Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In this section you are required to create adjusting journal entries to account for the following accrued expenses and a prepayment of insurance. This is

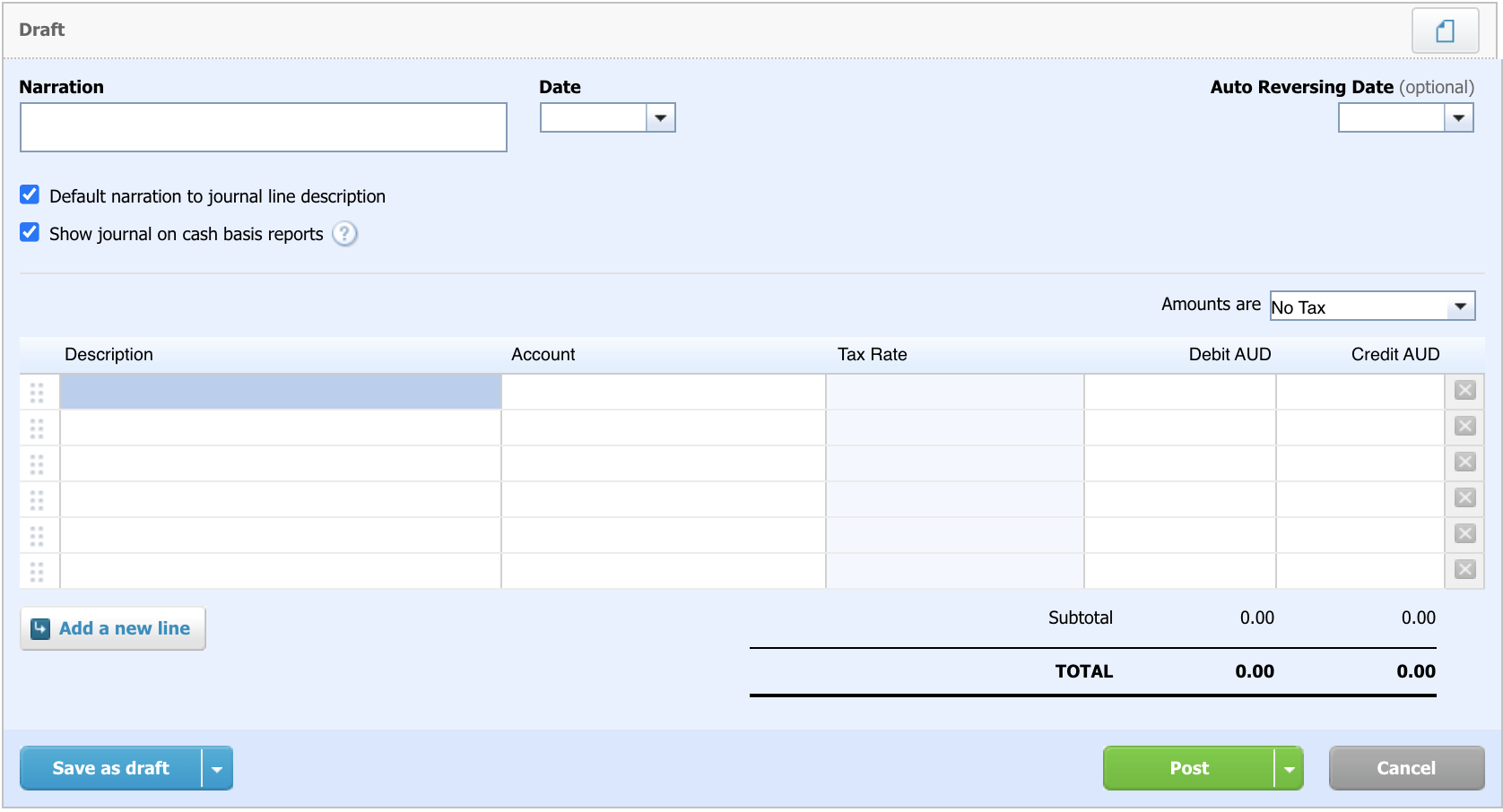

In this section you are required to create adjusting journal entries to account for the following accrued expenses and a prepayment of insurance. This is nearly the end of the reporting period (i.e., 31 March 2021), Macquarie Plumbing wants to ensure that transactions in the accounts match the period to which they relate. They've identified 2 transactions that require manual adjustments. Regarding the plumbing service contract with New Albion Grammar School signed on 1 Feb 2021, 20% of the job has been completed. At the quarter end of March, a two-month insurance has expired. You will need to calculate and recognise the Insurance expense (expense). Activity 1. Select the Accounting tab and select Manual Journals. 2. Click +New Journal 3. Create your journal entry ensuring that the narration, date, description and account fields are completed and that your debits and credits balance 4. Click Post 5. Repeat the above steps for each adjusting entry Draft Narration Date Auto Reversing Date (optional) Default narration to journal line description Show journal on cash basis reports Amounts are No Tax Description Account Tax Rate Debit AUD Credit AUD x x x x x x Subtotal 0.00 0.00 Add a new line TOTAL 0.00 0.00 Save as draft Post Cancel

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started