Answered step by step

Verified Expert Solution

Question

1 Approved Answer

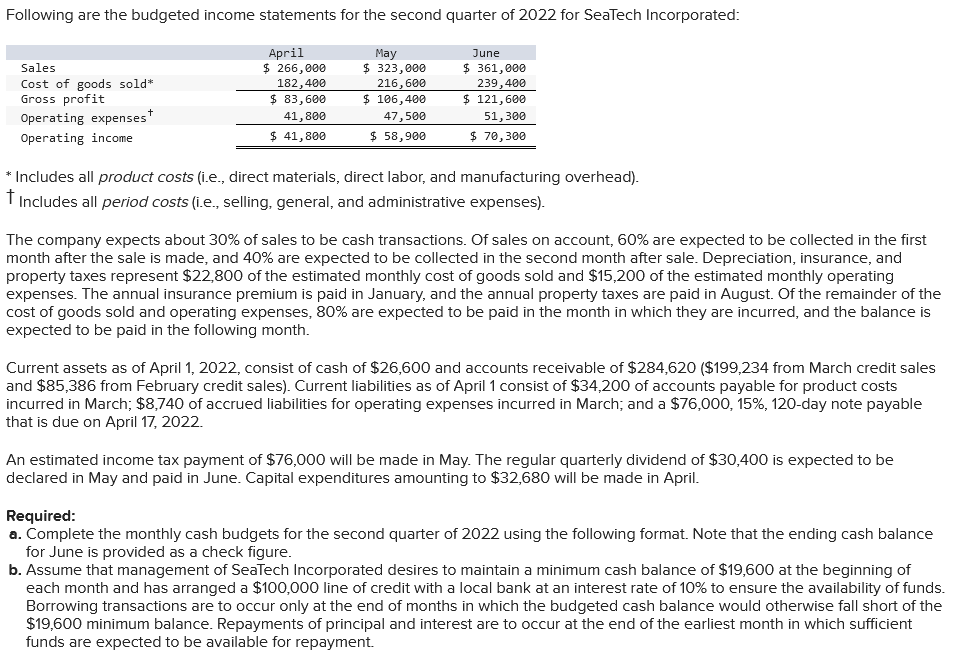

Includes all product costs (i.e., direct materials, direct labor, and manufacturing overhead). The company expects about 30% of sales to be cash transactions. Of sales

