Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In Year 2 , LIFO liquidation was caused primarily by a substantial reduction during the year in [ the inventory of ] molasses ( the

In Year LIFO liquidation was caused primarily by a substantial reduction during the year in the inventory of molasses the major raw

material This LIFO liquidation, which resulted in cost of products sold being charged with higher inventory costs from prior years,

caused a decrease in Year net income of approximately $ or $ per share.

LIFO inventories at December Year and Year were $ and $ respectively, which is approximately

$ and $ less than replacement cost at those dates.

In accordance with generally recognized trade practices, inventories of distilled spirits in bonded aging warehouses have been

included in current assets, although the normal aging period is usually from one to three years.

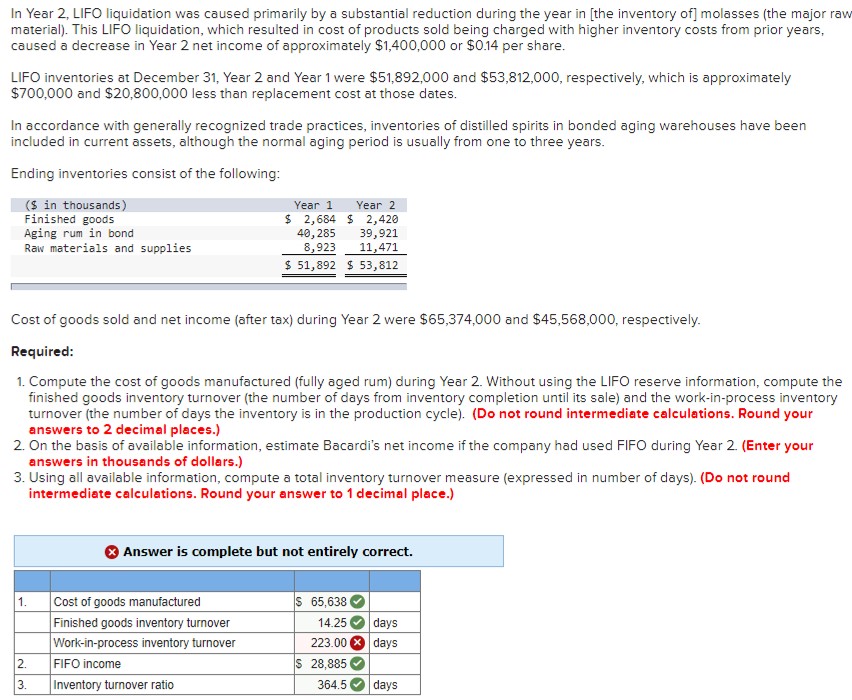

Ending inventories consist of the following:

Cost of goods sold and net income after tax during Year were $ and $ respectively.

Required:

Compute the cost of goods manufactured fully aged rum during Year Without using the LIFO reserve information, compute the

finished goods inventory turnover the number of days from inventory completion until its sale and the workinprocess inventory

turnover the number of days the inventory is in the production cycleDo not round intermediate calculations. Round your

answers to decimal places.

On the basis of available information, estimate Bacardi's net income if the company had used FIFO during Year Enter your

answers in thousands of dollars.

Using all available information, compute a total inventory turnover measure expressed in number of daysDo not round

intermediate calculations. Round your answer to decimal place.

Answer is complete but not entirely correct.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started