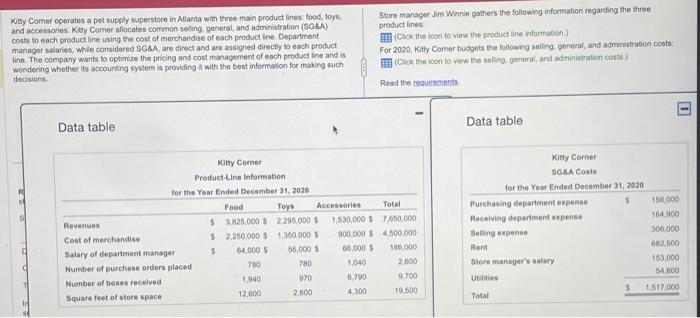

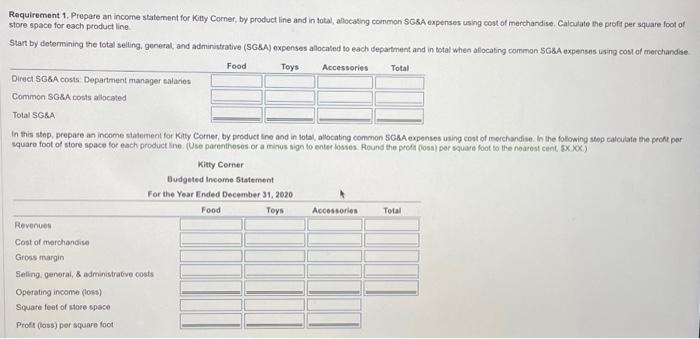

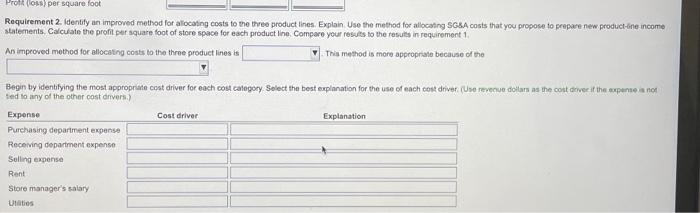

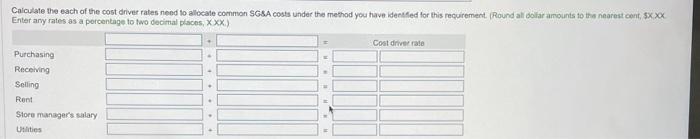

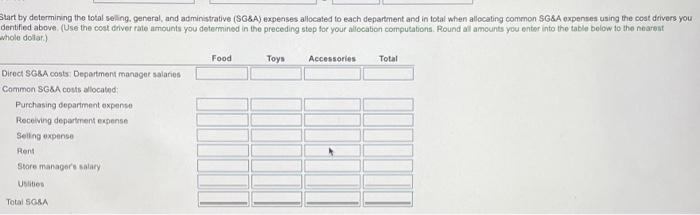

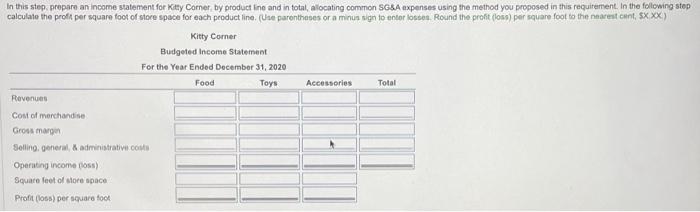

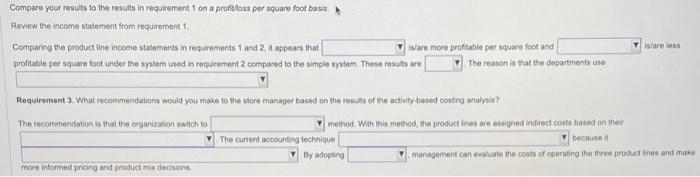

In this step. propare an income statement for Katy Corner, by product ine and in total, allocating common SGSA expenses using the method you proposed in this requirement. In the following step. calculate the proft per square foot of store space for each peoduct line. (Use parenthases or a minus sign to entor losses. Round the profit (loss) per square foot to the nearent cunt, 5 XX) tart by determining the total seling. general, and administrative (SGSA) expenses allocated to each department and in fotal when allocating common \$GSA expenses using the cost divers you entified above. (Use the cost diver rate amounts you determined in the preceding step for your allocaton computations. Round all amounts you enter into the table below to the nearest hole dolar.) Requirement 1. Prepere an income statement for Kitty Comer, by product line and in total, allocasing common SGBA expenses using cost of merchandise. Caloulate the proff per square foot of store space for each product line. Stant by dotermining the total selling. general, and administratwe (SGSA) expenses allocated to each department and in total when allocating comman 5 CSA expenses using cost of merchandse In this step, prepare an income statement for Kity Corner, by product ino and in lotal, allocating common 5GsA expenses using cost of merchandise. In the folowing step calculate the peofi per Kitfy Comer oporates a pet suppty superstore in Allamta with tretee main product lines: food, 10ys. and accesssories. Kotty Comer allocates common seling. goneral, and administration (SGSA) costs to each product line using the cost of merchandae of nach peoduct line. Departrent manager salaries, while considered SGSA, are direct and are assigned directly to each product line The compary wants to optimize the pricing and cost management of each product ine and fis wendering whether its accounteng system is providing A with the best informalion for making such decisions. Store manager Jim Winnin gathers tho following information regarding the three. product lines fClick the icen to view the product ine information. For 2020, Kitty Comer budgots the following selling, general, and administratea costs If Cick the icon to view fre seling, general, and administration sesta) Read the requirements Data table Data table Requirement 2. identify an improwed method for allocaling costs to the three product lines. Explain. Use the method for allocating SGSA costs that you propose to prepare new product-ine income statements, Calculate the profit per square foot of store space for each product line. Compore your resuls to the resuld in requirement 1 . An impeoved methed for allocating costs to the three product lines is This method is more approprisio because of the Begin by identifying the most appropriste cost driver for each cost calegory. Solect the