Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In this question, you will assume 360 days in a year. A German shipping cargo manufacturer imports steel parts from the UK and is quoted

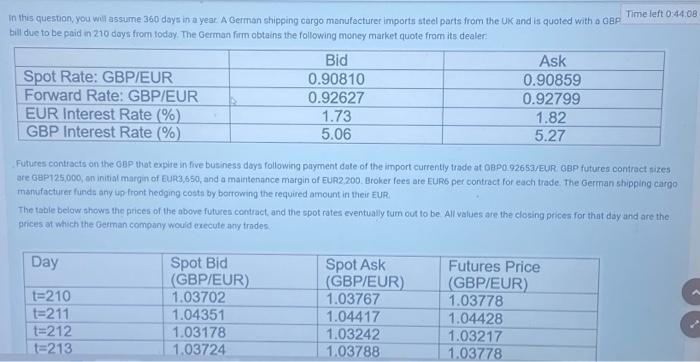

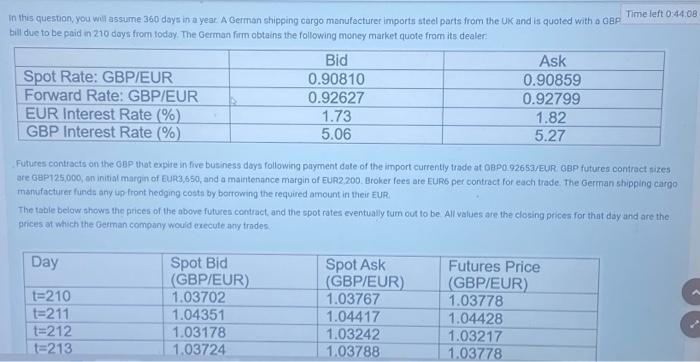

In this question, you will assume 360 days in a year. A German shipping cargo manufacturer imports steel parts from the UK and is quoted with a GBPL bill due to be paid in 210 days from today. The German firm obtains the following money market quote from its dealer: Spot Rate: GBP/EUR Forward Rate: GBP/EUR EUR Interest Rate (%) GBP Interest Rate (%) Day Futures contracts on the GBP that expire in five business days following payment date of the import currently trade at GBP0.92653/EUR. GBP futures contract sizes are GBP125,000, an initial margin of EUR3,650, and a maintenance margin of EUR2,200. Broker fees are EUR6 per contract for each trade. The German shipping cargo manufacturer funds any up-front hedging costs by borrowing the required amount in their EUR. t=210 t=211 t=212 t=213 Bid 0.90810 0.92627 1.73 5.06 The table below shows the prices of the above futures contract, and the spot rates eventually turn out to be. All values are the closing prices for that day and are the prices at which the German company would execute any trades. Spot Bid (GBP/EUR) 1.03702 1.04351 1.03178 1.03724 Ask 0.90859 0.92799 1.82 5.27 Spot Ask (GBP/EUR) 1.03767 1.04417 1.03242 1.03788 Time left 0:44:08 Futures Price (GBP/EUR) 1.03778 1.04428 1.03217 1.03778 what is the differnece between the cost of the money market hedge and future market hedge? the opportunity cost of futures margin requirements can be ignored. a) EUR 27,568 b) EUR17,294 c) EUR30,923 d) EUR44,862 e. none of the options in the question 2nd ques what is the differnece between the cost of money market hedge and forward market hedge? a) EUR48,227 b) EUR152,765 c) EUR104,538 d) EUR17,304 e) None of the options in the question  In this question, you wil assume 360 days in a year. A German shipping cargo manulacturer imports steel parts from the UK and is quoted with a GeP Time left 0:44 bill due to be paid in 210 doys from today. The German firm obtains the following money markel quote from its dealer: Fuhures contracts on the GBP that expire in five business days following payment date of the import currently trade at 9BP0 92653. EuR BBP futures contract nizes are GEPT25,000, an initial margin of EURC,650, and a maintenance margin of EUR2,200. Broker fees are EUR6 per contract for each trade. The German shipping cargo mamsifacturer funds any up front hedging costs by borrowing the required amount in their EUR. The table below shows the prices of the above futures contrach and the spot rates eventually fum out to be All values are the closing prices for that day and are the grices at which the German company would erecute ary trades

In this question, you wil assume 360 days in a year. A German shipping cargo manulacturer imports steel parts from the UK and is quoted with a GeP Time left 0:44 bill due to be paid in 210 doys from today. The German firm obtains the following money markel quote from its dealer: Fuhures contracts on the GBP that expire in five business days following payment date of the import currently trade at 9BP0 92653. EuR BBP futures contract nizes are GEPT25,000, an initial margin of EURC,650, and a maintenance margin of EUR2,200. Broker fees are EUR6 per contract for each trade. The German shipping cargo mamsifacturer funds any up front hedging costs by borrowing the required amount in their EUR. The table below shows the prices of the above futures contrach and the spot rates eventually fum out to be All values are the closing prices for that day and are the grices at which the German company would erecute ary trades

In this question, you will assume 360 days in a year. A German shipping cargo manufacturer imports steel parts from the UK and is quoted with a GBPL bill due to be paid in 210 days from today. The German firm obtains the following money market quote from its dealer: Spot Rate: GBP/EUR Forward Rate: GBP/EUR EUR Interest Rate (%) GBP Interest Rate (%) Day Futures contracts on the GBP that expire in five business days following payment date of the import currently trade at GBP0.92653/EUR. GBP futures contract sizes are GBP125,000, an initial margin of EUR3,650, and a maintenance margin of EUR2,200. Broker fees are EUR6 per contract for each trade. The German shipping cargo manufacturer funds any up-front hedging costs by borrowing the required amount in their EUR. t=210 t=211 t=212 t=213 Bid 0.90810 0.92627 1.73 5.06 The table below shows the prices of the above futures contract, and the spot rates eventually turn out to be. All values are the closing prices for that day and are the prices at which the German company would execute any trades. Spot Bid (GBP/EUR) 1.03702 1.04351 1.03178 1.03724 Ask 0.90859 0.92799 1.82 5.27 Spot Ask (GBP/EUR) 1.03767 1.04417 1.03242 1.03788 Time left 0:44:08 Futures Price (GBP/EUR) 1.03778 1.04428 1.03217 1.03778

what is the differnece between the cost of the money market hedge and future market hedge? the opportunity cost of futures margin requirements can be ignored.

a) EUR 27,568

b) EUR17,294

c) EUR30,923

d) EUR44,862

e. none of the options in the question

2nd ques

what is the differnece between the cost of money market hedge and forward market hedge?

a) EUR48,227

b) EUR152,765

c) EUR104,538

d) EUR17,304

e) None of the options in the question

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started