________________________

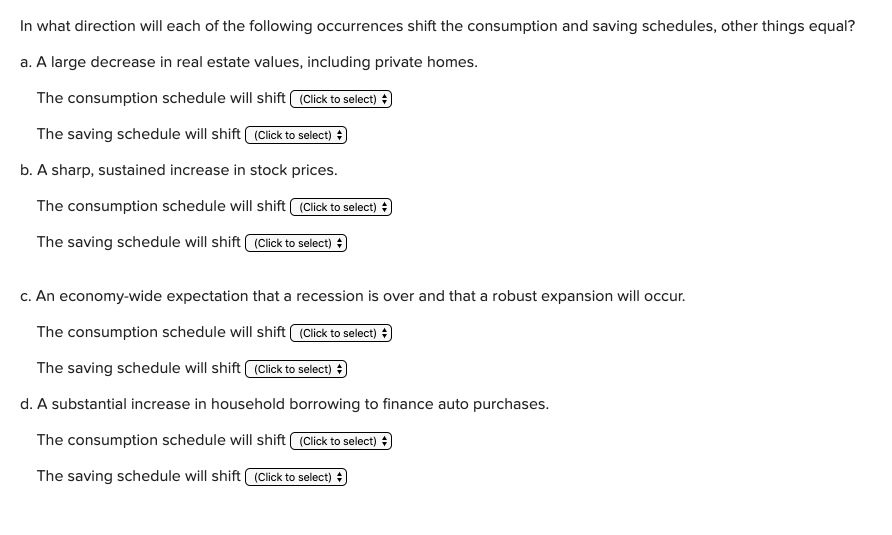

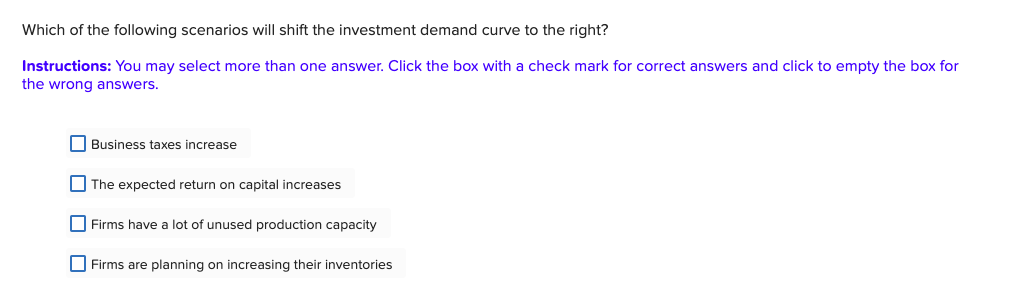

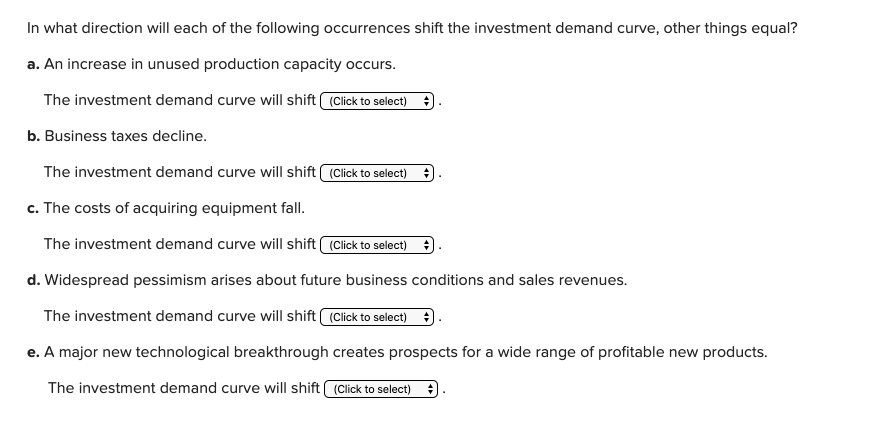

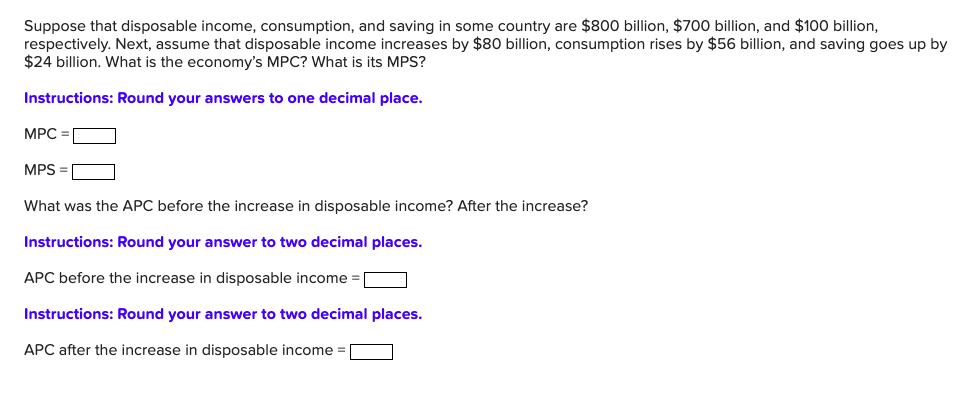

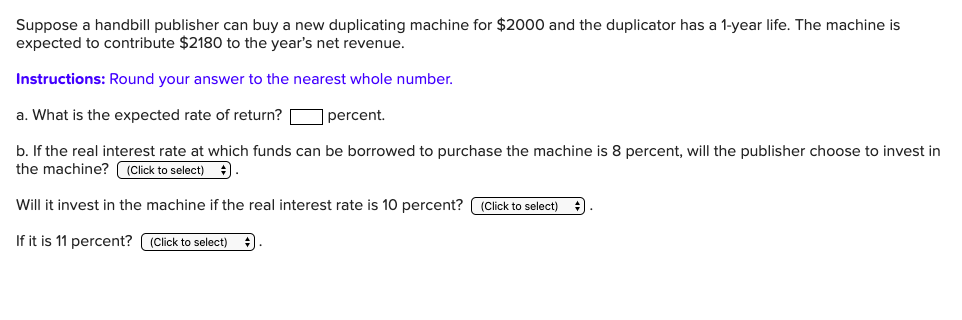

In what direction will each of the following occurrences shift the consumption and saving schedules, other things equal? a. A large decrease in real estate values, including private homes. The consumption schedule will shift The saving schedule will shift b. A sharp, sustained increase in stock prices. The consumption schedule will shift The saving schedule will shift c. An economy-wide expectation that a recession is over and that a robust expansion will occur. The consumption schedule will shift The saving schedule will shift d. A substantial increase in household borrowing to nance auto purchases. The consumption schedule will shift The saving schedule will shift Which of the following scenarios will shift the investment demand curve to the right? Instructions: You may select more than one answer. Click the box with a check mark for correct answers and click to empty the box for the wrong answers. Business taxes increase The expected return on capital increases Firms have a lot of unused production capacity Firms are planning on increasing their inventoriesIn what direction will each of the following occurrences shift the investment demand curve. other things equal? a. An increase in unused production capacityI occurs. The investment demand curve will shift . b. Business taxes decline. The investment demand curve will shift . c. The costs of acquiring equipment fall. The investment demand curve will shift . d. Widespread pessimism arises about future business conditions and sales revenues. The investment demand curve will shift . e. A major new technological breakthrough creates prospects for a wide range of protable new products. The investment demand curve will shift . Suppose that disposable income, consumption, and saving in some country are $800 billion, $700 billion. and $100 billion, respectively. Next, assume that disposable income increases by $80 billion, consumption rises by $56 billion, and saving goes up by $24 billion. What is the economy's MPC? What is its MP5? Instructions: Round your answers to one decimal place. MPC = MP5=:| 1What was the AFC before the increase in disposable income? Alter the increase? Instructions: Round your answer to two decimal places. APC before the increase in disposable income = Instructions: Round your answer to two decimal places. APC after the increase in disposable income = Suppose a handbill publisher can buy a new duplicating machine for $2000 and the duplicator has a 1-year life. The machine is expected to contribute $2180 to the year's net revenue. Instructions: Round your answer to the nearest whole number. a. What is the expected rate of return? percent. b. If the real interest rate at which funds can be borrowed to purchase the machine is 8 percent, will the publisher choose to invest in the machine? Will it invest in the machine if the real interest rate is 10 percent? . If it is '11 percent