Answered step by step

Verified Expert Solution

Question

1 Approved Answer

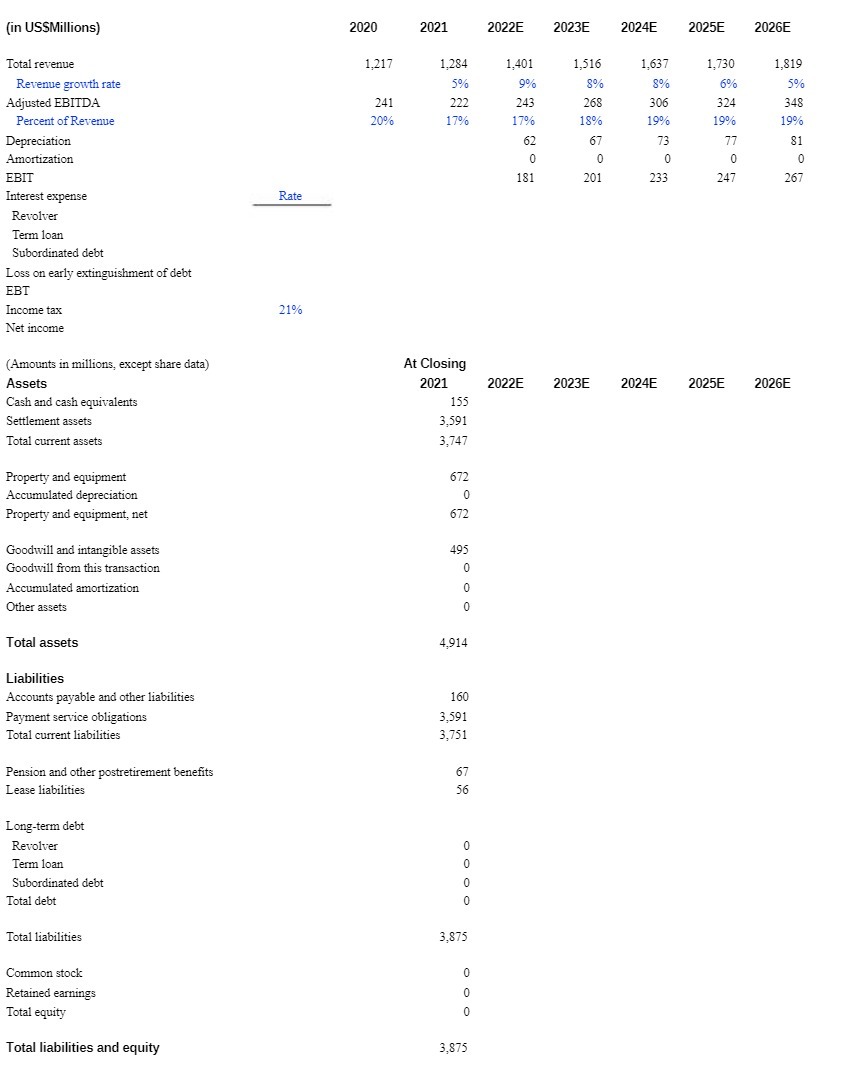

(in USSMillions) Total revenue Revenue growth rate Adjusted EBITDA Percent of Revenue Depreciation Amortization EBIT Interest expense Revolver Term loan Subordinated debt Loss on

(in USSMillions) Total revenue Revenue growth rate Adjusted EBITDA Percent of Revenue Depreciation Amortization EBIT Interest expense Revolver Term loan Subordinated debt Loss on early extinguishment of debt EBT Income tax Net income (Amounts in millions, except share data) Assets Cash and cash equivalents Settlement assets Total current assets Property and equipment Accumulated depreciation Property and equipment, net Goodwill and intangible assets Goodwill from this transaction Accumulated amortization Other assets Total assets Liabilities Accounts payable and other liabilities Payment service obligations Total current liabilities Pension and other postretirement benefits Lease liabilities Long-term debt Revolver Term loan Subordinated debt Total debt Total liabilities Common stock Retained earnings Total equity Total liabilities and equity Rate 21% 2020 2021 2022E 2023E 2024E 2025E 2026E 1,217 1,284 1,401 1,516 1,637 1,730 1,819 5% 9% 8% 8% 6% 5% 241 222 243 268 306 324 348 20% 17% 17% 18% 19% 19% 19% 62 67 73 77 81 0 0 0 0 0 181 201 233 247 267 At Closing 2021 2022E 2023E 2024E 2025E 2026E 155 3,591 3,747 672 0 672 495 0 0 0 4,914 160 3,591 3,751 67 56 3,875 3,875 0 0 0 0 0 0 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started