best explanation for the use of each cont driver. (Use revecuve doilars as the cont donver if the expunse a not ifed to any of the other cost drvers.? In this step. propare an income statement for Katy Corner, by product ine and in total, allocating common SGSA expenses using the method you proposed in this requirement. In the following step. calculate the proft per square foot of store space for each peoduct line. (Use parenthases or a minus sign to entor losses. Round the profit (loss) per square foot to the nearent cunt, 5 XX) tart by determining the total seling. general, and administrative (SGSA) expenses allocated to each department and in fotal when allocating common \$GSA expenses using the cost divers you entified above. (Use the cost diver rate amounts you determined in the preceding step for your allocaton computations. Round all amounts you enter into the table below to the nearest hole dolar.) Requirement 1. Prepere an income statement for Kitty Comer, by product line and in total, allocasing common SGBA expenses using cost of merchandise. Caloulate the proff per square foot of store space for each product line. Stant by dotermining the total selling. general, and administratwe (SGSA) expenses allocated to each department and in total when allocating comman 5 CSA expenses using cost of merchandse In this step, prepare an income statement for Kity Corner, by product ino and in lotal, allocating common 5GsA expenses using cost of merchandise. In the folowing step calculate the peofi per Kitfy Comer oporates a pet suppty superstore in Allamta with tretee main product lines: food, 10ys. and accesssories. Kotty Comer allocates common seling. goneral, and administration (SGSA) costs to each product line using the cost of merchandae of nach peoduct line. Departrent manager salaries, while considered SGSA, are direct and are assigned directly to each product line The compary wants to optimize the pricing and cost management of each product ine and fis wendering whether its accounteng system is providing A with the best informalion for making such decisions. Store manager Jim Winnin gathers tho following information regarding the three. product lines fClick the icen to view the product ine information. For 2020, Kitty Comer budgots the following selling, general, and administratea costs If Cick the icon to view fre seling, general, and administration sesta) Read the requirements Data table Data table Requirement 2. identify an improwed method for allocaling costs to the three product lines. Explain. Use the method for allocating SGSA costs that you propose to prepare new product-ine income statements, Calculate the profit per square foot of store space for each product line. Compore your resuls to the resuld in requirement 1 . An impeoved methed for allocating costs to the three product lines is This method is more approprisio because of the Begin by identifying the most appropriste cost driver for each cost calegory. Solect the best explanation for the use of each cont driver. (Use revecuve doilars as the cont donver if the expunse a not ifed to any of the other cost drvers