Question

In this task, we will apply the Dividend Discount Model (DDM) to analyze the effect of the interest rate on the valuation of shares. We

In this task, we will apply the Dividend Discount Model (DDM) to analyze the effect of the interest rate on the valuation of shares. We must also make connections to reality, but be aware then that the model is a rough simplification of reality and that the specific figures in the task are made up. I would still like to emphasize that the general points we will make are still the highest relevant to the valuation of shares and the current situation we are in today. This is why that all models for how to value stocks are to some extent about discounting a future cash flow and is affected by interest rates.

i) Valuate Marknaden AB's share for each year from year 0 to year 24 using DDM (Formula (10) in the formula collection) and plot the value of the stock in a chart. Suppose one at each time has assumed that the prevailing interest rate will be forever.

ii) Evaluate Marknaden ABs under two hypothetical scenarios where the interest rate is instead in one the case is still at 2% throughout the period and in the second case is still at 6% throughout period. Plot the values according to the two different scenarios in the same diagram as above.

iii)You realize that there is some risk that the zero interest rate that applies today may not apply forever and want to make a forecast of Marknaden AB's future share price will developed according to three different scenarios. Calculate the share price for Marknaden AB for each year 24 years ahead in time according to the three interest rate forecasts in Table 1. Plot your result in a new one chart together with your result from i). Your chart should therefore contain a curve which describes the share price from year 0 to year 24 with falling interest as in i). From year 25 to year 48, plot the three different curves generated by the different forecasts.

Interest from year 25 and forever

Prognos 1 0%

Prognos 2 1%

Prognos 3 2%

iv) You are fine-tuning your interest rate forecast and want to calculate the value today for Marknaden AB and the company FutureTech AB. You expect that the period of zero interest will continue in the coming year but that the interest rate will thereafter rise by 0.5% for each years until the interest rate has reached 2%. After that, do you think that the interest rate will remain at 2% for all eternity. As we know, Marknaden AB has a growth rate of its dividend of 2%. FutureTech, on the other hand, is not expected to pay any dividends at all for the next 2 years and only after 5 years will the dividend have a constant growth for eternal eternity, then at 5% per year.

Year 1 2 3 4 5

Interest 0% 0,5% 1,5% 2% 2,5%

Dividend

FutureTech 0 0 10 20 30

Market 16,0844 16,4061 16,7342 17,0689 17,4102

Growth of the dividend after 5 years Riskpremie

FutureTech 5% 6%

Market 2% 6%

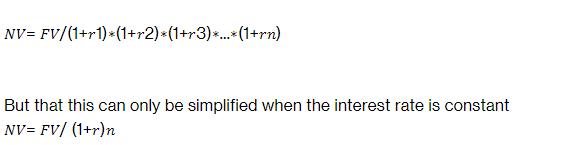

Calculate the percentage change in the share price for Marknaden AB and FutureTech AB which occurs if you go from an interest rate situation where the interest rate is expected to be 0% for all future compared to the case in the table above where you gradually go from 0% to 2% interest. Present your result in the form of a table with the share price for Marknaden AB and FutureTech AB during the two different scenarios and the percentage difference between different scenarios. Remember that the present value of a future amount at time ???? with an interest rate that varies calculated according to

v) Repeat the calculations in iv) but add 2% interest to both cases. So instead of constant zero interest rate, you should make your calculations with 2% interest rate constant forever as well the case where the interest rate rises from 2% to 4% in intervals of 0.5%. Present your result by entering the share price for Marknaden AB and FutureTech AB under the two different ones the scenarios and the percentage difference between the different scenarios in the same table as in iv).

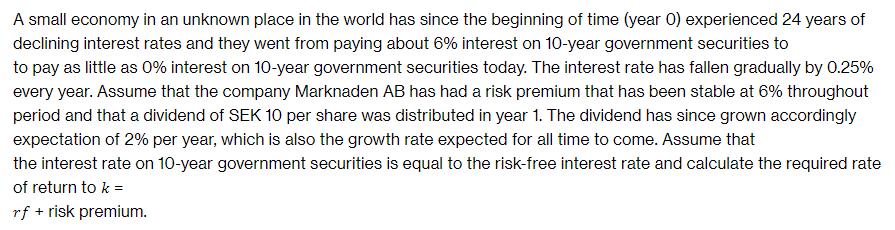

A small economy in an unknown place in the world has since the beginning of time (year 0) experienced 24 years of declining interest rates and they went from paying about 6% interest on 10-year government securities to to pay as little as 0% interest on 10-year government securities today. The interest rate has fallen gradually by 0.25% every year. Assume that the company Marknaden AB has had a risk premium that has been stable at 6% throughout period and that a dividend of SEK 10 per share was distributed in year 1. The dividend has since grown accordingly expectation of 2% per year, which is also the growth rate expected for all time to come. Assume that the interest rate on 10-year government securities is equal to the risk-free interest rate and calculate the required rate of return to k = rf + risk premium.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Analyzing Share Price with Dividend Discount Model DDM This document outlines how to apply the Dividend Discount Model DDM to assess the impact of interest rates on Marknaden ABs share price under var...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started