Question: In this question, we consider a problem which arises when we switch our pension system from PAYG to FF. Suppose that a PAYG pension

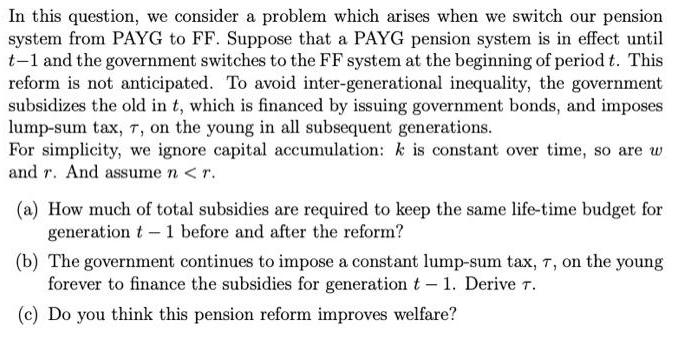

In this question, we consider a problem which arises when we switch our pension system from PAYG to FF. Suppose that a PAYG pension system is in effect until t-1 and the government switches to the FF system at the beginning of period t. This reform is not anticipated. To avoid inter-generational inequality, the government subsidizes the old in t, which is financed by issuing government bonds, and imposes lump-sum tax, 7, on the young in all subsequent generations. For simplicity, we ignore capital accumulation: k is constant over time, so are w and r. And assume n < r. (a) How much of total subsidies are required to keep the same life-time budget for generation t 1 before and after the reform? (b) The government continues to impose a constant lump-sum tax, 7, on the young forever to finance the subsidies for generation t - 1. Derive T. (c) Do you think this pension reform improves welfare?

Step by Step Solution

3.39 Rating (158 Votes )

There are 3 Steps involved in it

a Subsidies required to keep the same lifetime budget for generation t1 before and after reform In order to keep the same lifetime budget for generati... View full answer

Get step-by-step solutions from verified subject matter experts