Question

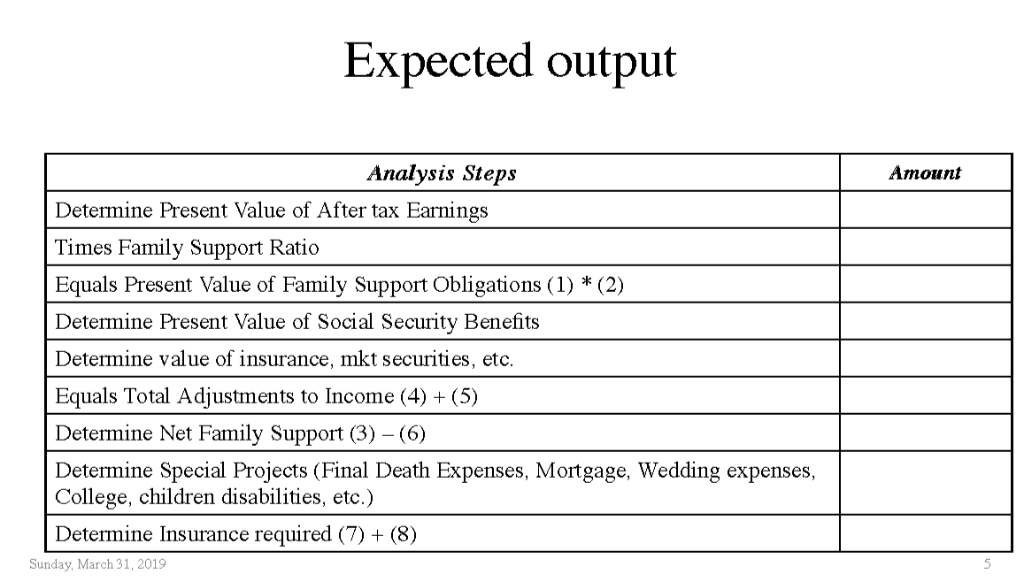

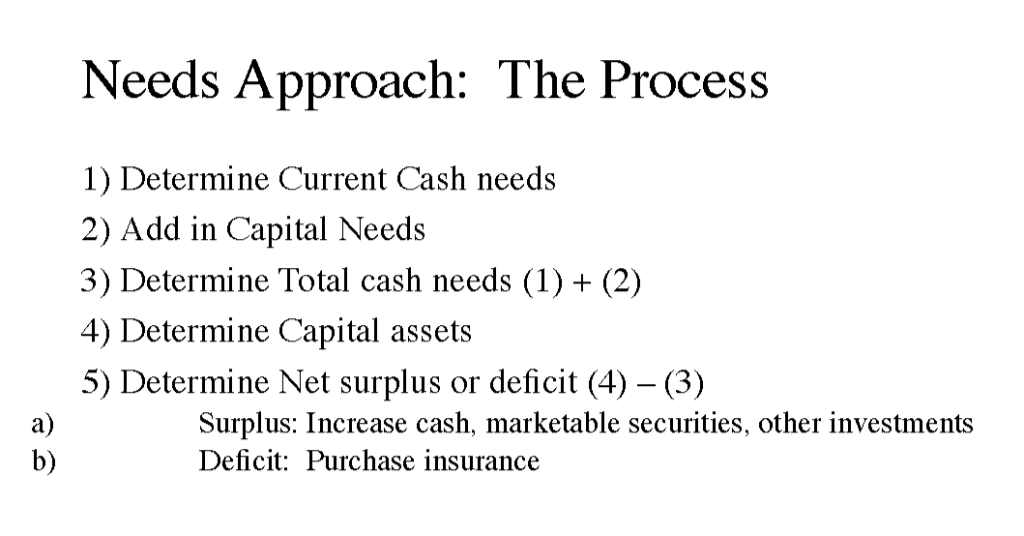

Income Replacement Approach Process 1) Determine Present Value of After tax Earnings 2) Times Family Support Ratio 3) Equals Present Value of Family Support Obligations

Income Replacement Approach Process

-

1) Determine Present Value of After tax Earnings

-

2) Times Family Support Ratio

-

3) Equals Present Value of Family Support Obligations (1) + (2)

-

4) Determine Present Value of Social Security Benefits

-

5) Determine value of insurance, mkt securities, etc.

