Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In you report calculate the following ratios for both financial years: Current Ratio Quick Ratio Average Sales (per day) Total Asset Turnover Fixed Asset

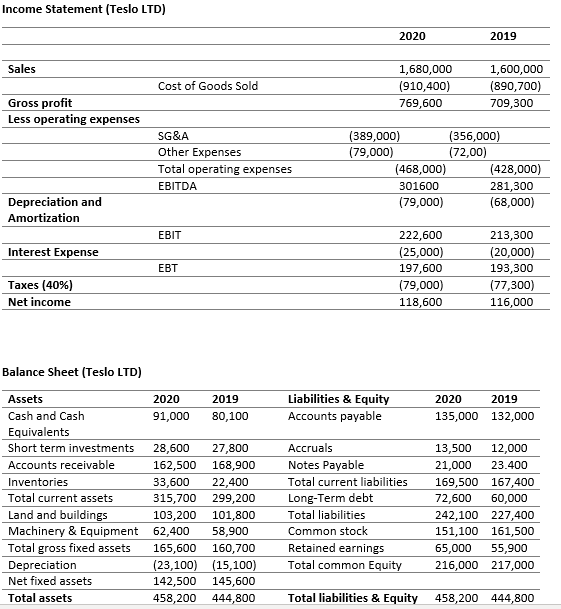

In you report calculate the following ratios for both financial years: Current Ratio Quick Ratio Average Sales (per day) Total Asset Turnover Fixed Asset Turnover Debt Ratio Debt-equity ratio Times-Interest-Earned Profit Margin Operating Profit Margin Net Profit Margin Basic Earning Power Return on Equity Return on Assets Income Statement (Teslo LTD) Sales Gross profit Less operating expenses Depreciation and Amortization Interest Expense Taxes (40%) Net income Balance Sheet (Teslo LTD) Assets Cash and Cash Equivalents Short term investments Accounts receivable Inventories Total current assets Land and buildings Machinery & Equipment Total gross fixed assets Depreciation Net fixed assets Total assets Cost of Goods Sold SG&A Other Expenses Total operating expenses EBITDA EBIT EBT 2020 2019 91,000 80,100 28,600 27,800 162,500 168,900 33,600 22,400 315,700 299,200 103,200 101,800 62,400 58,900 165,600 160,700 (23,100) (15,100) 142,500 145,600 458,200 444,800 2020 1,680,000 (910,400) 769,600 (389,000) (79,000) 2019 1,600,000 (890,700) 709,300 (428,000) 281,300 (68,000) 213,300 (20,000) 193,300 (77,300) 116,000 2020 2019 135,000 132,000 13,500 12,000 21,000 23.400 169,500 167,400 72,600 60,000 242,100 227,400 151,100 161,500 65,000 55,900 216,000 217,000 458,200 444,800 (468,000) 301600 (79,000) 222,600 (25,000) 197,600 (79,000) 118,600 Liabilities & Equity Accounts payable Accruals Notes Payable Total current liabilities Long-Term debt Total liabilities Common stock Retained earnings Total common Equity Total liabilities & Equity (356,000) (72,00)

Step by Step Solution

★★★★★

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Computation of Ratios Current Ratio Current Ratio Current Assets Current Liabilities For 2019 299200 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started