Question: In this task your line manager wants to assess your understanding and ability to prepare and produce the appropriate final accounts such as profit and

In this task your line manager wants to assess your understanding and ability to prepare and produce the appropriate final accounts such as profit and loss account, owners’ equity statement, and balance sheet.

Instructions

a. Produce the final accounts for a sole trader business (Software Programming Company) including profit and loss account, owners’ equity statement, and balance sheet for the Period ended November 30th. Using the trial balance that you have produced in problem 2.

b. Compare the essential features of each financial account statement to analyse the differences between them in terms purpose, structure and content.

TRANSACTIONS

January 1. Mr. Sameer invested cash 30,000 in the business

January 2. Paid 1000 cash for the rent office space for the next six months.

January 3. Purchased computer OMR 2000.

January 4. Paid wage OMR 150.

January 5. Completed work for a client and immediately collected cash OMR 1000

January 6. Perform services for a client and sent a bill OMR 3, 000 to be paid later.

January 7. Purchased supplies OMR 8,000 in cash.

January 8. Received cash OMR 3000 from a client for the service provided.

January 9 Paid for advertisement charges OMR100

January 10. Owner withdrew OMR. 200 cash for personal use.

January 11. Completed work for another client OMR. 3,000 but paid only for 50% of the January amount. The remaining agree to pay later.

January 12. Paid salary. OMR 100.

January 13. purchase additional supplies of OMR 600.

January 14. Paid electricity bill OMR 100.

January 15. Paid transportation charges OMR 150

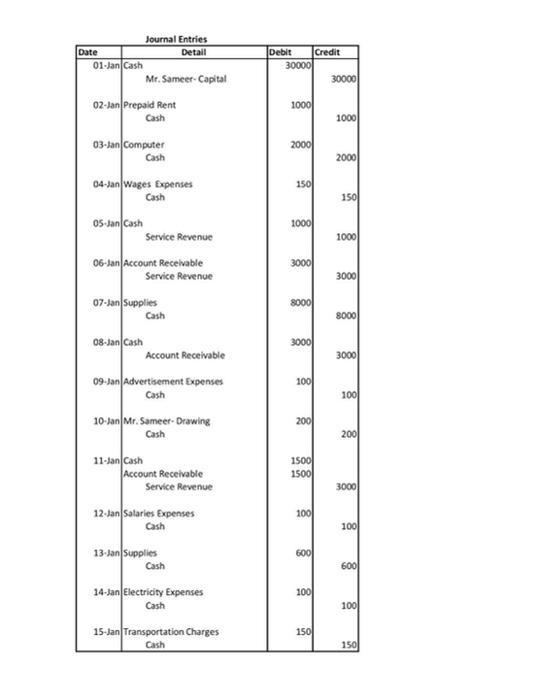

Journal Entries Date 01-Jan Cash Credit Debit 30000 Detail Mr. Sameer- Capital 30000 02-lan Prepaid Rent 1000 Cash 1000 03-Jan Computer 2000 Cash 2000 04-Jan wages Expenses 150 Cash 150 05-Jan Cash 1000 Service Revenue 1000 06-Jan Account Receivable 3000 Service Revenue 3000 07-Jan Supplies 8000 Cash 8000 08-Jan Cash 3000 Account Receivable 3000 09-Jan Advertisement Expenses 100 Cash 100 10-Jan Mr. Sameer- Drawing 200 Cash 200 11-Jan Cash Account Receivable Service Revenue 1500 1500 3000 12-Jan Salaries Expenses 100 Cash 100 13-Jan Supplies 600 Cash 600 14-Jan Electricty Expenses 100 Cash 100 15-Jan Transportation Charges Cash 150 150

Step by Step Solution

3.49 Rating (159 Votes )

There are 3 Steps involved in it

8Jan Cash 3000 Service Revenue 3000 Trial Balance Profit loss account Account titles Debit Credit Service Revenue 9000 Cash 22100 Less Expenses Accoun... View full answer

Get step-by-step solutions from verified subject matter experts