-

6) Equals Total Adjustments to Income (4) + (5)

-

7) Determine Net Family Support (3) (6)

-

8) Determine Special Projects (Final Death Expenses, Mortgage, Wedding expenses, College, children disabilities, etc.)

-

9) Sunday, MaDrch 3e1,t2e01r9mine Insurance required (7) + (8) 2

-->How much life insurance should mark and mary purchase?

--> How much life insurance should Susan and Bob buy?

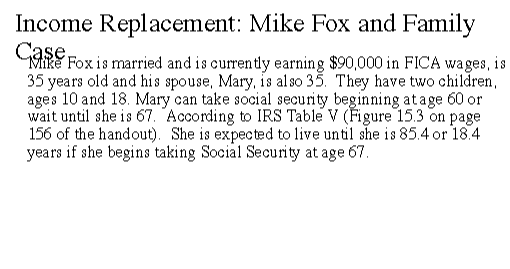

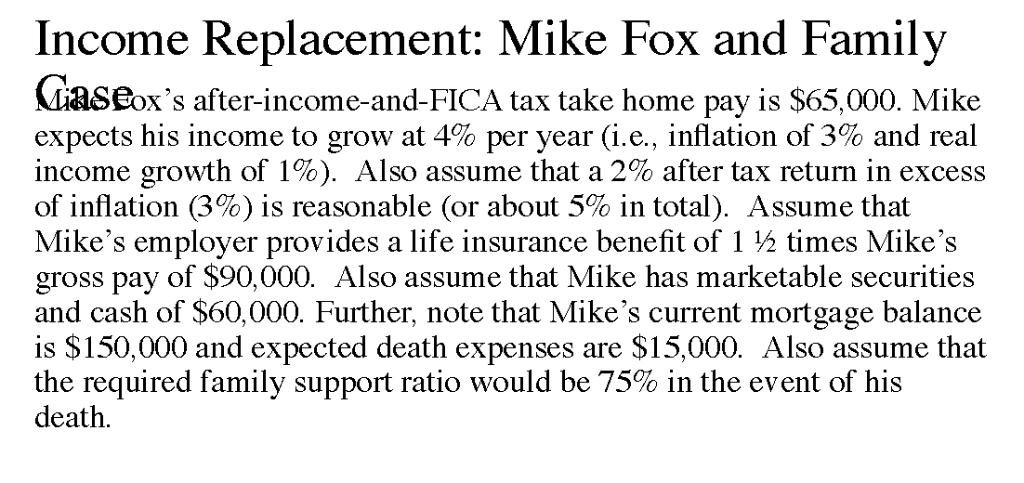

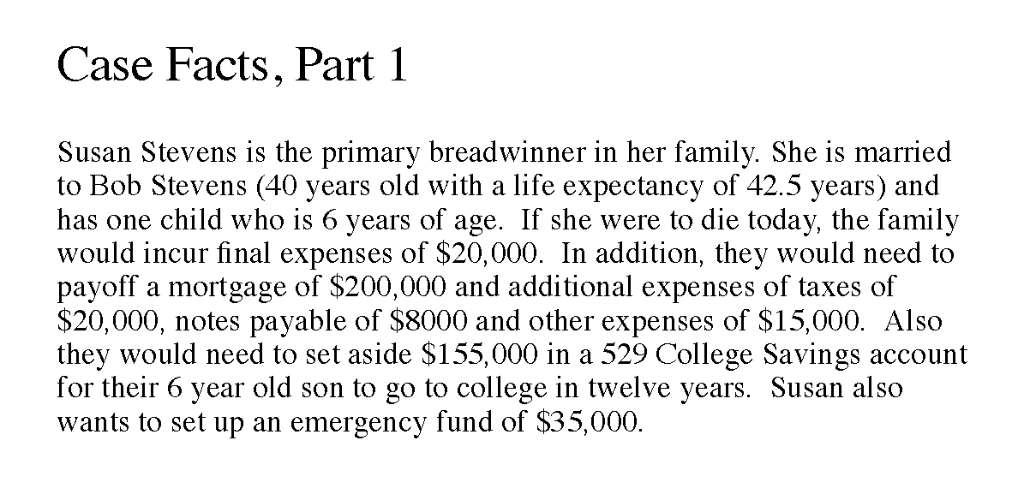

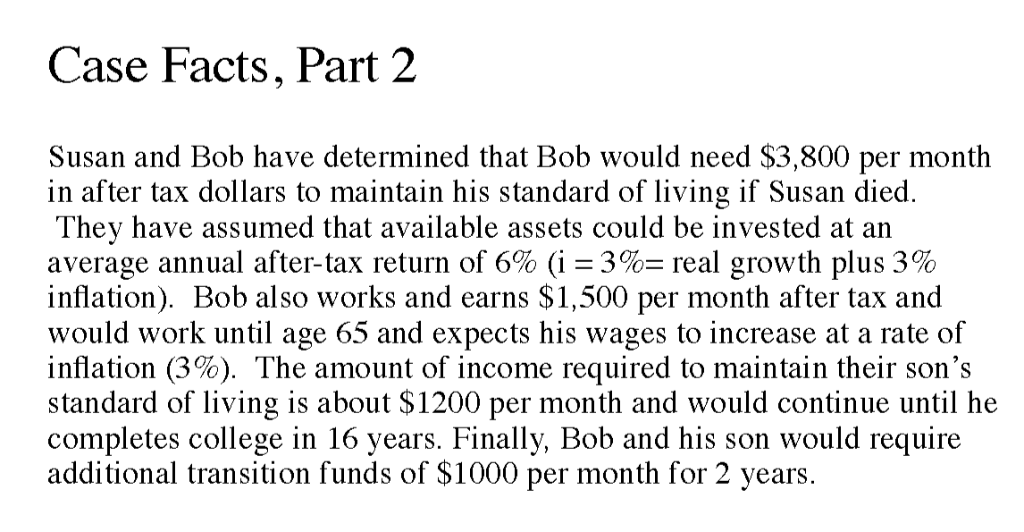

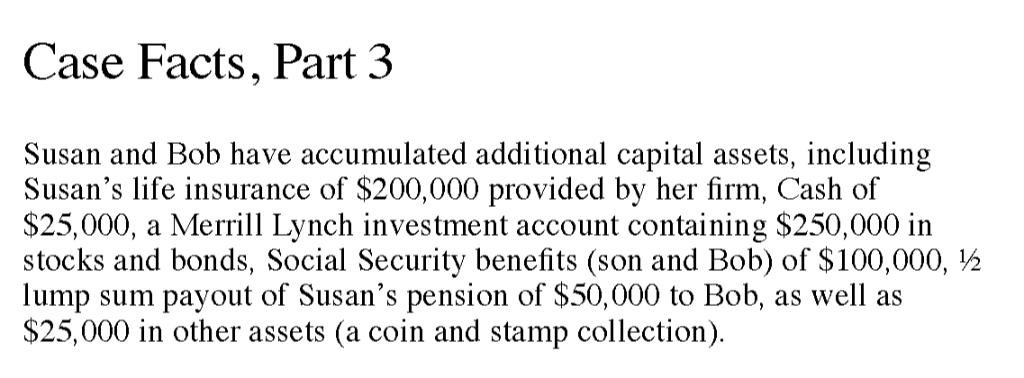

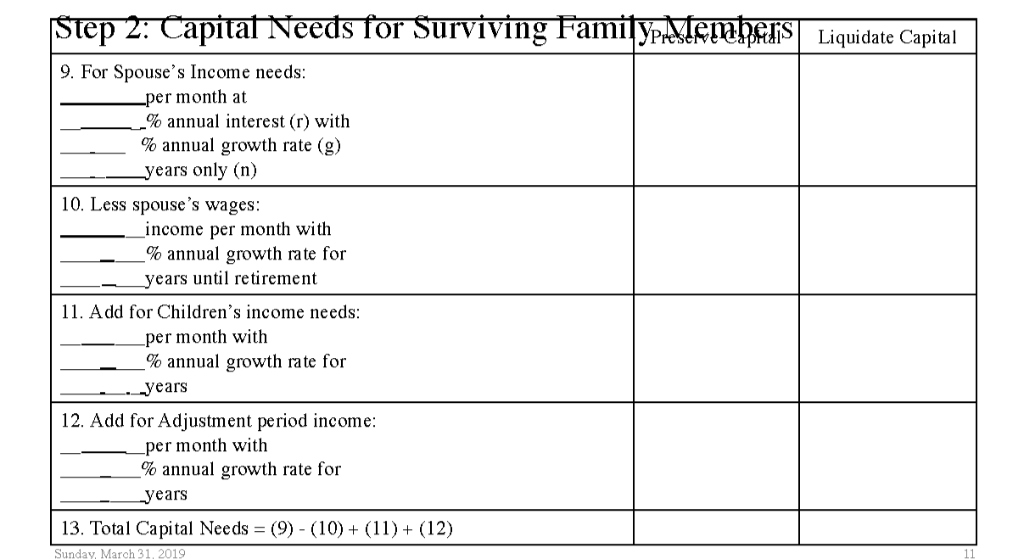

Income Replacement: Mike Fox and Family Se ike Fox is married and is currently earning $90,000 in FICA wages, is 35 years old and his spouse, Mary, is also 35. They have two childrern ages 10 and 18. Mary can take social security beginning atage 60 or wait until she is 67. According to IRS Table V (Figure 15.3 on page 156 of the handout). She is expected to live until she is 854or 18.4 years if she begins taking Social Security at age 67 Income Replacement: Mike Fox and Family Giaseox s after-income-and-FICA tax take home pay is $65,000. Mike expects his income to grow at 4% per year (ie, inflation of 3% and real income growth of 1%). Also assume that a 2% after tax return in excess of inflation (3%) is reasonable (or about 5% in total). Assume that Mike's employer provides a life insurance benefit of 1 times Mike's gross pay of $90,000. Also assume that Mike has marketable securities and cash of $60,000. Further, note that Mike's current mortgage balance is $150,000 and expected death expenses are $15,000. Also assume that the required family support ratio would be 75% in the event of his death Expected