Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In this problem set, we analyse the trade-offs for monetary policy in the open economy. The model economy is described by the following relationships (same

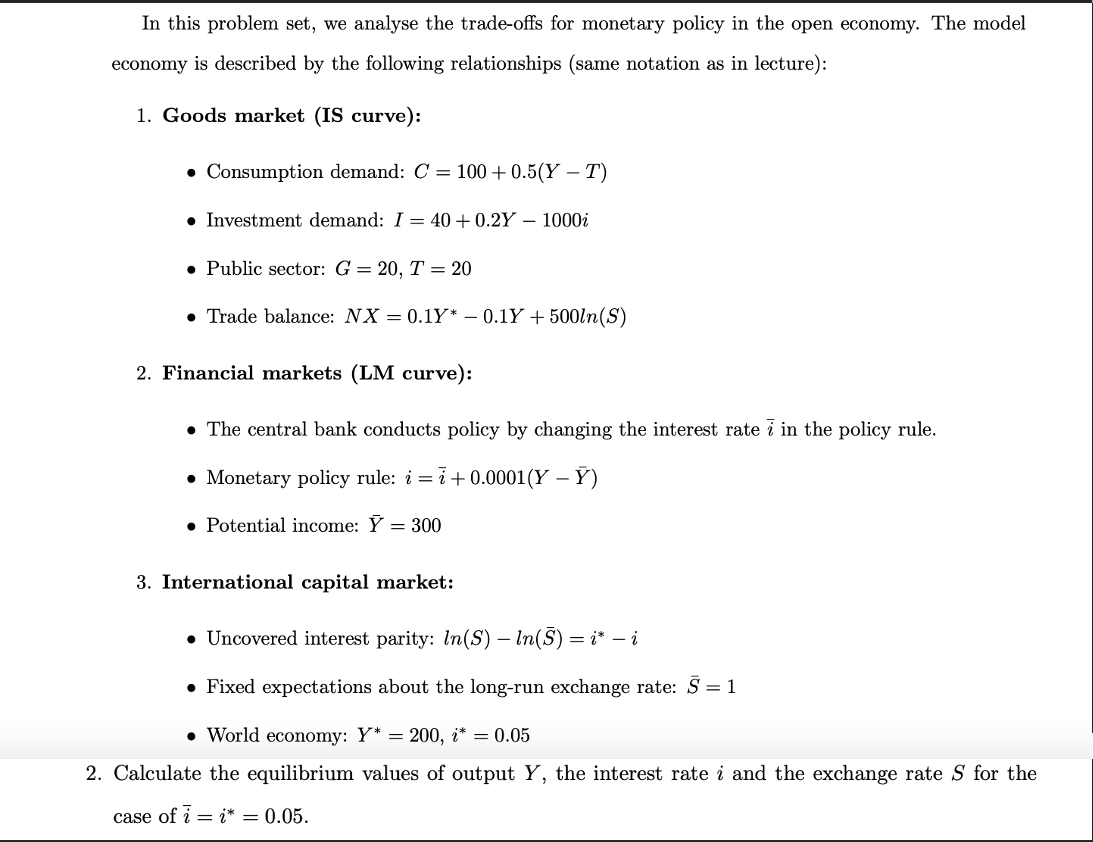

In this problem set, we analyse the trade-offs for monetary policy in the open economy. The model economy is described by the following relationships (same notation as in lecture): 1. Goods market (IS curve): - Consumption demand: C=100+0.5(YT) - Investment demand: I=40+0.2Y1000i - Public sector: G=20,T=20 - Trade balance: NX=0.1Y0.1Y+500ln(S) 2. Financial markets (LM curve): - The central bank conducts policy by changing the interest rate i in the policy rule. - Monetary policy rule: i=i+0.0001(YY) - Potential income: Y=300 3. International capital market: - Uncovered interest parity: ln(S)ln(S)=ii - Fixed expectations about the long-run exchange rate: S=1 - World economy: Y=200,i=0.05 Calculate the equilibrium values of output Y, the interest rate i and the exchange rate S for the case of i=i=0.05

In this problem set, we analyse the trade-offs for monetary policy in the open economy. The model economy is described by the following relationships (same notation as in lecture): 1. Goods market (IS curve): - Consumption demand: C=100+0.5(YT) - Investment demand: I=40+0.2Y1000i - Public sector: G=20,T=20 - Trade balance: NX=0.1Y0.1Y+500ln(S) 2. Financial markets (LM curve): - The central bank conducts policy by changing the interest rate i in the policy rule. - Monetary policy rule: i=i+0.0001(YY) - Potential income: Y=300 3. International capital market: - Uncovered interest parity: ln(S)ln(S)=ii - Fixed expectations about the long-run exchange rate: S=1 - World economy: Y=200,i=0.05 Calculate the equilibrium values of output Y, the interest rate i and the exchange rate S for the case of i=i=0.05 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started