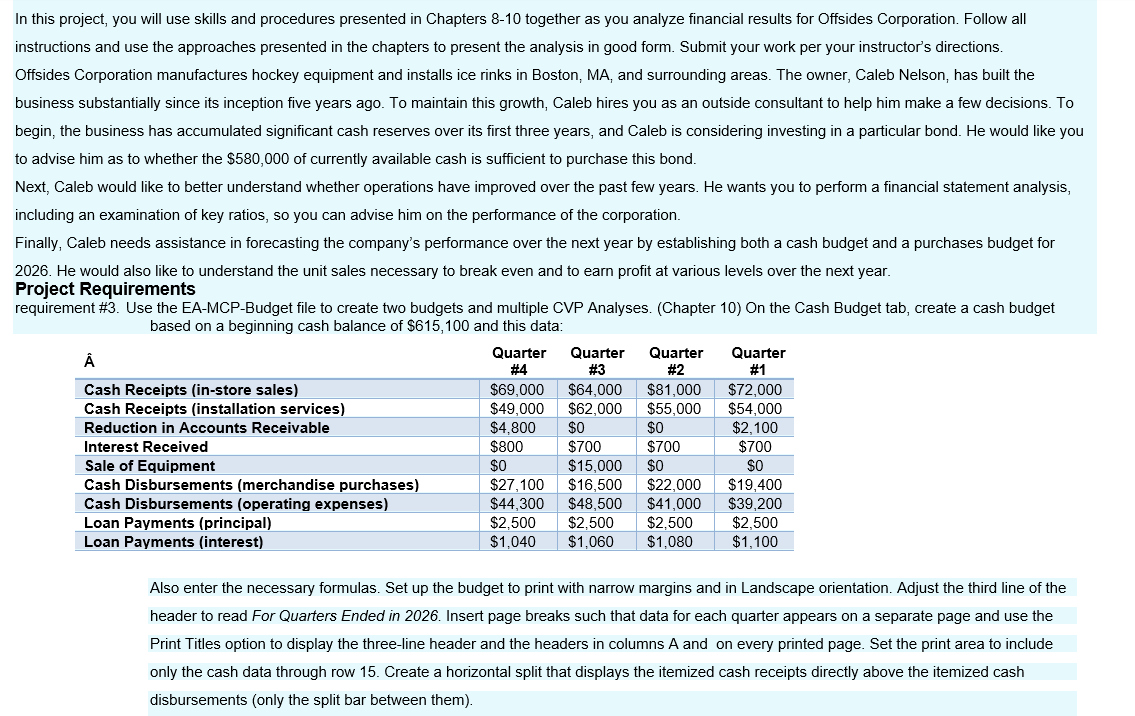

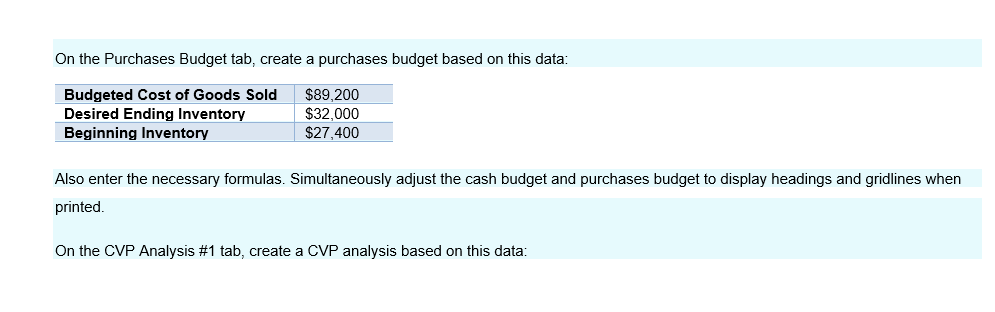

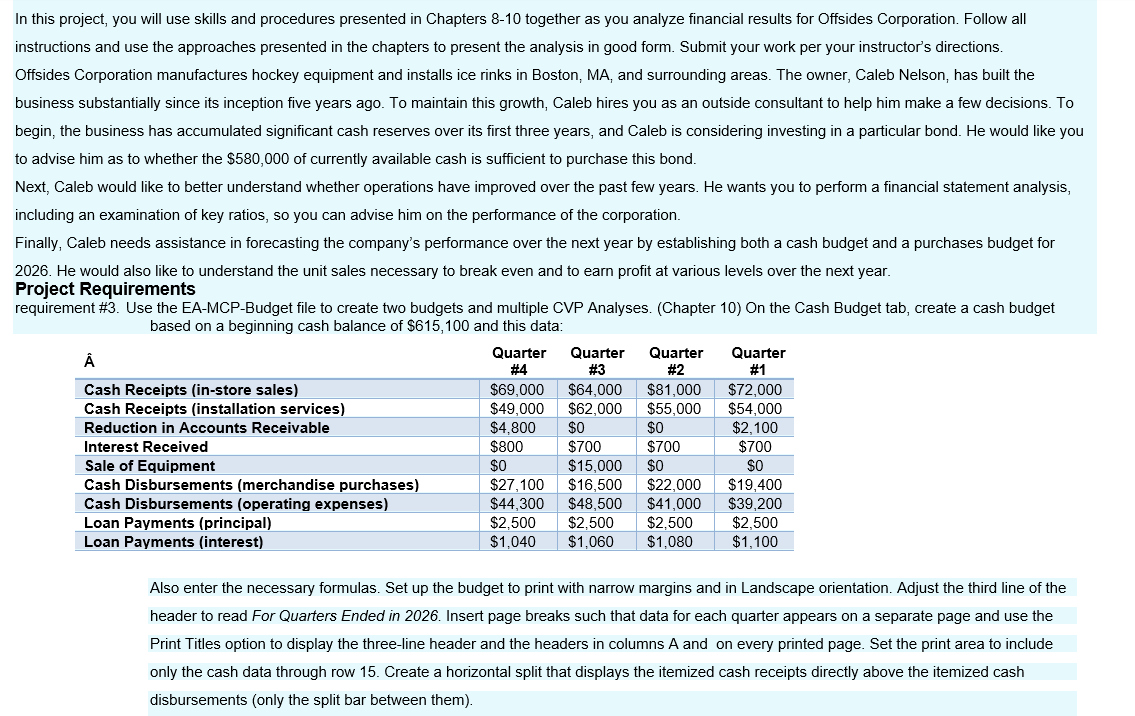

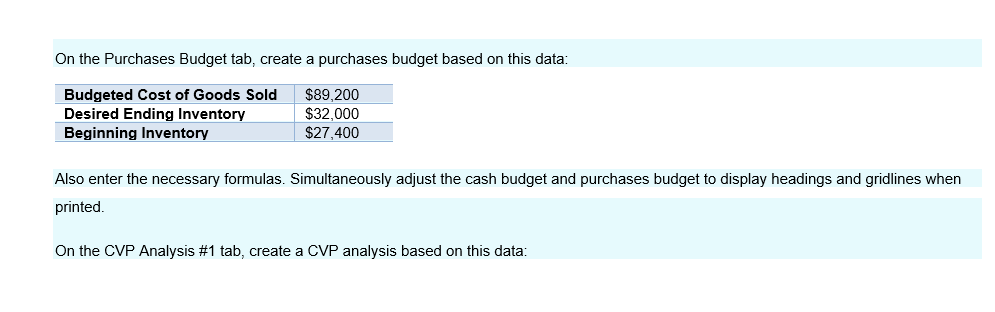

In this project, you will use skills and procedures presented in Chapters 8-10 together as you analyze financial results for Offsides Corporation. Follow all instructions and use the approaches presented in the chapters to present the analysis in good form. Submit your work per your instructor's directions. Offsides Corporation manufactures hockey equipment and installs ice rinks in Boston, MA, and surrounding areas. The owner, Caleb Nelson, has built the business substantially since its inception five years ago. To maintain this growth, Caleb hires you as an outside consultant to help him make a few decisions. To begin, the business has accumulated significant cash reserves over its first three years, and Caleb is considering investing in a particular bond. He would like you to advise him as to whether the $580,000 of currently available cash is sufficient to purchase this bond. Next, Caleb would like to better understand whether operations have improved over the past few years. He wants you to perform a financial statement analysis, including an examination of key ratios, so you can advise him on the performance of the corporation. Finally, Caleb needs assistance in forecasting the company's performance over the next year by establishing both a cash budget and a purchases budget for 2026. He would also like to understand the unit sales necessary to break even and to earn profit at various levels over the next year. Project Requirements requirement #3. Use the EA-MCP-Budget file to create two budgets and multiple CVP Analyses. (Chapter 10) On the Cash Budget tab, create a cash budget based on a beginning cash balance of $615,100 and this data: Quarter Quarter Quarter Quarter #4 #3 #2 #1 Cash Receipts (in-store sales) $69,000 $64,000 $81,000 $72,000 Cash Receipts (installation services) $49,000 $62,000 $55,000 $54,000 Reduction in Accounts Receivable $4,800 $0 $0 $2,100 Interest Received $800 $700 $700 $700 Sale of Equipment $0 $15.000 $0 SO Cash Disbursements (merchandise purchases) $27,100 $16,500 $22,000 $19,400 Cash Disbursements (operating expenses) $44,300 $48,500 $41,000 $39,200 Loan Payments (principal) $2,500 $2,500 $2,500 $2,500 Loan Payments (interest) $1,040 $1,060 $1,080 $1,100 Also enter the necessary formulas. Set up the budget to print with narrow margins and in Landscape orientation. Adjust the third line of the header to read For Quarters Ended in 2026. Insert page breaks such that data for each quarter appears on a separate page and use the Print Titles option to display the three-line header and the headers in columns A and on every printed page. Set the print area to include only the cash data through row 15. Create a horizontal split that displays the itemized cash receipts directly above the itemized cash disbursements (only the split bar between them). On the Purchases Budget tab, create a purchases budget based on this data: Budgeted Cost of Goods Sold Desired Ending Inventory Beginning Inventory $89,200 $32,000 $27,400 Also enter the necessary formulas. Simultaneously adjust the cash budget and purchases budget to display headings and gridlines when printed On the CVP Analysis #1 tab, create a CVP analysis based on this data: In this project, you will use skills and procedures presented in Chapters 8-10 together as you analyze financial results for Offsides Corporation. Follow all instructions and use the approaches presented in the chapters to present the analysis in good form. Submit your work per your instructor's directions. Offsides Corporation manufactures hockey equipment and installs ice rinks in Boston, MA, and surrounding areas. The owner, Caleb Nelson, has built the business substantially since its inception five years ago. To maintain this growth, Caleb hires you as an outside consultant to help him make a few decisions. To begin, the business has accumulated significant cash reserves over its first three years, and Caleb is considering investing in a particular bond. He would like you to advise him as to whether the $580,000 of currently available cash is sufficient to purchase this bond. Next, Caleb would like to better understand whether operations have improved over the past few years. He wants you to