output Analysis Steps Amount Determine Present Value of After tax Earnings Times Family Support Ratio Equals Present Value of Family Support Obligations (1) * (2) Determine Present Value of Social Security Benefits Determine value of insurance, mkt securities, etc. Equals Total Adjustments to Income (4)+(5) Determine Net Family Support (3) (6) Determine Special Projects (Final Death Expenses, Mortgage, Wedding expenses, College, children disabilities, etc.) Determine Insurance required (7) + (8) Sunday, March 31, 2019 Case Facts, Part 1 Susan Stevens is the primary breadwinner in her family. She is married to Bob Stevens (40 years old with a life expectancy of 42.5 years) and has one child who is 6 years of age. If she were to die today, the family would incur final expenses of $20,000. In addition, they would need to payoff a mortgage of $200,000 and additional expenses of taxes of $20,000, notes payable of $8000 and other expenses of $15,000. Also they would need to set aside $155,000 in a 529 College Savings account for their 6 year old son to go to college in twelve years. Susan also wants to set up an emergency fund of $35,000. Case Facts, Part 3 Susan and Bob have accumulated additional capital assets, including Susan's life insurance of $200,000 provided by her firm, Cash of $25,000, a Merrill Lynch investment account containing $250,000 in stocks and bonds, Social Security benefits (son and Bob) of $100,000, lump sum payout of Susan's pension of $50,000 to Bob, as well as $25,000 in other assets (a coin and stamp collection). ep 2. Capital Needs Ior Surviving FamilypHSVSKliS Liquidate Capital 9. For Spouse's Income needs: per month at 5% annual interest (r) with % annual growth rate (g) years only (n) 10. Less spouse's wages: