Answered step by step

Verified Expert Solution

Question

1 Approved Answer

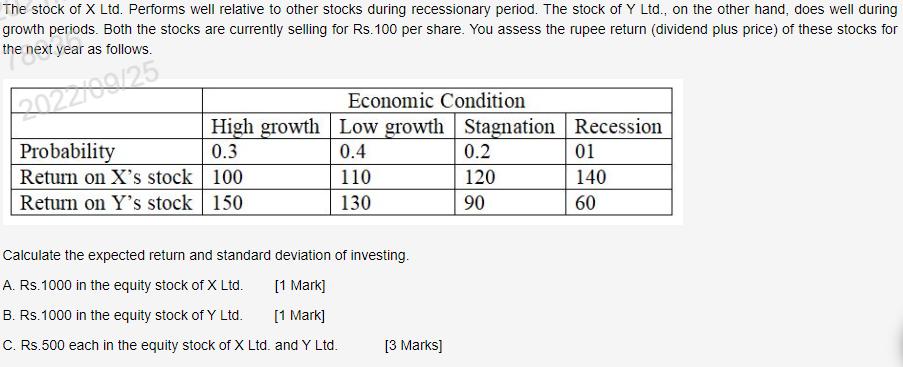

The stock of X Ltd. Performs well relative to other stocks during recessionary period. The stock of Y Ltd., on the other hand, does

The stock of X Ltd. Performs well relative to other stocks during recessionary period. The stock of Y Ltd., on the other hand, does well during growth periods. Both the stocks are currently selling for Rs.100 per share. You assess the rupee return (dividend plus price) of these stocks for the next year as follows. Economic Condition High growth Low growth Stagnation Probability 0.3 0.4 Return on X's stock 100 110 Return on Y's stock 150 130 Calculate the expected return and standard deviation of investing. A. Rs.1000 in the equity stock of X Ltd. [1 mark] B. Rs.1000 in the equity stock of Y Ltd. [1 mark] C. Rs.500 each in the equity stock of X Ltd. and Y Ltd. [3 Marks] 0.2 120 90 Recession 01 140 60

Step by Step Solution

★★★★★

3.42 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Rs 1000 in the equity stock of x LTD ERx 03100 04120 011...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635df2ca1ce81_180215.pdf

180 KBs PDF File

635df2ca1ce81_180215.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started