perform a financial statement analysis, including an examination of key ratios, so you can advise him on the performance of the corporation. Finally, Caleb needs assistance in forecasting the company's performance over the next year by establishing both a cash budget and a purchases budget for 2026. He would also like to understand the unit sales necessary to break even and to earn profit at various levels over the next year. Project Requirements requirement #3. Use the EA-MCP-Budget file to create two budgets and multiple CVP Analyses. (Chapter 10) On the Cash Budget tab, create a cash budget based on a beginning cash balance of $615,100 and this data: Quarter Quarter Quarter Quarter #4 #3 #2 #1 Cash Receipts (in-store sales) $69,000 $64,000 $81,000 $72,000 Cash Receipts (installation services) $49,000 $62,000 $55,000 $54,000 Reduction in Accounts Receivable $4,800 $0 $0 $2,100 Interest Received $800 $700 $700 $700 Sale of Equipment $0 $15.000 $0 SO Cash Disbursements (merchandise purchases) $27,100 $16,500 $22,000 $19,400 Cash Disbursements (operating expenses) $44,300 $48,500 $41,000 $39,200 Loan Payments (principal) $2,500 $2,500 $2,500 $2,500 Loan Payments (interest) $1,040 $1,060 $1,080 $1,100 Also enter the necessary formulas. Set up the budget to print with narrow margins and in Landscape orientation. Adjust the third line of the header to read For Quarters Ended in 2026. Insert page breaks such that data for each quarter appears on a separate page and use the Print Titles option to display the three-line header and the headers in columns A and on every printed page. Set the print area to include only the cash data through row 15. Create a horizontal split that displays the itemized cash receipts directly above the itemized cash disbursements (only the split bar between them). On the Purchases Budget tab, create a purchases budget based on this data: Budgeted Cost of Goods Sold Desired Ending Inventory Beginning Inventory $89,200 $32,000 $27,400 Also enter the necessary formulas. Simultaneously adjust the cash budget and purchases budget to display headings and gridlines when printed On the CVP Analysis #1 tab, create a CVP analysis based on this data