Answered step by step

Verified Expert Solution

Question

1 Approved Answer

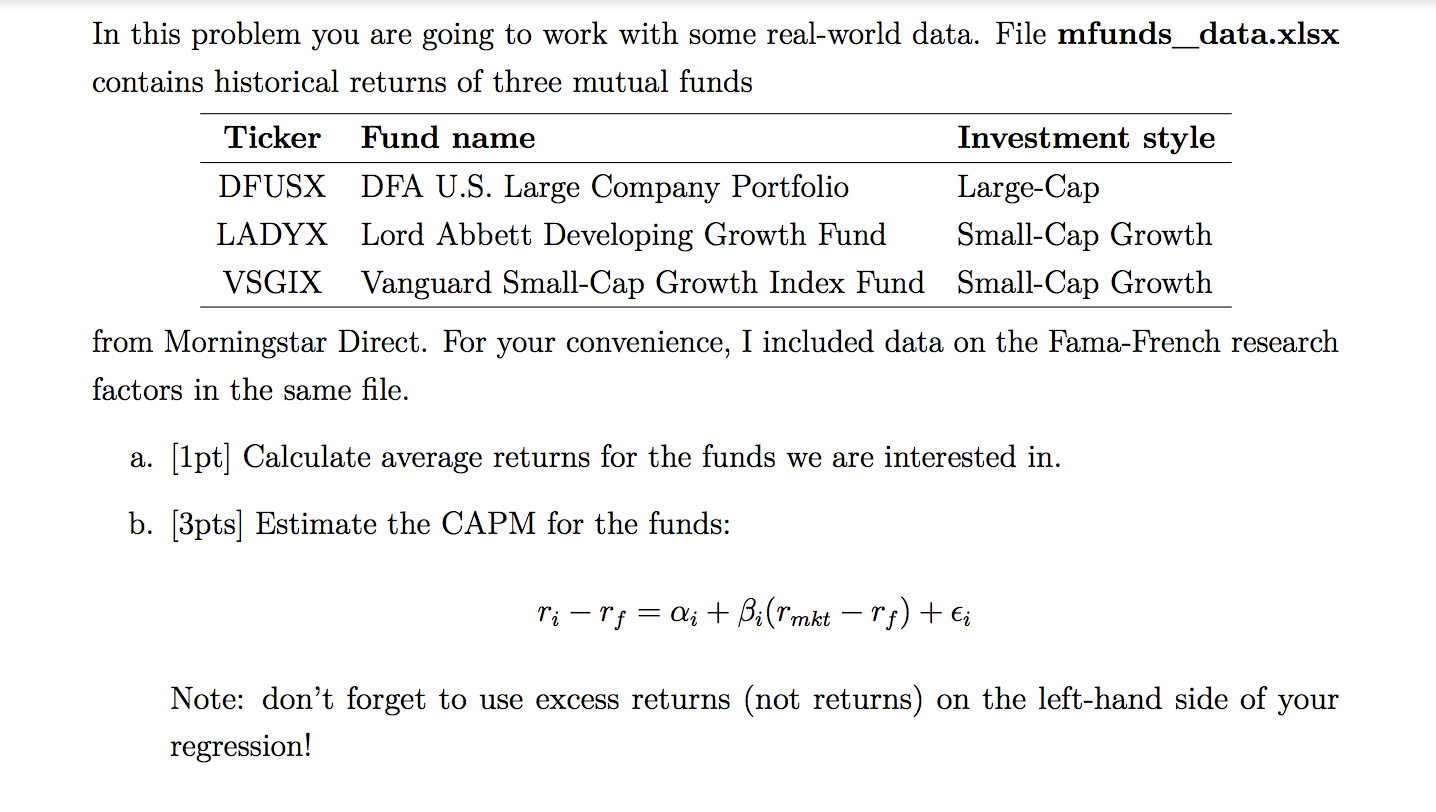

In this problem you are going to work with some real-world data. File mfunds_data.xlsx contains historical returns of three mutual funds Ticker Fund name

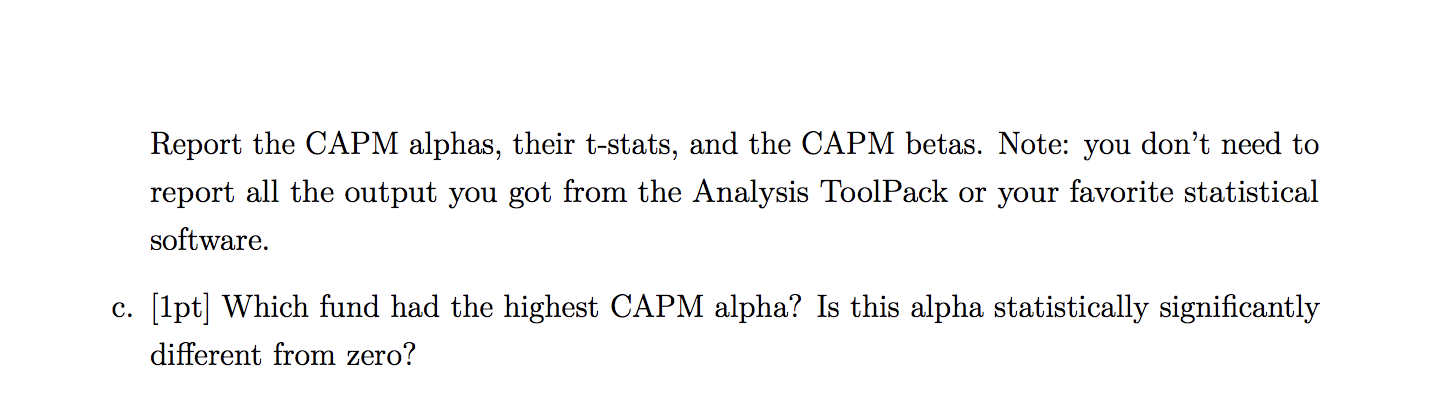

In this problem you are going to work with some real-world data. File mfunds_data.xlsx contains historical returns of three mutual funds Ticker Fund name DFUSX DFA U.S. Large Company Portfolio LADYX Lord Abbett Developing Growth Fund VSGIX Vanguard Small-Cap Growth Index Fund Investment style Large-Cap Small-Cap Growth Small-Cap Growth from Morningstar Direct. For your convenience, I included data on the Fama-French research factors in the same file. a. [1pt] Calculate average returns for the funds we are interested in. b. [3pts] Estimate the CAPM for the funds: ri r = i + Bi (1mkt r) + i Note: don't forget to use excess returns (not returns) on the left-hand side of your regression! Report the CAPM alphas, their t-stats, and the CAPM betas. Note: you don't need to report all the output you got from the Analysis ToolPack or your favorite statistical software. c. [1pt] Which fund had the highest CAPM alpha? Is this alpha statistically significantly different from zero?

Step by Step Solution

★★★★★

3.64 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Here are the answers using the data from the mfundsdataxlsx fi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started