Question

You have been engaged for the audit of the Upper X Company for the year ended December 31, 2016. The Upper X Company is in

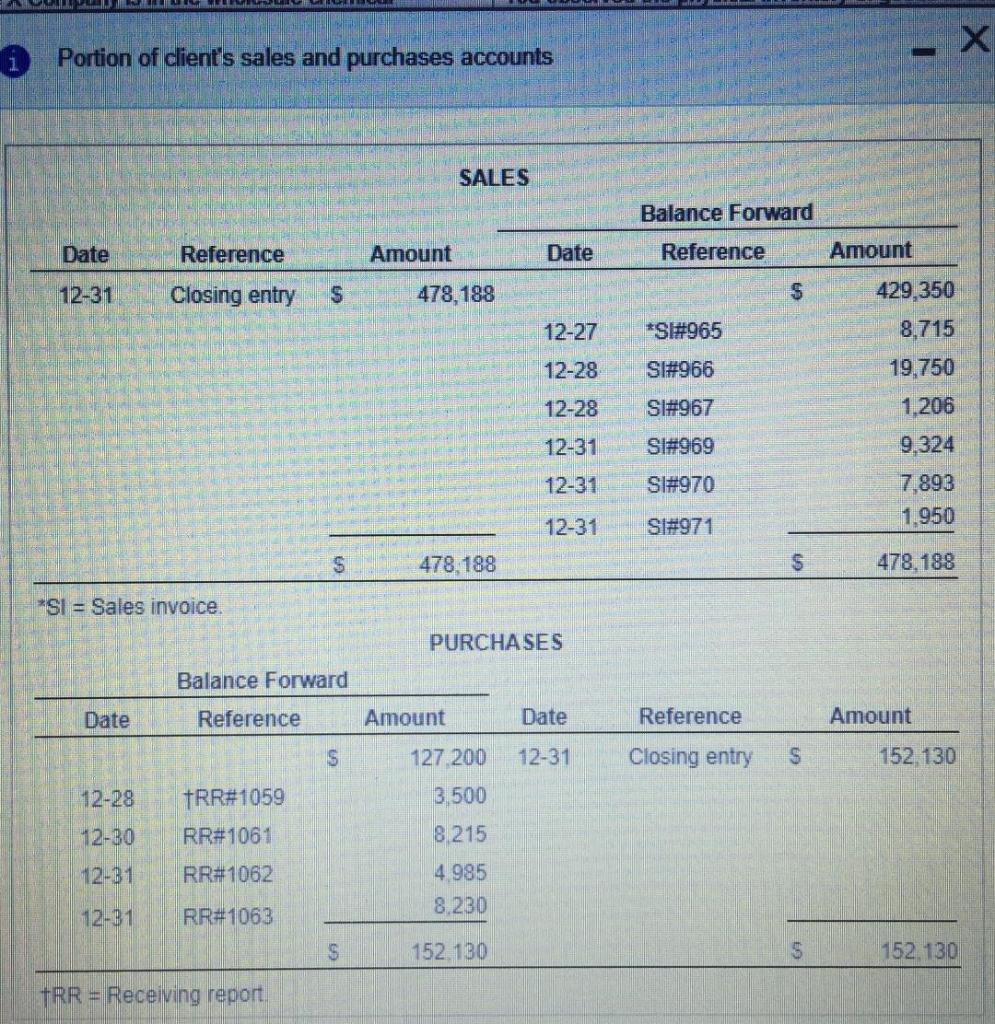

You have been engaged for the audit of the Upper X Company for the year ended December 31, 2016. The Upper X Company is in the wholesale chemical business and makes all sales at 25 % over cost. Following are portions of the client's sales and purchases accounts for the calendar year 2016.