income per month with % annual growth rate for years until retirement 11. Add for Children's income needs per month with % annual growth rate for - years 12. Add for Adjustment period income: per month with % annual growth rate for years 13. Total Capital Needs (9) (10(11)(12) Sunday, March 31, 2019 Income Replacement: Mike Fox and Family Se ike Fox is married and is currently earning $90,000 in FICA wages, is 35 years old and his spouse, Mary, is also 35. They have two childrern ages 10 and 18. Mary can take social security beginning atage 60 or wait until she is 67. According to IRS Table V (Figure 15.3 on page 156 of the handout). She is expected to live until she is 854or 18.4 years if she begins taking Social Security at age 67 Income Replacement: Mike Fox and Family Giaseox s after-income-and-FICA tax take home pay is $65,000. Mike expects his income to grow at 4% per year (ie, inflation of 3% and real income growth of 1%). Also assume that a 2% after tax return in excess of inflation (3%) is reasonable (or about 5% in total). Assume that Mike's employer provides a life insurance benefit of 1 times Mike's gross pay of $90,000. Also assume that Mike has marketable securities and cash of $60,000. Further, note that Mike's current mortgage balance is $150,000 and expected death expenses are $15,000. Also assume that the required family support ratio would be 75% in the event of his death Expected output Analysis Steps Amount Determine Present Value of After tax Earnings Times Family Support Ratio Equals Present Value of Family Support Obligations (1) * (2) Determine Present Value of Social Security Benefits Determine value of insurance, mkt securities, etc. Equals Total Adjustments to Income (4)+(5) Determine Net Family Support (3) (6) Determine