Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a) On 17 June 2017, ABC Corporation reported an increase of 2 pennies in earnings per share (EPS). Nevertheless, the price of the stock

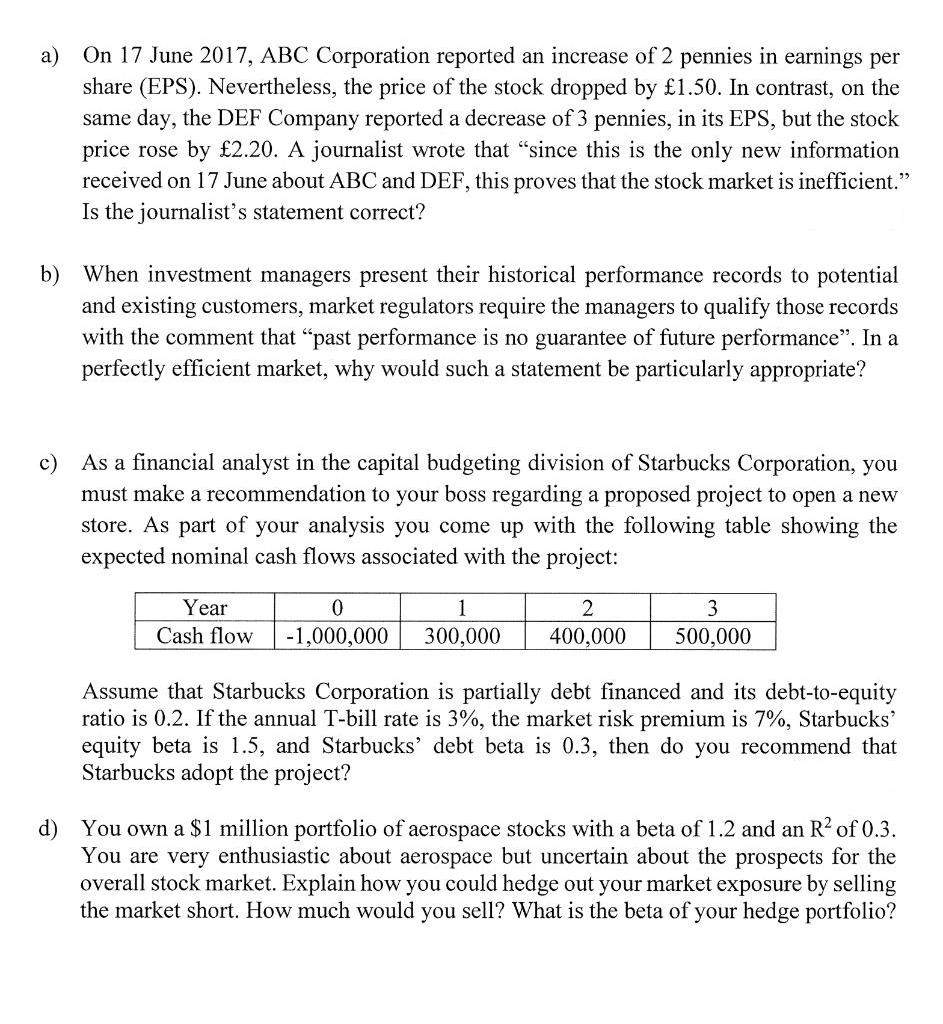

a) On 17 June 2017, ABC Corporation reported an increase of 2 pennies in earnings per share (EPS). Nevertheless, the price of the stock dropped by 1.50. In contrast, on the same day, the DEF Company reported a decrease of 3 pennies, in its EPS, but the stock price rose by 2.20. A journalist wrote that "since this is the only new information received on 17 June about ABC and DEF, this proves that the stock market is inefficient." Is the journalist's statement correct? b) When investment managers present their historical performance records to potential and existing customers, market regulators require the managers to qualify those records with the comment that "past performance is no guarantee of future performance". In a perfectly efficient market, why would such a statement be particularly appropriate? c) As a financial analyst in the capital budgeting division of Starbucks Corporation, you must make a recommendation to your boss regarding a proposed project to open a new store. As part of your analysis you come up with the following table showing the expected nominal cash flows associated with the project: Year Cash flow 0 1 2 -1,000,000 300,000 400,000 3 500,000 Assume that Starbucks Corporation is partially debt financed and its debt-to-equity ratio is 0.2. If the annual T-bill rate is 3%, the market risk premium is 7%, Starbucks' equity beta is 1.5, and Starbucks' debt beta is 0.3, then do you recommend that Starbucks adopt the project? d) You own a $1 million portfolio of aerospace stocks with a beta of 1.2 and an R of 0.3. You are very enthusiastic about aerospace but uncertain about the prospects for the overall stock market. Explain how you could hedge out your market exposure by selling the market short. How much would you sell? What is the beta of your hedge portfolio? a) On 17 June 2017, ABC Corporation reported an increase of 2 pennies in earnings per share (EPS). Nevertheless, the price of the stock dropped by 1.50. In contrast, on the same day, the DEF Company reported a decrease of 3 pennies, in its EPS, but the stock price rose by 2.20. A journalist wrote that "since this is the only new information received on 17 June about ABC and DEF, this proves that the stock market is inefficient." Is the journalist's statement correct? b) When investment managers present their historical performance records to potential and existing customers, market regulators require the managers to qualify those records with the comment that "past performance is no guarantee of future performance". In a perfectly efficient market, why would such a statement be particularly appropriate? c) As a financial analyst in the capital budgeting division of Starbucks Corporation, you must make a recommendation to your boss regarding a proposed project to open a new store. As part of your analysis you come up with the following table showing the expected nominal cash flows associated with the project: Year Cash flow 0 1 2 -1,000,000 300,000 400,000 3 500,000 Assume that Starbucks Corporation is partially debt financed and its debt-to-equity ratio is 0.2. If the annual T-bill rate is 3%, the market risk premium is 7%, Starbucks' equity beta is 1.5, and Starbucks' debt beta is 0.3, then do you recommend that Starbucks adopt the project? d) You own a $1 million portfolio of aerospace stocks with a beta of 1.2 and an R of 0.3. You are very enthusiastic about aerospace but uncertain about the prospects for the overall stock market. Explain how you could hedge out your market exposure by selling the market short. How much would you sell? What is the beta of your hedge portfolio?

Step by Step Solution

★★★★★

3.28 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Ans b The expected return from investing in any asset sh...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started