Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In this problem assume that Rockhead has total sales of $3,000, with the additional $1,000 of sales occurring in state C. Initially assume that

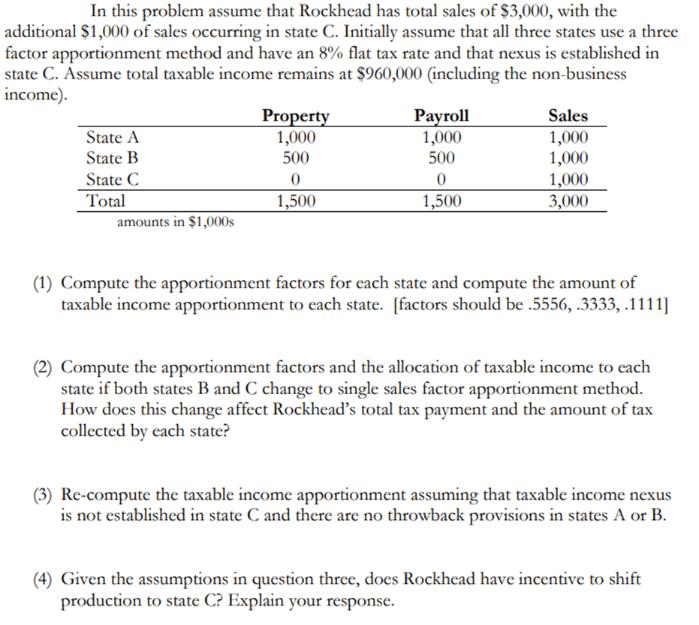

In this problem assume that Rockhead has total sales of $3,000, with the additional $1,000 of sales occurring in state C. Initially assume that all three states use a three factor apportionment method and have an 8% flat tax rate and that nexus is established in state C. Assume total taxable income remains at $960,000 (including the non-business income). State A State B State C Total amounts in $1,000s Property 1,000 500 0 1,500 Payroll 1,000 500 0 1,500 Sales 1,000 1,000 1,000 3,000 (1) Compute the apportionment factors for each state and compute the amount of taxable income apportionment to each state. [factors should be .5556, .3333, .1111] (2) Compute the apportionment factors and the allocation of taxable income to each state if both states B and C change to single sales factor apportionment method. How does this change affect Rockhead's total tax payment and the amount of tax collected by each state? (3) Re-compute the taxable income apportionment assuming that taxable income nexus is not established in state C and there are no throwback provisions in states A or B. (4) Given the assumptions in question three, does Rockhead have incentive to shift production to state C? Explain your response.

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

1 Computation of apportionment factors and taxable income for each state using 3factor method State ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started