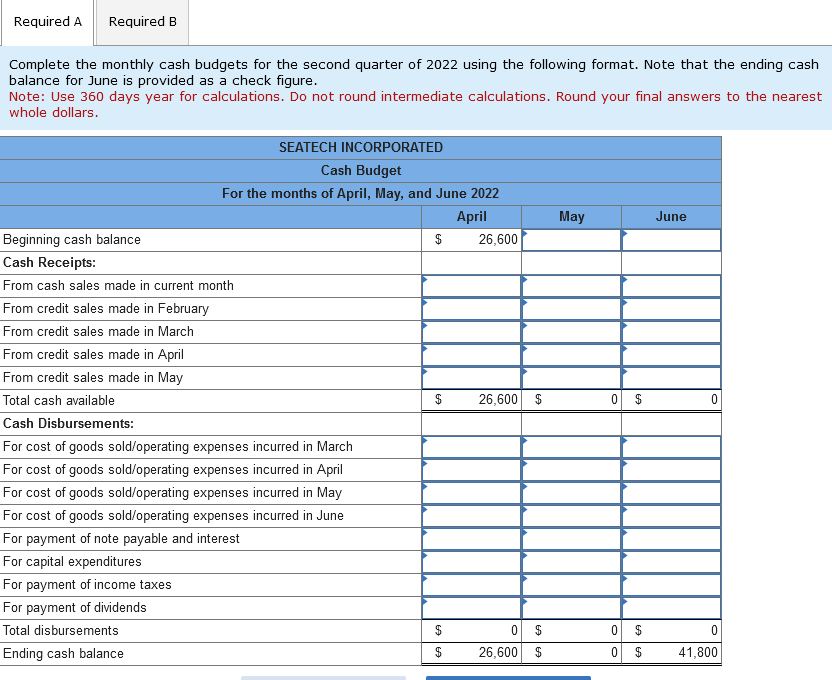

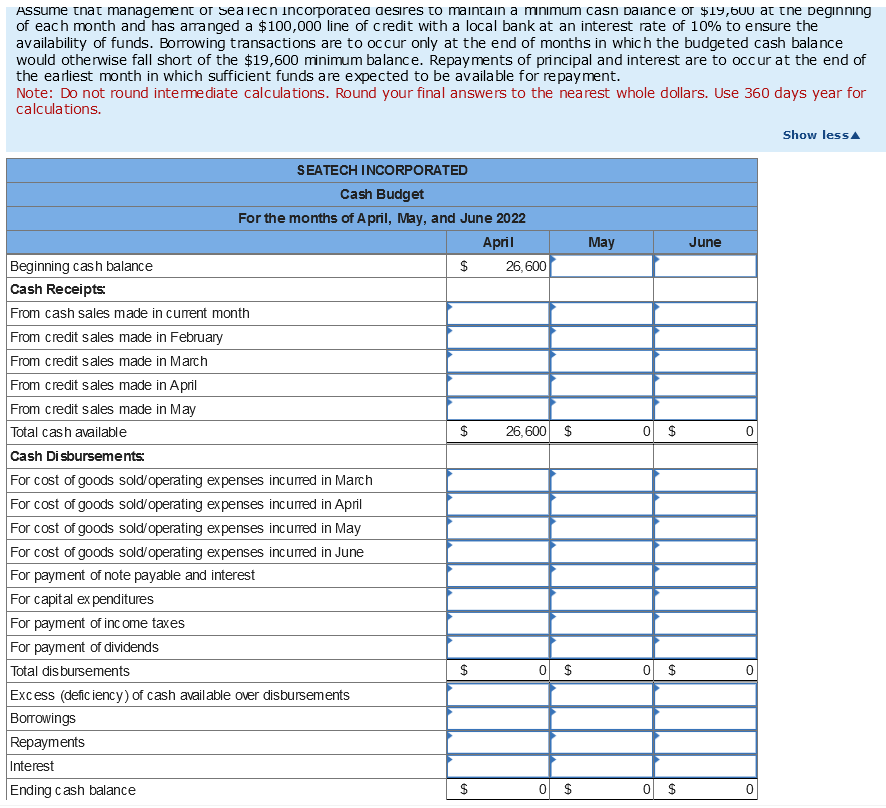

Includes all product costs (i.e., direct materials, direct labor, and manufacturing overhead). The company expects about 30% of sales to be cash transactions. Of sales on account, 60% are expected to be collected in the first month after the sale is made, and 40% are expected to be collected in the second month after sale. Depreciation, insurance, and property taxes represent $22,800 of the estimated monthly cost of goods sold and $15,200 of the estimated monthly operating expenses. The annual insurance premium is paid in January, and the annual property taxes are paid in August. Of the remainder of the cost of goods sold and operating expenses, 80% are expected to be paid in the month in which they are incurred, and the balance is expected to be paid in the following month. Current assets as of April 1, 2022, consist of cash of $26,600 and accounts receivable of $284,620($199,234 from March credit sales and $85,386 from February credit sales). Current liabilities as of April 1 consist of $34,200 of accounts payable for product costs incurred in March; $8,740 of accrued liabilities for operating expenses incurred in March; and a $76,000,15%,120-day note payable that is due on April 17, 2022. An estimated income tax payment of $76,000 will be made in May. The regular quarterly dividend of $30,400 is expected to be declared in May and paid in June. Capital expenditures amounting to $32,680 will be made in April. Required: a. Complete the monthly cash budgets for the second quarter of 2022 using the following format. Note that the ending cash balance for June is provided as a check figure. b. Assume that management of SeaTech Incorporated desires to maintain a minimum cash balance of $19,600 at the beginning of each month and has arranged a $100,000 line of credit with a local bank at an interest rate of 10% to ensure the availability of funds. Borrowing transactions are to occur only at the end of months in which the budgeted cash balance would otherwise fall short of the $19,600 minimum balance. Repayments of principal and interest are to occur at the end of the earliest month in which sufficient funds are expected to be available for repayment. Complete the monthly cash budgets for the second quarter of 2022 using the following format. Note that the ending cash balance for June is provided as a check figure. Note: Use 360 days year for calculations. Do not round intermediate calculations. Round your final answers to the nearest whole Hollare Assume chac managemenc or sea ecn incorporacea aesres co mancan a mmum casn dance or \&y, ouU ar cne Degnnng of each month and has arranged a $100,000 line of credit with a local bank at an interest rate of 10% to ensure the availability of funds. Borrowing transactions are to occur only at the end of months in which the budgeted cash balance would otherwise fall short of the $19,600 minimum balance. Repayments of principal and interest are to occ ur at the end of the earliest month in which sufficient funds are expected to be available for repayment. Note: Do not round intemediate calculations. Round your final answers to the nearest whole