Answered step by step

Verified Expert Solution

Question

1 Approved Answer

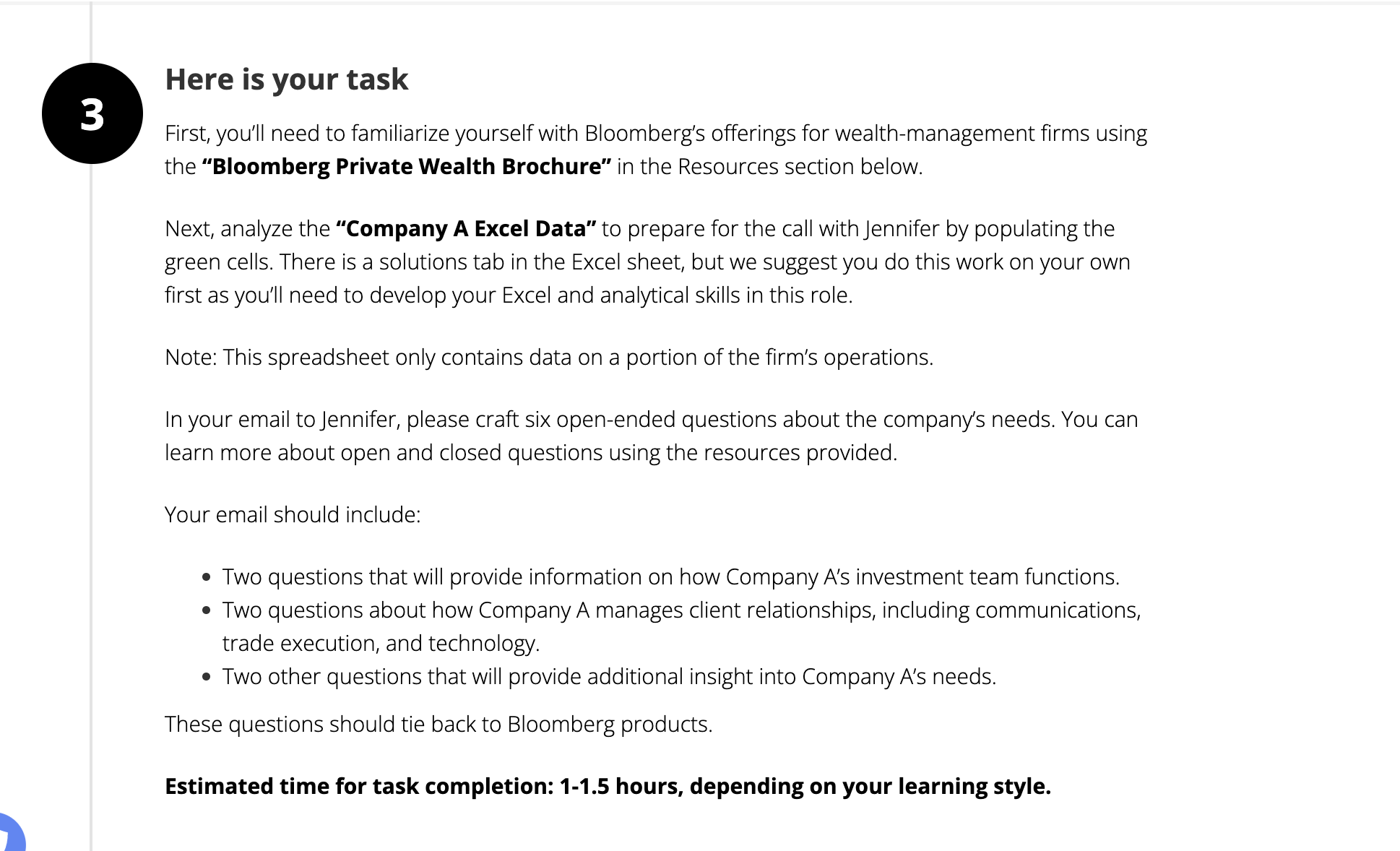

In your email to Jennifer, please craft six open-ended questions about the company's needs. You can learn more about open and closed questions using the

In your email to Jennifer, please craft six open-ended questions about the company's needs. You can learn more about open and closed questions using the resources provided.

