Question

In writing the memo, use section headers to clearly delineate each of the following five sections: 1. Analyze three items on the income statement (or

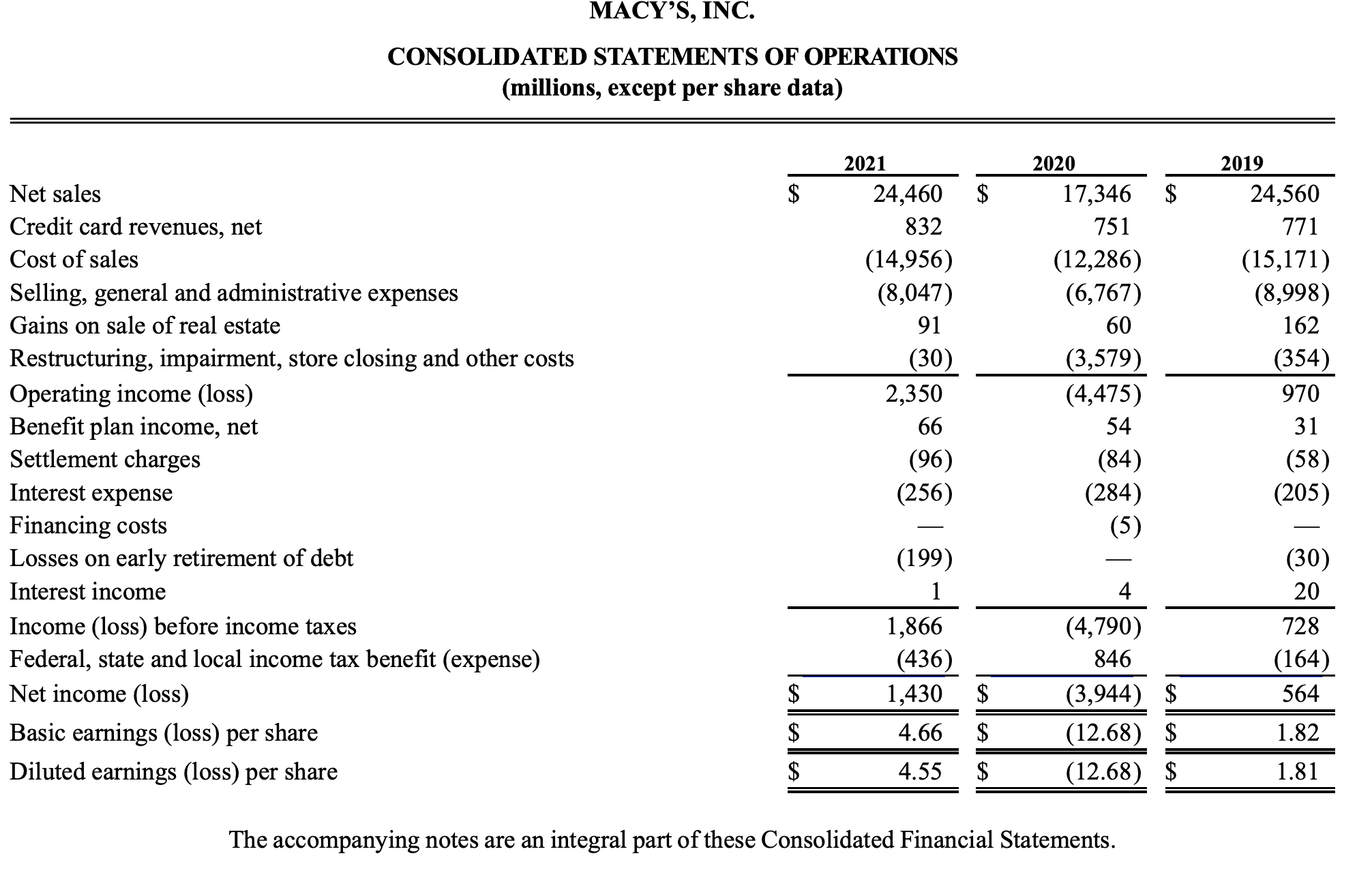

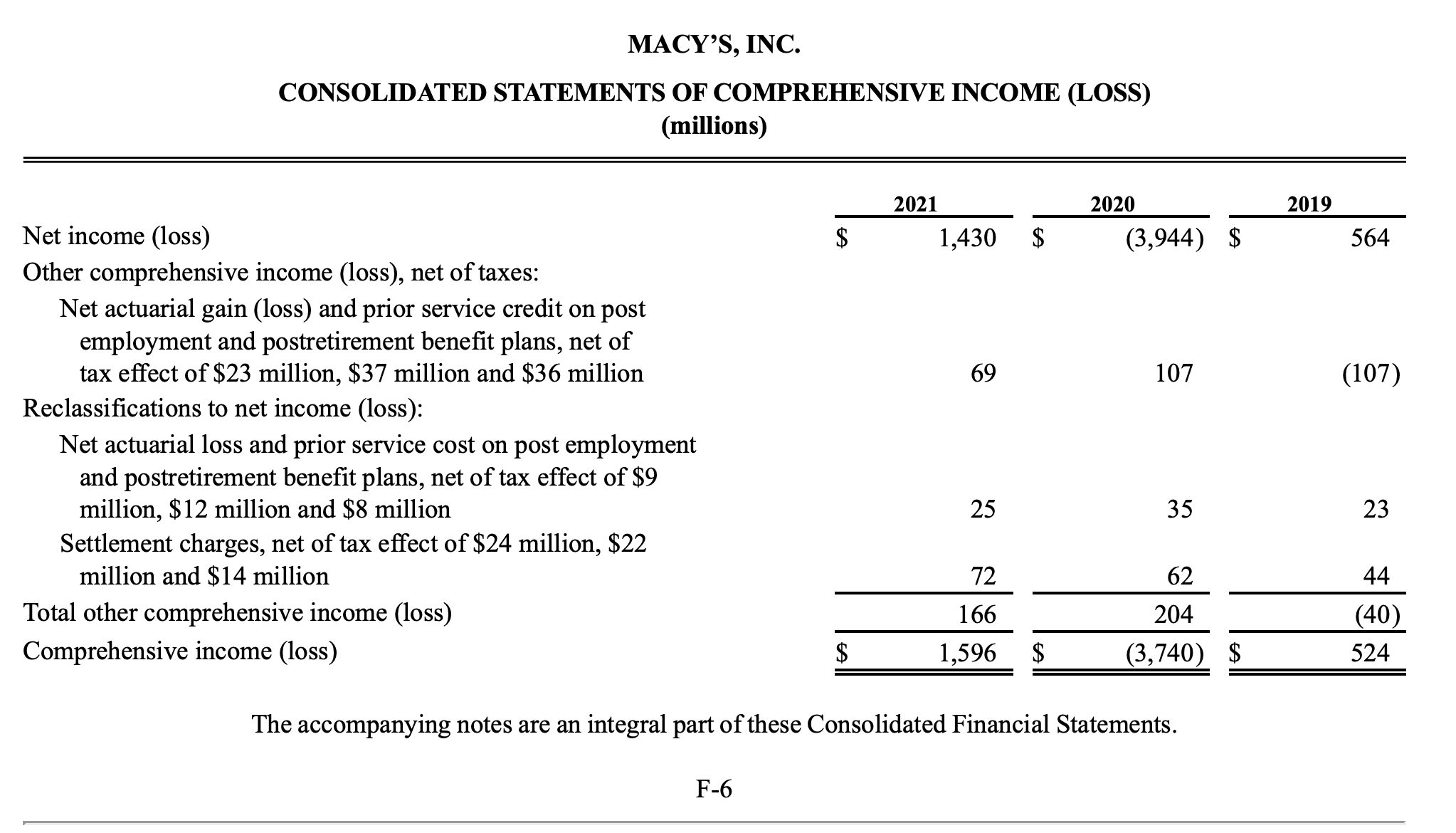

In writing the memo, use section headers to clearly delineate each of the following five sections: 1. Analyze three items on the income statement (or income statement-based financial ratios; see the list on page 4) for your base company for the last three years and discuss whether the company's performance related to these items appear to be improving, deteriorating, or remaining stable. Justify your answer.

While you are not limited to the financial statement ratios we covered in class for your I/S and B/S analysis, if you choose to use them, please use the following classifications. Income Statement-based ratios: - ROE - ROA - PM, GPM - Interest coverage - Change in revenue

Link to the data for 10-K

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started