Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In your role as Financial Analyst Assistant, how would you evaluate the company's performance in terms of profitability and liquidity compared with the average of

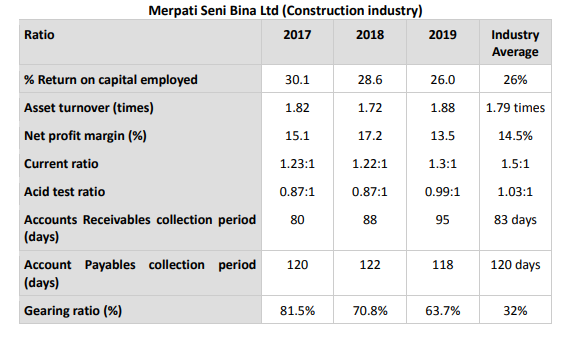

In your role as Financial Analyst Assistant, how would you evaluate the company's performance in terms of profitability and liquidity compared with the average of the sector over the period based on the financial ratios given?

Ratio Merpati Seni Bina Ltd (Construction industry) % Return on capital employed Asset turnover (times) Net profit margin (%) Current ratio Acid test ratio Accounts Receivables collection period (days) 2017 30.1 1.82 15.1 1.23:1 0.87:1 80 Account Payables collection period 120 (days) Gearing ratio (%) 81.5% 2018 28.6 1.72 17.2 1.22:1 0.87:1 88 122 70.8% 2019 26.0 1.88 13.5 1.3:1 0.99:1 95 118 63.7% Industry Average 26% 1.79 times 14.5% 1.5:1 1.03:1 83 days 120 days 32%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the financial ratios provided heres an evaluation of Merpati Seni Bina Ltds performance in terms of profitability and liquidity compared to t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started