Your email should include:

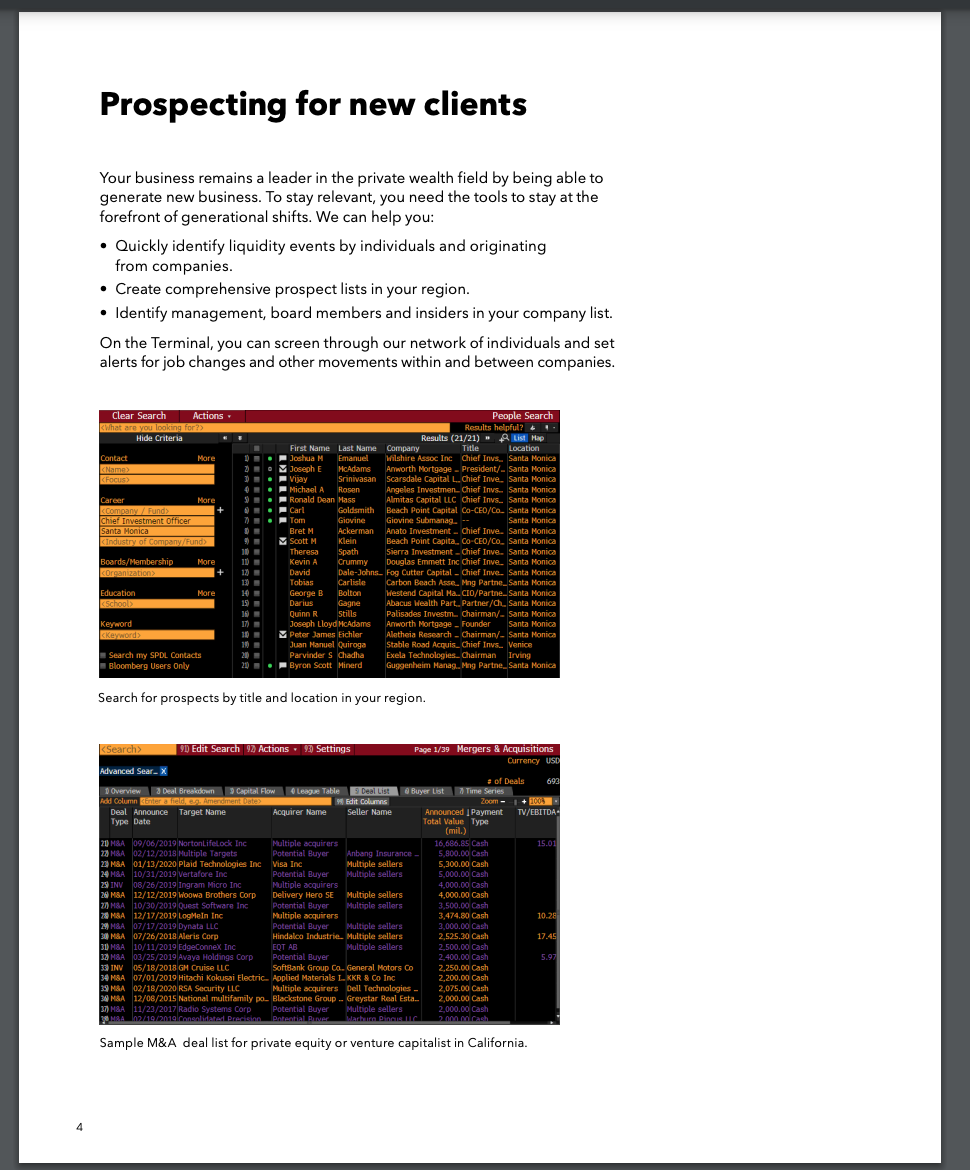

- Two questions that will provide information on how Company A's investment team functions.

- Two questions about how Company A manages client relationships, including communications, trade execution, and technology.

- Two other questions that will provide additional insight into Company A's needs.

