Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In your examination of the financial statements of PQR Co., you learned that the president has a profit sharing agreement with the corporation. The

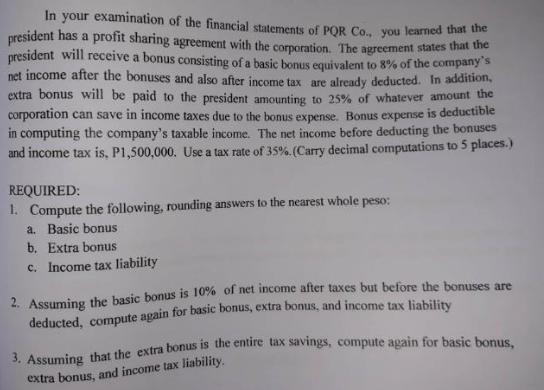

In your examination of the financial statements of PQR Co., you learned that the president has a profit sharing agreement with the corporation. The agreement states that the president will receive a bonus consisting of a basic bonus equivalent to 8% of the company's net income after the bonuses and also after income tax are already deducted. In addition, extra bonus will be paid to the president amounting to 25% of whatever amount the corporation can save in income taxes due to the bonus expense. Bonus expense is deductible in computing the company's taxable income. The net income before deducting the bonuses and income tax is, P1,500,000. Use a tax rate of 35%. (Carry decimal computations to 5 places.) REQUIRED: 1. Compute the following, rounding answers to the nearest whole peso: a. Basic bonus b. Extra bonus c. Income tax liability 2. Assuming the basic bonus is 10% of net income after taxes but before the bonuses are deducted, compute again for basic bonus, extra bonus, and income tax liability 3. Assuming that the extra bonus is the entire tax savings, compute again for basic bonus, extra bonus, and income tax liability.

Step by Step Solution

★★★★★

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

1 Compute the following rounding answers to the nearest whole peso a Basic bonus Basic bonus 8 Net i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started