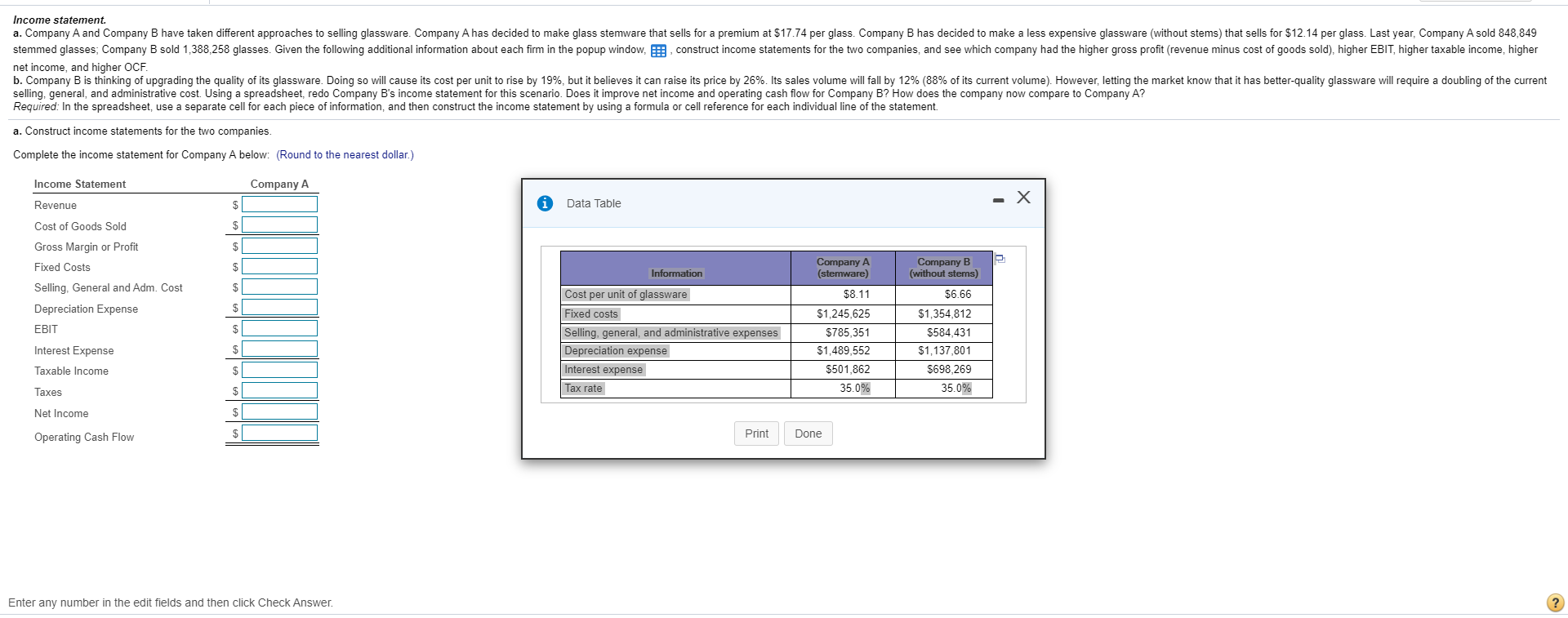

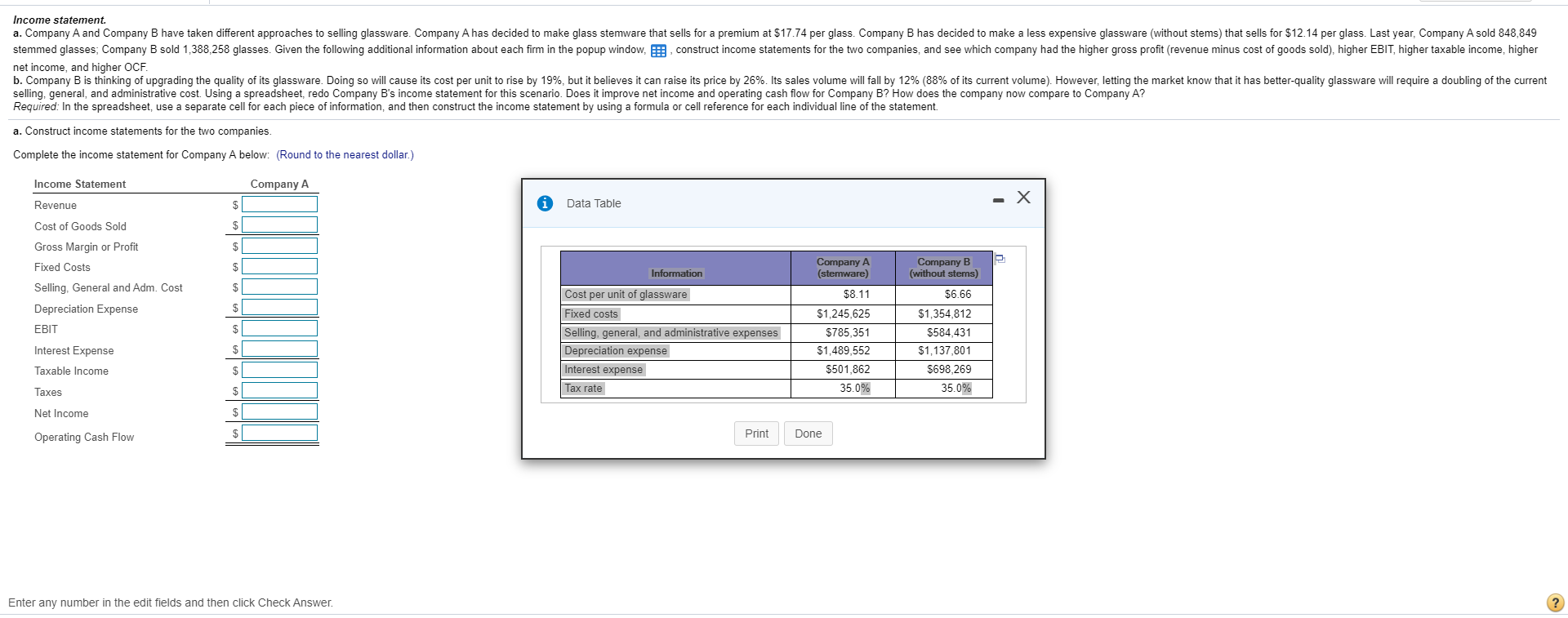

Income statement. a. Company A and Company B have taken different approaches to selling glassware. Company A has decided to make glass stemware that sells for a premium at $17.74 per glass. Company B has decided to make a less expensive glassware (without stems) that sells for $12.14 per glass. Last year, Company A sold 848,849 stemmed glasses: Company B sold 1,388,258 glasses. Given the following additional information about each firm in the popup window, E, construct income statements for the two companies, and see which company had the higher gross profit (revenue minus cost of goods sold), higher EBIT, higher taxable income, higher net income, and higher OCF. b. Company B is thinking of upgrading the quality of its glassware. Doing so will cause its cost per unit to rise by 19%, but it believes it can raise its price by 26%. Its sales volume will fall by 12% (88% of its current volume). However, letting the market know that it has better-quality glassware will require a doubling of the current selling, general, and administrative cost. Using a spreadsheet, redo Company B's income statement for this scenario. Does it improve net income and operating cash flow for Company B? How does the company now compare to Company A? Required: In the spreadsheet, use a separate cell for each piece of information, and then construct the income statement by using a formula or cell reference for each individual line of the statement a. Construct income statements for the two companies Complete the income statement for Company A below: (Round to the nearest dollar.) Income Statement Company A Revenue Data Table - X Cost of Goods Sold $ Gross Margin or Profit $ Fixed Costs $ Information Selling, General and Adm. Cost Depreciation Expense $ $ EBIT $ Cost per unit of glassware Fixed costs Selling, general, and administrative expenses Depreciation expense Interest expense Tax rate Company A (stemware) $8.11 $1,245,625 $785,351 $1,489,552 $501,862 35.0% Company B (without stems) $6.66 $1,354,812 $584,431 $1,137,801 $698,269 35.0% $ Interest Expense Taxable Income $ Taxes $ Net Income $ Print Operating Cash Flow Done Enter any number in the edit fields and then click Check