Answered step by step

Verified Expert Solution

Question

1 Approved Answer

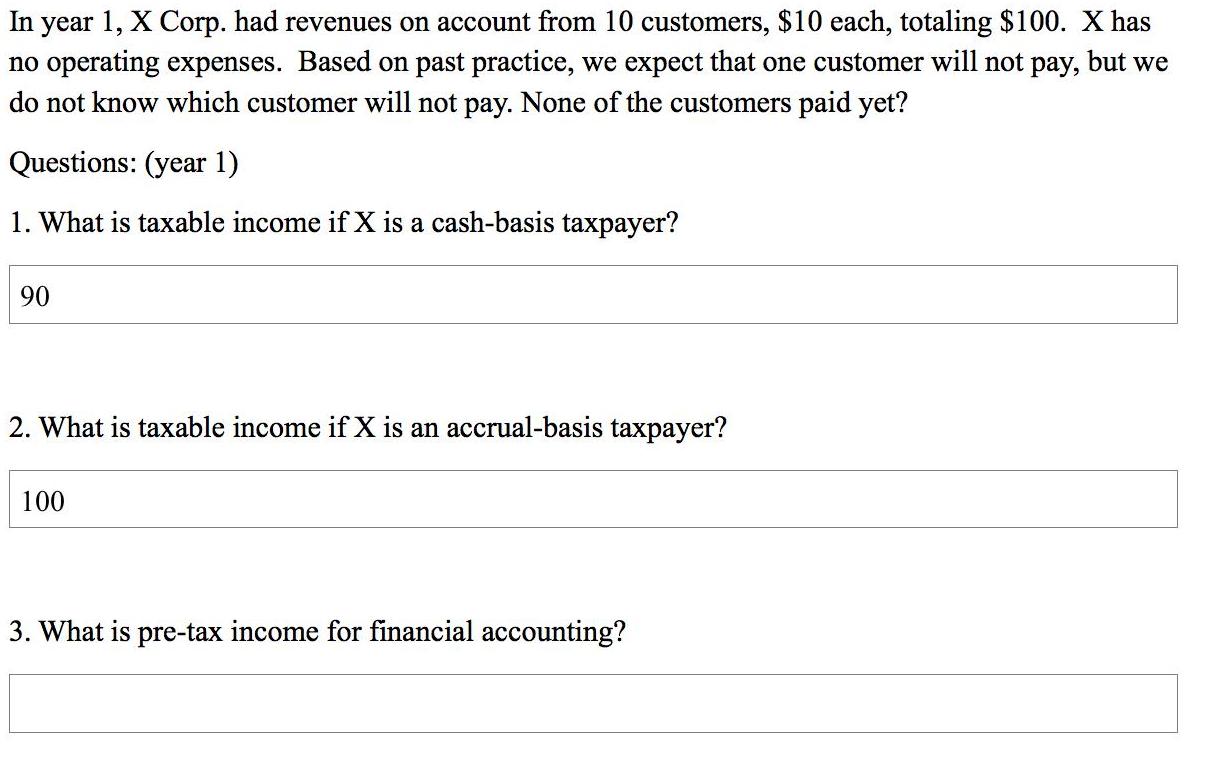

In year 1, X Corp. had revenues on account from 10 customers, $10 each, totaling $100. X has no operating expenses. Based on past

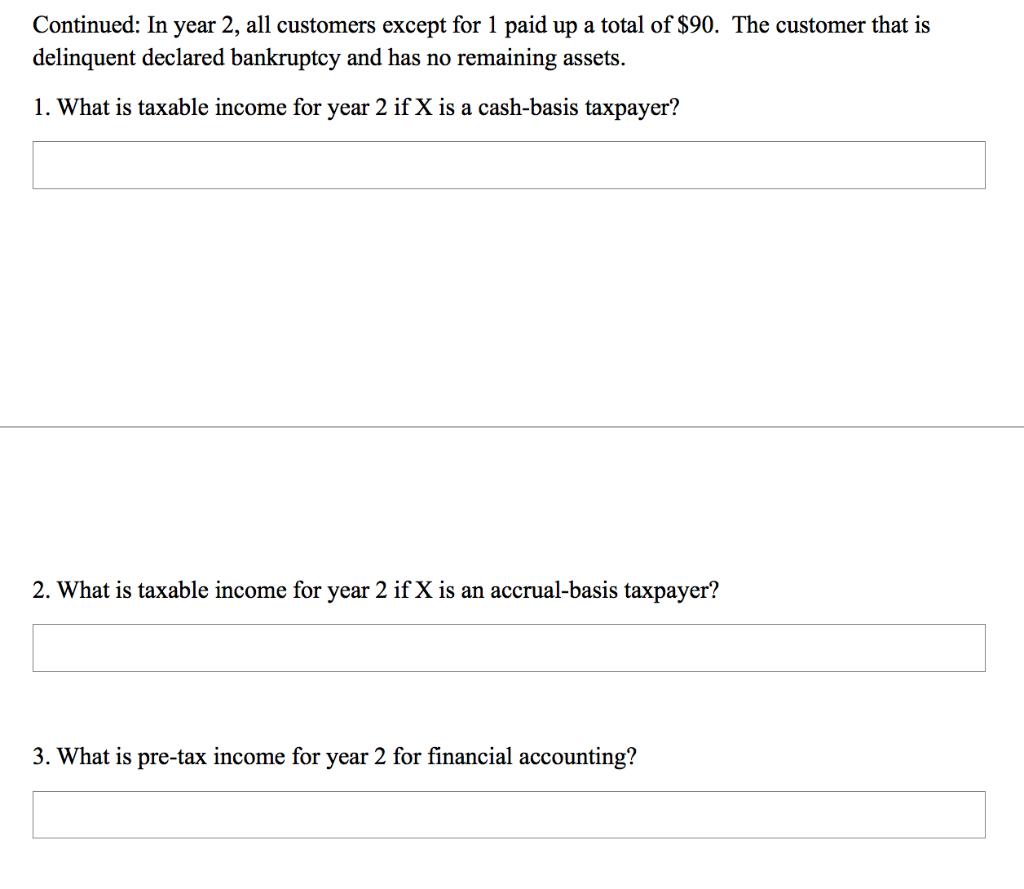

In year 1, X Corp. had revenues on account from 10 customers, $10 each, totaling $100. X has no operating expenses. Based on past practice, we expect that one customer will not pay, but we do not know which customer will not pay. None of the customers paid yet? Questions: (year 1) 1. What is taxable income if X is a cash-basis taxpayer? 90 2. What is taxable income if X is an accrual-basis taxpayer? 100 3. What is pre-tax income for financial accounting? Continued: In year 2, all customers except for 1 paid up a total of $90. The customer that is delinquent declared bankruptcy and has no remaining assets. 1. What is taxable income for year 2 if X is a cash-basis taxpayer? 2. What is taxable income for year 2 if X is an accrual-basis taxpayer? 3. What is pre-tax income for year 2 for financial accounting?

Step by Step Solution

★★★★★

3.50 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Answer Year I 1 100 taxable income under Cash basis accounting you cant cla...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started