dollars. Use 360 days year for calculations. Includes all product costs (i.e., direct materials, direct labor, and manufacturing overhead). The company expects about 30% of sales to be cash transactions. Of sales on account, 60% are expected to be collected in the first month after the sale is made, and 40% are expected to be collected in the second month after sale. Depreciation, insurance, and property taxes represent $22,800 of the estimated monthly cost of goods sold and $15,200 of the estimated monthly operating expenses. The annual insurance premium is paid in January, and the annual property taxes are paid in August. Of the remainder of the cost of goods sold and operating expenses, 80% are expected to be paid in the month in which they are incurred, and the balance is expected to be paid in the following month. Current assets as of April 1, 2022, consist of cash of $26,600 and accounts receivable of $284,620($199,234 from March credit sales and $85,386 from February credit sales). Current liabilities as of April 1 consist of $34,200 of accounts payable for product costs incurred in March; $8,740 of accrued liabilities for operating expenses incurred in March; and a $76,000,15%,120-day note payable that is due on April 17, 2022. An estimated income tax payment of $76,000 will be made in May. The regular quarterly dividend of $30,400 is expected to be declared in May and paid in June. Capital expenditures amounting to $32,680 will be made in April. Required: a. Complete the monthly cash budgets for the second quarter of 2022 using the following format. Note that the ending cash balance for June is provided as a check figure. b. Assume that management of SeaTech Incorporated desires to maintain a minimum cash balance of $19,600 at the beginning of each month and has arranged a $100,000 line of credit with a local bank at an interest rate of 10% to ensure the availability of funds. Borrowing transactions are to occur only at the end of months in which the budgeted cash balance would otherwise fall short of the $19,600 minimum balance. Repayments of principal and interest are to occur at the end of the earliest month in which sufficient funds are expected to be available for repayment. Complete the monthly cash budgets for the second quarter of 2022 using the following format. Note that the ending cash balance for June is provided as a check figure. Note: Use 360 days year for calculations. Do not round intermediate calculations. Round your final answers to the nearest whole Hollare Assume chac managemenc or sea ecn incorporacea aesres co mancan a mmum casn dance or \&y, ouU ar cne Degnnng of each month and has arranged a $100,000 line of credit with a local bank at an interest rate of 10% to ensure the availability of funds. Borrowing transactions are to occur only at the end of months in which the budgeted cash balance would otherwise fall short of the $19,600 minimum balance. Repayments of principal and interest are to occ ur at the end of the earliest month in which sufficient funds are expected to be available for repayment. Note: Do not round intemediate calculations. Round your final answers to the nearest whole dollars. Use 360 days year for calculations