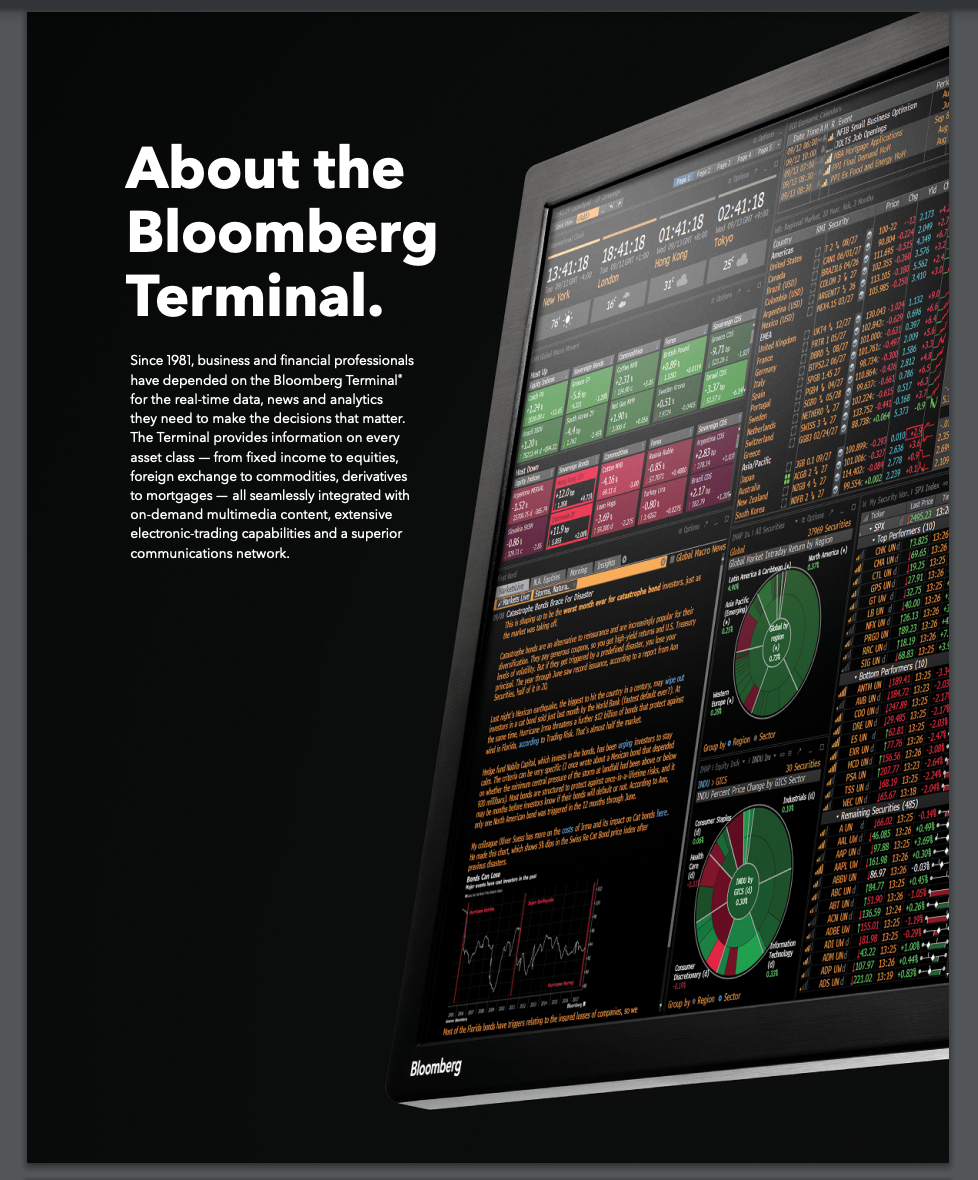

These questions should tie back to Bloomberg products.