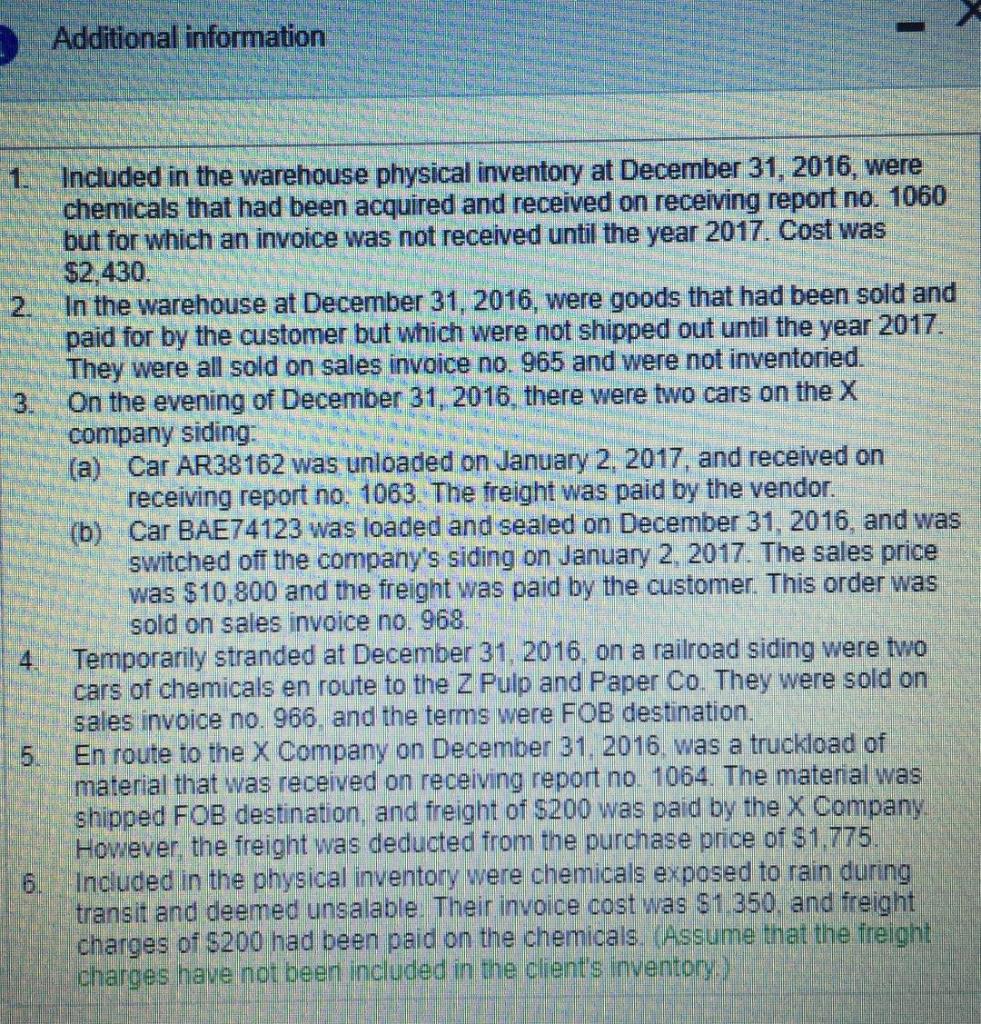

You observed the physical inventory of goods in the warehouse on December 31, 2016, and were satisfied that it was properly taken. When performing a sales and purchases cutoff test, you found that at December 31, 2016, the last receiving report that had been used was no. 1063 and that no shipments have been made on any sales invoices with numbers larger than no. 968. You also obtained the following additional information:

A Portion of client's sales and purchases accounts SALES Balance Forward Date Reference Amount Date Reference Amount 12-31 Closing entry 478,188 429,350 12-27 *S#965 8,715 12-28 S#966 19,750 12-28 SI#967 1,206 12-31 S#969 9,324 12-31 S#970 7,893 12-31 SI#971 1,950 478,188 478,188 "SI Sales invoice. PURCHASES Balance Forward Date Reference Amount Date Reference Amount 127 200 12-31 Closing entry 152,130 12-28 TRR#1059 3,500 12-30 RR#1061 8.215 12-31 RR#1062 4.985 12-31 RR#1063 8,230 152.130 152.130 TRR = Receiving report.

Step by Step Solution

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started