Includes all product costs (i.e., direct materials, direct labor, and manufacturing overhead). The company expects about 30% of sales to be cash transactions. Of sales on account, 60% are expected to be collected in the first month after the sale is made, and 40% are expected to be collected in the second month after sale. Depreciation, insurance, and property taxes represent $22,800 of the estimated monthly cost of goods sold and $15,200 of the estimated monthly operating expenses. The annual insurance premium is paid in January, and the annual property taxes are paid in August. Of the remainder of the cost of goods sold and operating expenses, 80% are expected to be paid in the month in which they are incurred, and the balance is expected to be paid in the following month. Current assets as of April 1, 2022, consist of cash of $26,600 and accounts receivable of $284,620($199,234 from March credit sales and $85,386 from February credit sales). Current liabilities as of April 1 consist of $34,200 of accounts payable for product costs incurred in March; $8,740 of accrued liabilities for operating expenses incurred in March; and a $76,000,15%,120-day note payable that is due on April 17, 2022. An estimated income tax payment of $76,000 will be made in May. The regular quarterly dividend of $30,400 is expected to be declared in May and paid in June. Capital expenditures amounting to $32,680 will be made in April. Required: a. Complete the monthly cash budgets for the second quarter of 2022 using the following format. Note that the ending cash balance for June is provided as a check figure. b. Assume that management of SeaTech Incorporated desires to maintain a minimum cash balance of $19,600 at the beginning of each month and has arranged a $100,000 line of credit with a local bank at an interest rate of 10% to ensure the availability of funds. Borrowing transactions are to occur only at the end of months in which the budgeted cash balance would otherwise fall short of the $19,600 minimum balance. Repayments of principal and interest are to occur at the end of the earliest month in which sufficient funds are expected to be available for repayment. Complete the monthly cash budgets for the second quarter of 2022 using the following format. Note that the ending cash balance for June is provided as a check figure. Note: Use 360 days year for calculations. Do not round intermediate calculations. Round your final answers to the nearest whole Hollare Assume chac managemenc or sea ecn incorporacea aesres co mancan a mmum casn dance or \&y, ouU ar cne Degnnng of each month and has arranged a $100,000 line of credit with a local bank at an interest rate of 10% to ensure the availability of funds. Borrowing transactions are to occur only at the end of months in which the budgeted cash balance would otherwise fall short of the $19,600 minimum balance. Repayments of principal and interest are to occ ur at the end of the earliest month in which sufficient funds are expected to be available for repayment. Note: Do not round intemediate calculations. Round your final answers to the nearest whole dollars. Use 360 days year for calculations. Includes all product costs (i.e., direct materials, direct labor, and manufacturing overhead). The company expects about 30% of sales to be cash transactions. Of sales on account, 60% are expected to be collected in the first month after the sale is made, and 40% are expected to be collected in the second month after sale. Depreciation, insurance, and property taxes represent $22,800 of the estimated monthly cost of goods sold and $15,200 of the estimated monthly operating expenses. The annual insurance premium is paid in January, and the annual property taxes are paid in August. Of the remainder of the cost of goods sold and operating expenses, 80% are expected to be paid in the month in which they are incurred, and the balance is expected to be paid in the following month. Current assets as of April 1, 2022, consist of cash of $26,600 and accounts receivable of $284,620($199,234 from March credit sales and $85,386 from February credit sales). Current liabilities as of April 1 consist of $34,200 of accounts payable for product costs incurred in March; $8,740 of accrued liabilities for operating expenses incurred in March; and a $76,000,15%,120-day note payable that is due on April 17, 2022. An estimated income tax payment of $76,000 will be made in May. The regular quarterly dividend of $30,400 is expected to be declared in May and paid in June. Capital expenditures amounting to $32,680 will be made in April. Required: a. Complete the monthly cash budgets for the second quarter of 2022 using the following format. Note that the ending cash balance for June is provided as a check figure. b. Assume that management of SeaTech Incorporated desires to maintain a minimum cash balance of $19,600 at the beginning of each month and has arranged a $100,000 line of credit with a local bank at an interest rate of 10% to ensure the availability of funds. Borrowing transactions are to occur only at the end of months in which the budgeted cash balance would otherwise fall short of the $19,600 minimum balance. Repayments of principal and interest are to occur at the end of the earliest month in which sufficient funds are expected to be available for repayment. Complete the monthly cash budgets for the second quarter of 2022 using the following format. Note that the ending cash balance for June is provided as a check figure. Note: Use 360 days year for calculations. Do not round intermediate calculations. Round your final answers to the nearest whole Hollare Assume chac managemenc or sea ecn incorporacea aesres co mancan a mmum casn dance or \&y, ouU ar cne Degnnng of each month and has arranged a $100,000 line of credit with a local bank at an interest rate of 10% to ensure the availability of funds. Borrowing transactions are to occur only at the end of months in which the budgeted cash balance would otherwise fall short of the $19,600 minimum balance. Repayments of principal and interest are to occ ur at the end of the earliest month in which sufficient funds are expected to be available for repayment. Note: Do not round intemediate calculations. Round your final answers to the nearest whole dollars. Use 360 days year for calculations Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started