Answered step by step

Verified Expert Solution

Question

1 Approved Answer

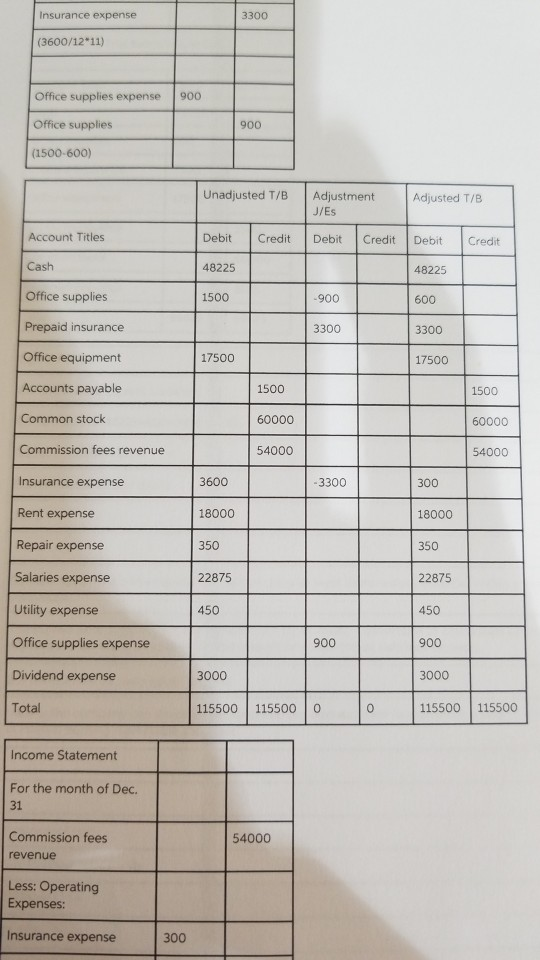

In this problem, I understand all of the record transactions except for underneath the adjusted trail balance, the cash is stated to be 48,225. I

In this problem, I understand all of the record transactions except for underneath the adjusted trail balance, the cash is stated to be 48,225. I am having trouble understanding how to get this amount in the answer provided by chegg.

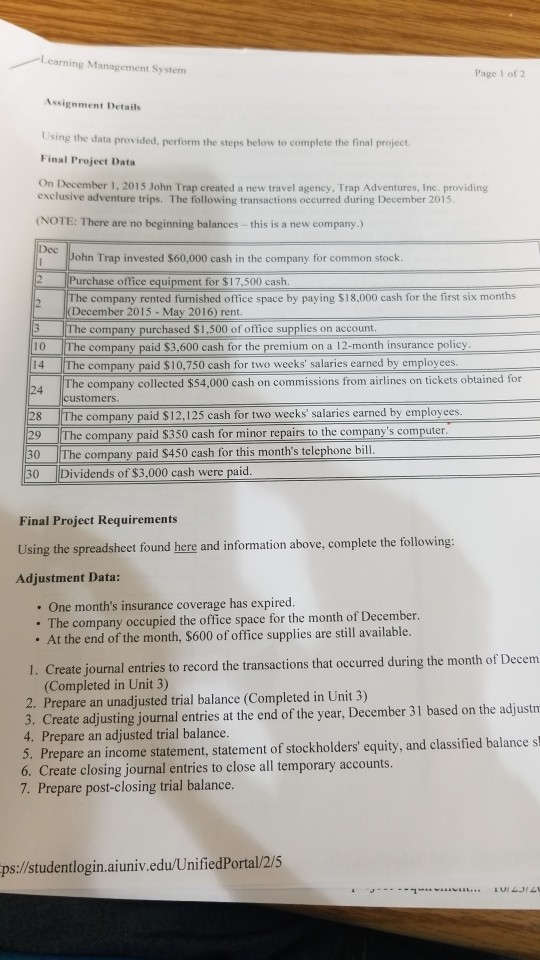

Learning Management System Page 1 of 2 Assignment Details sing the data provided, perform the steps below to complete the final project Final Project Data On December 1, 2015 John Trap created a new travel agency. Trap Adventures, Inc. providing exclusive adventure trips. The following transactions occurred during December 2015 (NOTE: There are no beginning balances -- this is a new company.) Dec John Trap invested $60,000 cash in the company for common stock. 14 Purchase office equipment for $17,500 cash. The company rented furnished office space by paying $18,000 cash for the first six months (December 2015 - May 2016) rent. The company purchased $1.500 of office supplies on account. The company paid $3,600 cash for the premium on a 12-month insurance policy. The company paid $10,750 cash for two weeks' salaries earned by employees. The company collected $54,000 cash on commissions from airlines on tickets obtained for customers. The company paid $12,125 cash for two weeks' salaries earned by employees. The company paid $350 cash for minor repairs to the company's computer. The company paid $450 cash for this month's telephone bill. Dividends of $3,000 cash were paid. 24 28 29 30 30 Final Project Requirements Using the spreadsheet found here and information above, complete the following: Adjustment Data: One month's insurance coverage has expired. The company occupied the office space for the month of December. . At the end of the month, $600 of office supplies are still available. 1. Create journal entries to record the transactions that occurred during the month of Decem (Completed in Unit 3) 2. Prepare an unadjusted trial balance (Completed in Unit 3) 3. Create adjusting journal entries at the end of the year, December 31 based on the adjust 4. Prepare an adjusted trial balance. 5. Prepare an income statement, statement of stockholders' equity, and classified balance s 6. Create closing journal entries to close all temporary accounts. 7. Prepare post-closing trial balance. ps://studentlogin.aiuniv.edu/UnifiedPortal/2/5 LUI 2 Insurance expense 3300 (3600/12*11) Office supplies expense 900 Office supplies 900 (1500-600) Unadjusted T/B Adjustment J/ES Adjusted T/B Account Titles Debit Credit Debit Credit Debit Credit Cash Office supplies Obce plies 48225 1500 48225 600 -900 Prepaid insurance 3300 3300 Office equipment 17500 17500 Accounts payable 1500 1500 Common stock 60000 60000 Commission fees revenue 54000 54000 Insurance expense 3600 - 3300 300 Rent expense 18000 18000 Repair expense 350 350 TL Salaries expense 22875 22875 450 Utility expense TL 450 Office supplies expense 900 900 Dividend expense 3000 3000 115500 Total 115500 115500 115500 Income Statement For the month of Dec. 31 Commission fees revenue 54000 Less: Operating Expenses: Insurance expense 300 Learning Management System Page 1 of 2 Assignment Details sing the data provided, perform the steps below to complete the final project Final Project Data On December 1, 2015 John Trap created a new travel agency. Trap Adventures, Inc. providing exclusive adventure trips. The following transactions occurred during December 2015 (NOTE: There are no beginning balances -- this is a new company.) Dec John Trap invested $60,000 cash in the company for common stock. 14 Purchase office equipment for $17,500 cash. The company rented furnished office space by paying $18,000 cash for the first six months (December 2015 - May 2016) rent. The company purchased $1.500 of office supplies on account. The company paid $3,600 cash for the premium on a 12-month insurance policy. The company paid $10,750 cash for two weeks' salaries earned by employees. The company collected $54,000 cash on commissions from airlines on tickets obtained for customers. The company paid $12,125 cash for two weeks' salaries earned by employees. The company paid $350 cash for minor repairs to the company's computer. The company paid $450 cash for this month's telephone bill. Dividends of $3,000 cash were paid. 24 28 29 30 30 Final Project Requirements Using the spreadsheet found here and information above, complete the following: Adjustment Data: One month's insurance coverage has expired. The company occupied the office space for the month of December. . At the end of the month, $600 of office supplies are still available. 1. Create journal entries to record the transactions that occurred during the month of Decem (Completed in Unit 3) 2. Prepare an unadjusted trial balance (Completed in Unit 3) 3. Create adjusting journal entries at the end of the year, December 31 based on the adjust 4. Prepare an adjusted trial balance. 5. Prepare an income statement, statement of stockholders' equity, and classified balance s 6. Create closing journal entries to close all temporary accounts. 7. Prepare post-closing trial balance. ps://studentlogin.aiuniv.edu/UnifiedPortal/2/5 LUI 2 Insurance expense 3300 (3600/12*11) Office supplies expense 900 Office supplies 900 (1500-600) Unadjusted T/B Adjustment J/ES Adjusted T/B Account Titles Debit Credit Debit Credit Debit Credit Cash Office supplies Obce plies 48225 1500 48225 600 -900 Prepaid insurance 3300 3300 Office equipment 17500 17500 Accounts payable 1500 1500 Common stock 60000 60000 Commission fees revenue 54000 54000 Insurance expense 3600 - 3300 300 Rent expense 18000 18000 Repair expense 350 350 TL Salaries expense 22875 22875 450 Utility expense TL 450 Office supplies expense 900 900 Dividend expense 3000 3000 115500 Total 115500 115500 115500 Income Statement For the month of Dec. 31 Commission fees revenue 54000 Less: Operating Expenses: Insurance expense 300

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started