Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In this project, we will use the financial Internet website, morningstar.com, to analyze a company of your choice, do not use Hewlett Packard. Can you

In this project, we will use the financial Internet website, morningstar.com, to analyze a company of your choice, do not use Hewlett Packard. Can you use Apple, Starbucks, or Dunkin Donuts for this please?

Once on the website, you simply enter the companys ticker symbol Ex Macy would use M to obtain the financial information needed. We will also perform a trend analysis, where we evaluate changes in key ratios over time. There will be two parts to this project. Part will be gathering data points to put into excel. Part will be analyzing those data points by answering a series of questions. Within these questions, you will explain what each topic means, why it is used and how your company has performed.

Through the Morningstar website, you can find the firms financials Income Statement, Balance Sheet, and Cash Flow on an annual or quarterly basis for the five most recent time periods by clicking on each statements name as you scroll down your screen. In addition, the site contains Key Ratios Profitability Growth, Cash Flow, Financial Health, and Efficiency for years. From the home screen, click on Key Ratios and Full Key Ratios Data. Then the next screen shows years worth of key ratios. We will use the Key Ratios on this site to conduct the firms trend analysis. At the top of the home screen, you will see that you can click on the Learn tab and select Investing Glossary to find definitions.

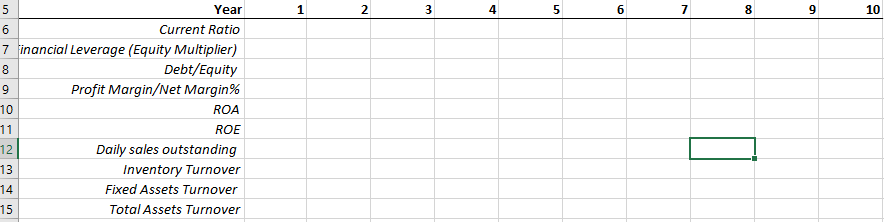

Part : Gather the following information and place it into excel to compare data. Use this Excel spreadsheet: Final Project BADM Financial Management.xlsx

Current Ratio

Financial Leverage Equity Multiplier

DebtEquity

Net Margin

ROA

ROE

Daily sales outstanding

Inventory Turnover

Fixed Assets Turnover

Total Assets Turnover

Part : Based on your findings above answer the following questions:

Briefly explain what each ratio means, why it is important and how it is calculated.

Choose several ratios from above to explain what this company has done well over the last years.

Choose several ratios from above to explain what this company needs to work on moving forward or point out an area of concern for this company.

Would you invest in this company? Why or why not? Is it a longterm investment, short term or a waitandsee? Use specific data points from above to argue your position.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started