costs. There is no agency problem. Information is symmetric across individauls and firms.

1

-

Notations: There are 2 periods in this model, t0 and t1. In t0, investors invest; in t1, firms generate profit and distribute to investors. There are 2 almost identical firms, firm A and firm B, almost identical in the sense that they have the same performance and generate the same cash flow (EBIT) X. Firm A and firm B, however, differ in thier capital structures. Firm A has both debt and equity, while firm B is a purely equity financing company.

-

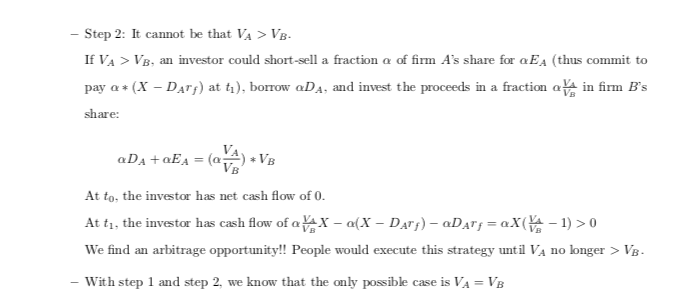

he above derivation is the proof of the famous Modigliani-Miller Proposition I: In a frictionless world, capital structure has no effect on firm value.

-

MM actually have a very cute analogy. Capital structurein a frictionless work is like slicing a unit pie. The size of the pie would not be affected by how you slice and distribute it.

-

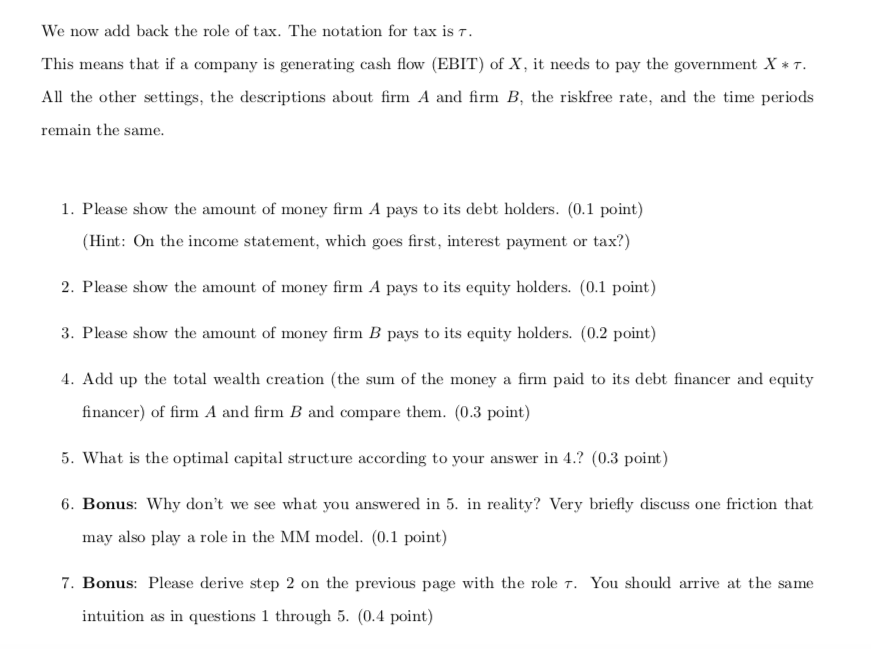

Modigliani-Miller Proposition II: In MM proposition II, we now put back one important friction in our model, TAX!

-

When we add back the flavor of tax, we shall see that debt financing would provide more benefit than equity financing. The more a firm raise money through debt financing, the higher its firm value. This incremental value is what we have discussed in the class: Tax Shield.

-

The proof will be left as the first special homework for you to solve. I will post the answer after the homework is due.

-

Lastly, I want you guys to think about MM proposition II more deeply. Is it true that in reality, companies rely most of their funds through debt financing? If not, why? Are we missing any friction that is related to the downsides of debt financing in our model?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started