Question

In this question, you will analyze their Measures of Profitability: Although Rush Industries' gross profit margin is ( a . below or b . above

In this question, you will analyze their Measures of Profitability: Although Rush Industries' gross profit margin is a below or b above

its industry average, the company has ana higher or b lower

net profit margin in comparison to average. Additional details are below: Week KPI Assignment

This week you will explore analysis by computing key performance indicators for a company. You should calculate each ratio using the financial statements provided and then choose the correct answer from the choices provided in the assignment. You will round to two decimal places. If it is expressed at a you need to convert to and then take out two decimal places. Standard rounding applies.

Rush Industries Income Statement for the Year Ended December

Sales revenue $

Less: Cost of sales

Gross profits $

Less: Operating expenses

Sales and marketing expense $

General and administrative expenses

Lease expense

Depreciation expense

Total operating expense $

Operating profits $

Less: Interest expense

Net profits before taxes $

Less: Taxes

Net income $

Rush Industries Balance Sheet December

Assets

Cash $

Marketable securities

Accounts receivable

Inventories

Total current assets $

Land $

Buildings and equipment

Less: Accumulated depreciation

Total fixed assets $

Total assets $

Liabilities and Stockholders Equity

Accounts payable $

Notes payable

Total current liabilities $

Longterm debt

Total liabilities

Common stocka

Retained earnings

Total stockholders' equity

Total liabilities and stockholders equity $

a The firms outstanding shares of common stock closed at a price of $ per share.

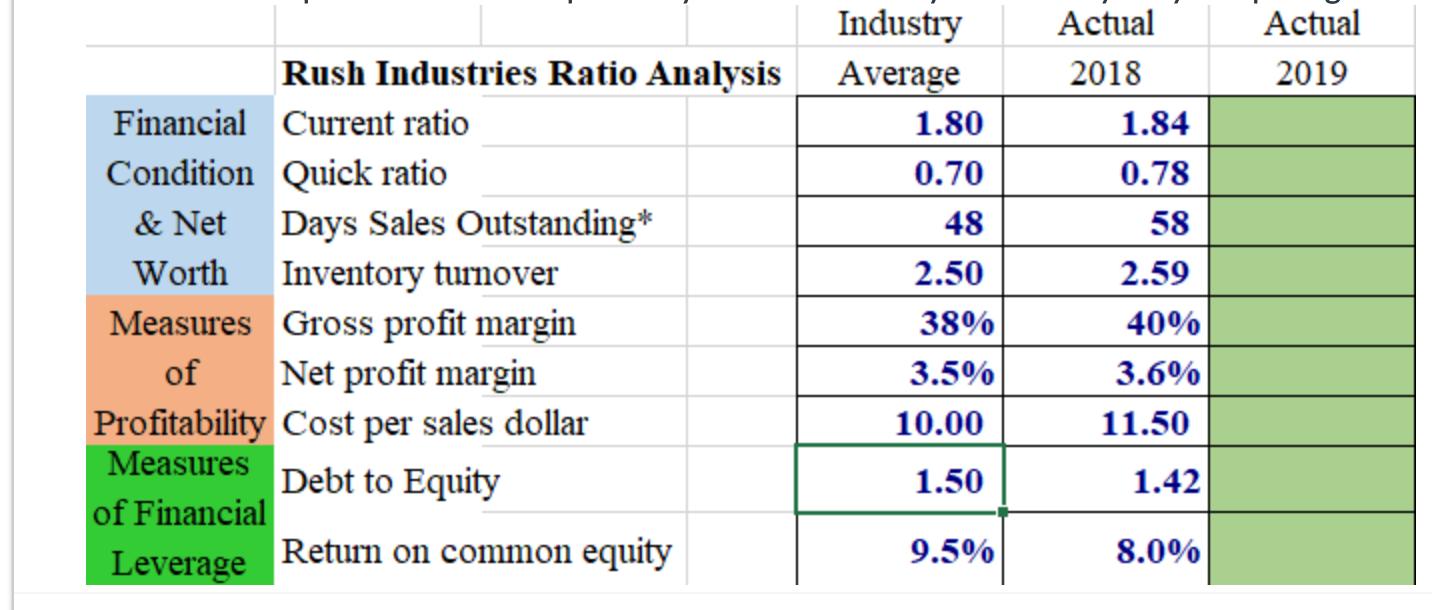

Using the financial statements above, you will calculate the actual ratios. You will then enter your answers in the questions that follow. The first set of questions will be to provide your ratios. Then you will analyze by comparing to industry and both provided here

Industry Actual Actual Rush Industries Ratio Analysis Average 2018 2019 Financial Current ratio 1.80 1.84 Condition Quick ratio 0.70 0.78 & Net Days Sales Outstanding* 48 58 Worth Inventory turnover 2.50 2.59 Measures Gross profit margin of Net profit margin 38% 40% 3.5% 3.6% Profitability Cost per sales dollar 10.00 11.50 Measures Debt to Equity 1.50 1.42 of Financial Leverage Return on common equity 9.5% 8.0%

Step by Step Solution

3.32 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Based on the provided information the measures of profitability for Rush Industries are as follows G...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started