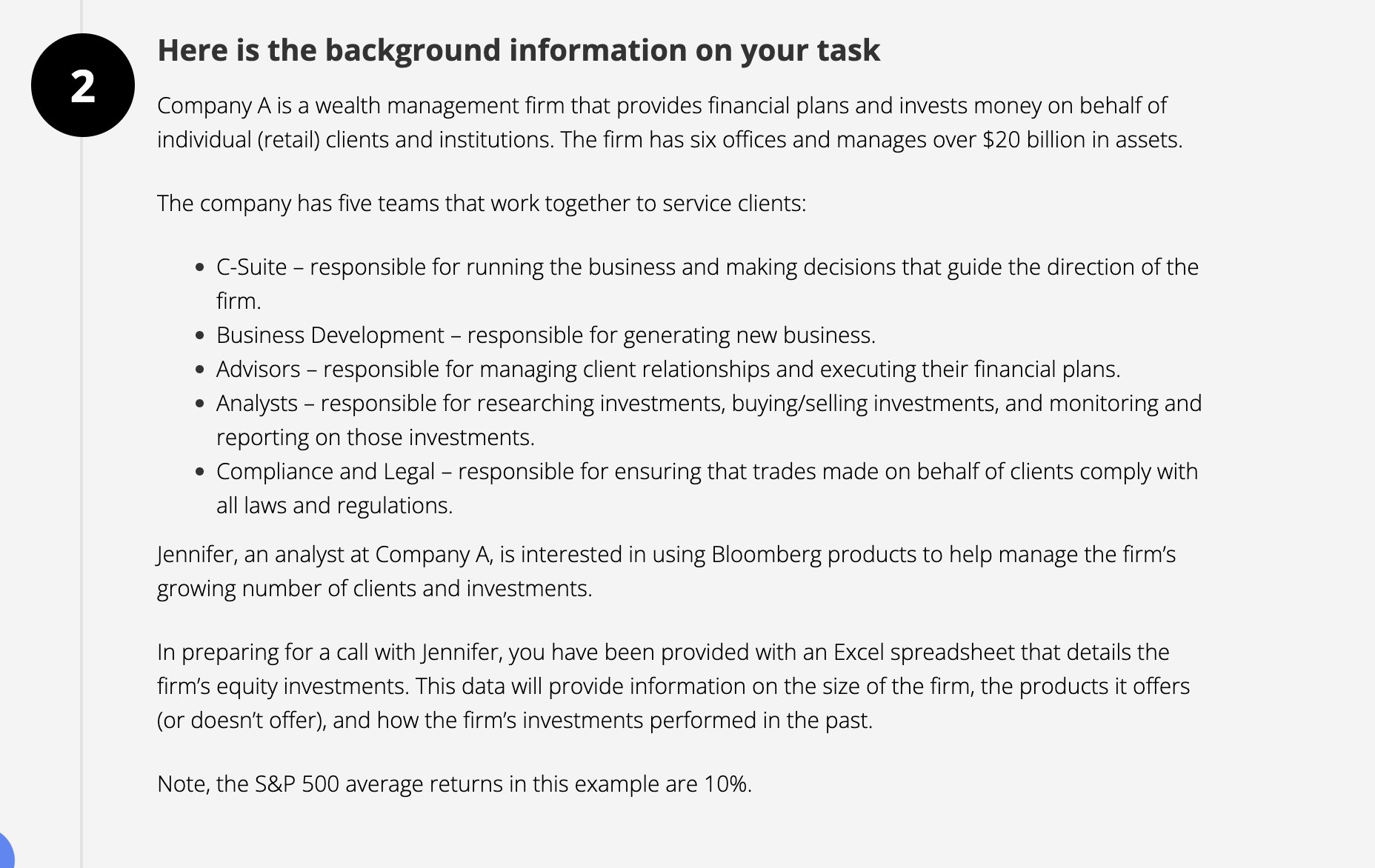

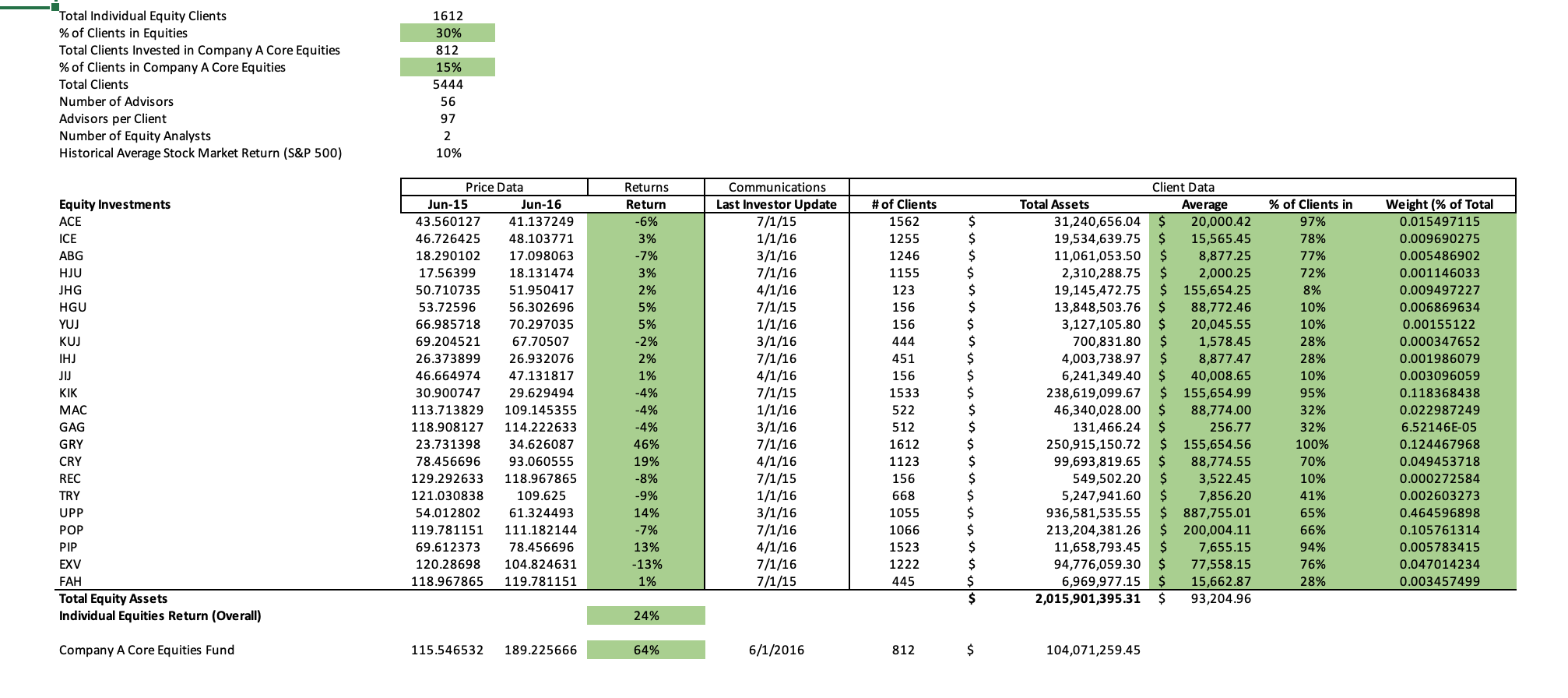

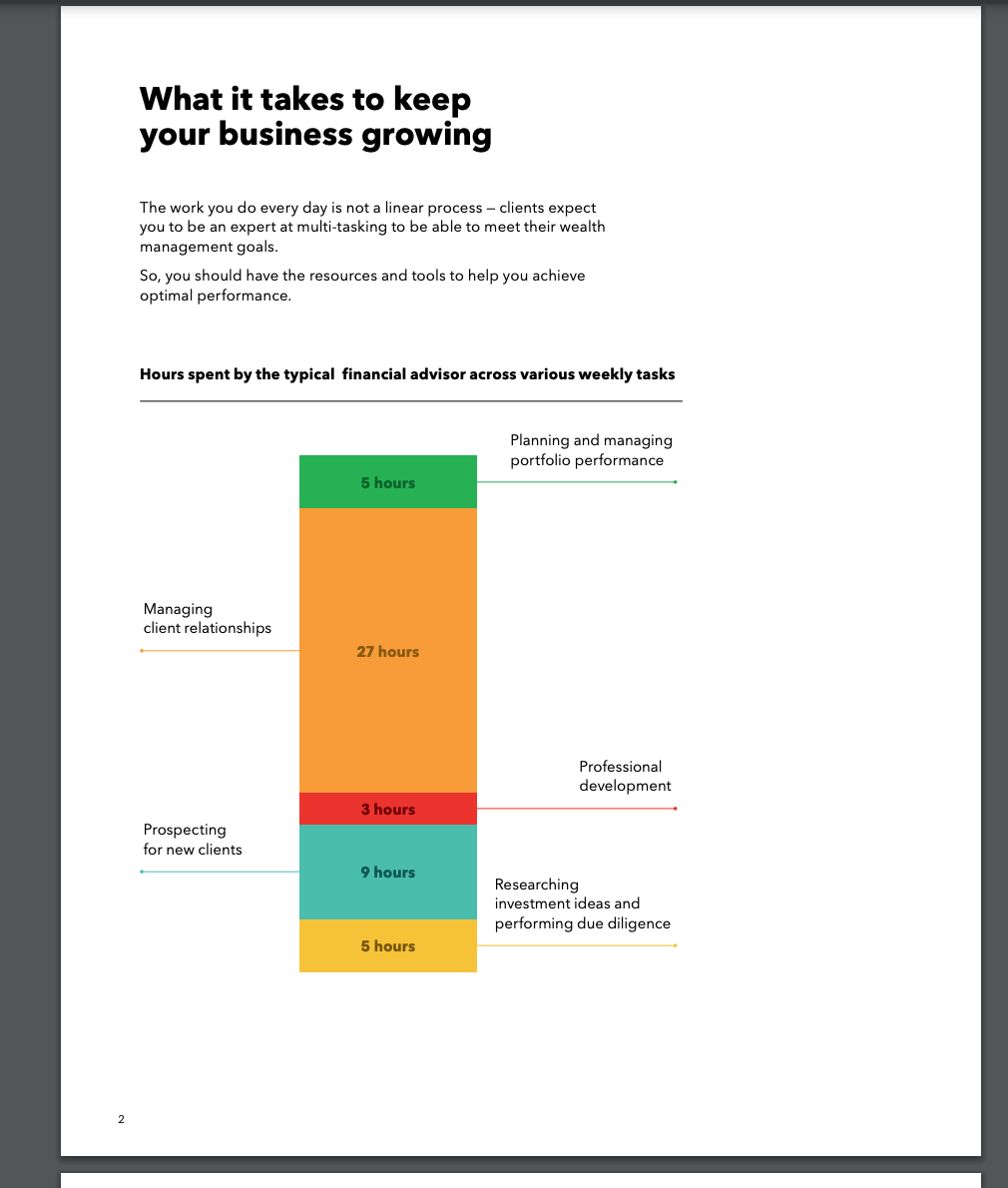

2 Here is the background information on your task Company A is a wealth management firm that provides financial plans and invests money on behalf of individual (retail) clients and institutions. The firm has six offices and manages over $20 billion in assets. The company has five teams that work together to service clients: C-Suite - responsible for running the business and making decisions that guide the direction of the firm. Business Development - responsible for generating new business. Advisors - responsible for managing client relationships and executing their financial plans. Analysts - responsible for researching investments, buying/selling investments, and monitoring and reporting on those investments. Compliance and Legal - responsible for ensuring that trades made on behalf of clients comply with all laws and regulations. Jennifer, an analyst at Company A, is interested in using Bloomberg products to help manage the firm's growing number of clients and investments. In preparing for a call with Jennifer, you have been provided with an Excel spreadsheet that details the firm's equity investments. This data will provide information on the size of the firm, the products it offers (or doesn't offer), and how the firm's investments performed in the past. Note, the S&P 500 average returns in this example are 10%.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here are the calculations I completed based on analyzing the data provided for Company A 1 Total num...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started