Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In your text you examined how to work through various time value of money problems. In this example you are asked to calculate the price

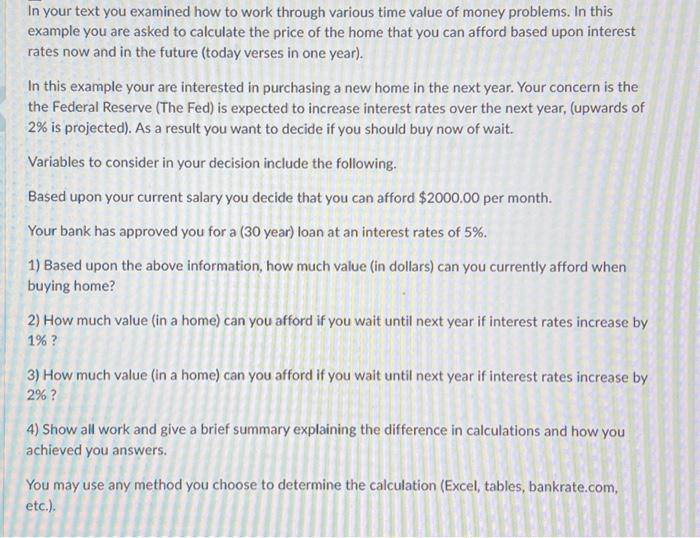

In your text you examined how to work through various time value of money problems. In this example you are asked to calculate the price of the home that you can afford based upon interest rates now and in the future today verses in one year

In this example your are interested in purchasing a new home in the next year. Your concern is the the Federal Reserve The Fed is expected to increase interest rates over the next year, upwards of is projected As a result you want to decide if you should buy now of wait.

Variables to consider in your decision include the following.

Based upon your current salary you decide that you can afford $ per month.

Your bank has approved you for a year loan at an interest rates of

Based upon the above information, how much value in dollars can you currently afford when buying home?

How much value in a home can you afford if you wait until next year if interest rates increase by

How much value in a home can you afford if you wait until next year if interest rates increase by

Show all work and give a brief summary explaining the difference in calculations and how you achieved you answers.

You may use any method you choose to determine the calculation Excel tables, bankrate.com, etc.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started