Answered step by step

Verified Expert Solution

Question

1 Approved Answer

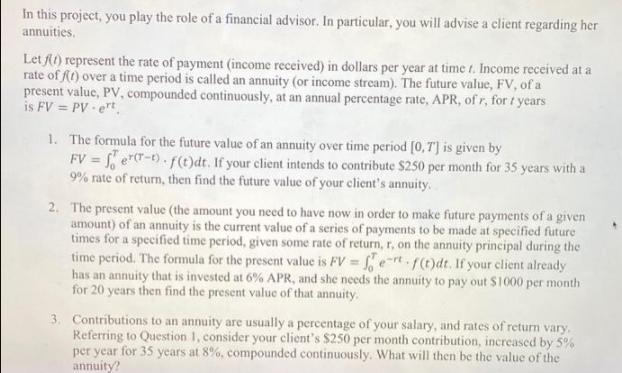

In this project, you play the role of a financial advisor. In particular, you will advise a client regarding her annuities. Let (r) represent

In this project, you play the role of a financial advisor. In particular, you will advise a client regarding her annuities. Let (r) represent the rate of payment (income received) in dollars per year at time r. Income received at a rate of ft) over a time period is called an annuity (or income stream). The future value, FV, of a present value, PV, compounded continuously, at an annual percentage rate, APR, of r, for t years is FV = PV-ert 1. The formula for the future value of an annuity over time period [0, 7] is given by FV = fer-t) f(t)dt. If your client intends to contribute $250 per month for 35 years with a 9% rate of return, then find the future value of your client's annuity. 2. The present value (the amount you need to have now in order to make future payments of a given amount) of an annuity is the current value of a series of payments to be made at specified future times for a specified time period, given some rate of return, r, on the annuity principal during the time period. The formula for the present value is FV = f et f(t)dt. If your client already has an annuity that is invested at 6% APR, and she needs the annuity to pay out $1000 per month for 20 years then find the present value of that annuity. 3. Contributions to an annuity are usually a percentage of your salary, and rates of return vary. Referring to Question 1, consider your client's $250 per month contribution, increased by 5% per year for 35 years at 8%, compounded continuously. What will then be the value of the annuity?

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

1 The future value of the annuity is given by the formula FV e17t ftdt FV e17t 250dt FV e1...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started