Special Projects (Final Death Expenses, Mortgage, Wedding expenses, College, children disabilities, etc.) Determine Insurance required (7) + (8) Sunday, March 31, 2019 Case Facts, Part 1 Susan Stevens is the primary breadwinner in her family. She is married to Bob Stevens (40 years old with a life expectancy of 42.5 years) and has one child who is 6 years of age. If she were to die today, the family would incur final expenses of $20,000. In addition, they would need to payoff a mortgage of $200,000 and additional expenses of taxes of $20,000, notes payable of $8000 and other expenses of $15,000. Also they would need to set aside $155,000 in a 529 College Savings account for their 6 year old son to go to college in twelve years. Susan also wants to set up an emergency fund of $35,000. Case Facts, Part 3 Susan and Bob have accumulated additional capital assets, including Susan's life insurance of $200,000 provided by her firm, Cash of $25,000, a Merrill Lynch investment account containing $250,000 in stocks and bonds, Social Security benefits (son and Bob) of $100,000, lump sum payout of Susan's pension of $50,000 to Bob, as well as $25,000 in other assets (a coin and stamp collection). ep 2. Capital Needs Ior Surviving FamilypHSVSKliS Liquidate Capital 9. For Spouse's Income needs: per month at 5% annual interest (r) with % annual growth rate (g) years only (n) 10. Less spouse's wages: income per month with % annual growth rate for years until retirement 11. Add for Children's income needs per month with % annual growth rate for - years 12. Add for Adjustment period income: per month with % annual growth rate for years 13. Total Capital Needs (9) (10(11)(12) Sunday, March 31, 2019Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started