1) Naylor's is levered firm with debt-equity ratio of 2. The firm has 30,000 shares of stock outstanding at a market price of $50 a

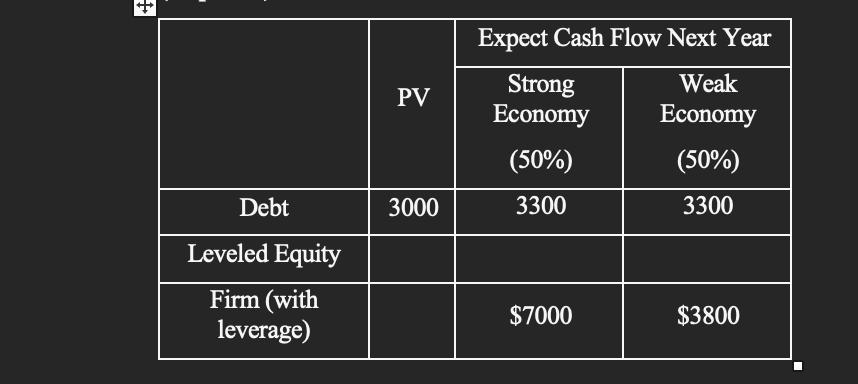

1) Naylor's is levered firm with debt-equity ratio of 2. The firm has 30,000 shares of stock outstanding at a market price of $50 a share. Given information in the following table, assuming there is no tax, fill in blanks of the table first. What is WACC=? Re=?(10 points)

2) Suppose you own 20,000 shares of Naylor's stock, you feel unsafe with the risk level of the stocks in hand. You decide to unlever this position by homemade leverage. You targeted expected return is 20%. Assume you are free to sell your storage of stocks and you also can borrow or lend out at 10 percent interest. Describe your homemade leverage in details (7 points)

+ Debt Leveled Equity Firm (with leverage) PV 3000 Expect Cash Flow Next Year Weak Economy (50%) 3300 Strong Economy (50%) 3300 $7000 $3800

Step by Step Solution

3.30 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

1 Given that Debt equity ratio of firm 2 The va...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started