Question: inclucte in Class 4 . 4 deduct in the vear incurred Question 3 ( 2 points ) Saved On January 1 , 2 0 2

inclucte in Class

deduct in the vear incurred

Question points

Saved

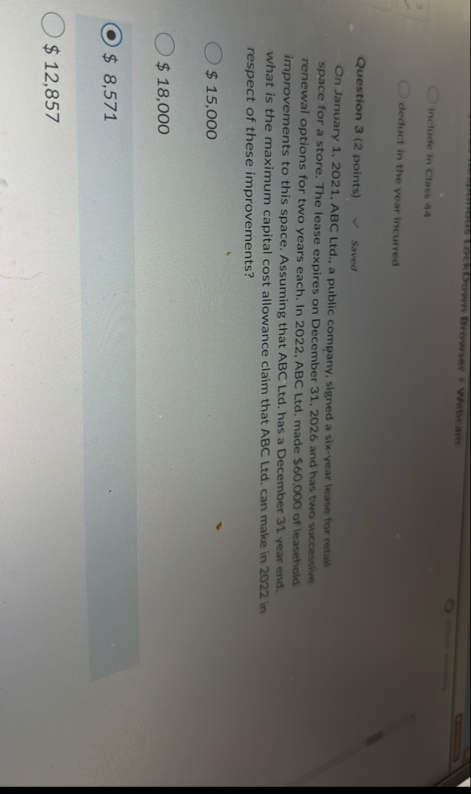

On January ABC Ltd a public company, signed a sixyear lease for retail space for a store. The lease expires on December and has two succesbive renewal options for two years each. In ABC Ltd made $ of leasehold improvements to this space. Assuming that ABC Ltd has a December year end. what is the maximum capital cost allowance claim that ABC Ltd can make in in respect of these improvements?

$

$

$

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock