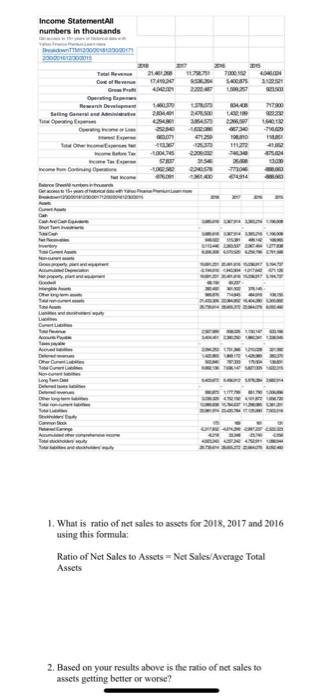

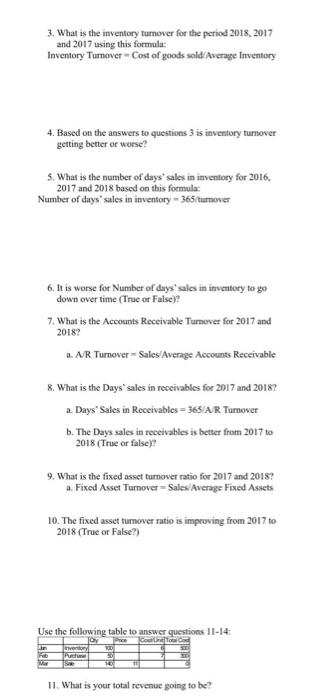

Income Statement All numbers in thousands 21 1. What is ratio of net sales to assets for 2018, 2017 and 2016 using this formula: Ratio of Net Sales to Assets Net Sales/Average Total Assets 2. Based on your results above is the ratio of net sales to assets getting better or worse? 3. What is the inventory turnover for the period 2018, 2017 and 2017 using this formula: Inventory Turnover Cost of goods sold Average Inventory 4. Based on the answers to questions 3 is inventory turnover getting better or worse? 5. What is the number of days' sales in inventory for 2016, 2017 and 2018 based on this formula: Number of days' sales in inventory - 365 turnover 6. It is worse for Number of days' sales in inventory to go down over time (True or False)? 7. What is the Accounts Receivable Turnover for 2017 and 2018? a. A/R Tumover -Sales/Average Accounts Receivable 8. What is the Days' sales in receivables for 2017 and 2018? a. Days' Sales in Receivables = 365/A/R Tumover b. The Days sales in receivables is better from 2017 to 2018 (True or false)? 9. What is the fixed asset turnover ratio for 2017 and 2018? a. Fixed Asset Tumover =Sales/Average Fixed Assets 10. The fixed asset turnover ratio is improving from 2017 to 2018 (True or False?) Use the following table to answer questions 11-14 11. What is your total revenue going to be? Income Statement All numbers in thousands 21 1. What is ratio of net sales to assets for 2018, 2017 and 2016 using this formula: Ratio of Net Sales to Assets Net Sales/Average Total Assets 2. Based on your results above is the ratio of net sales to assets getting better or worse? 3. What is the inventory turnover for the period 2018, 2017 and 2017 using this formula: Inventory Turnover Cost of goods sold Average Inventory 4. Based on the answers to questions 3 is inventory turnover getting better or worse? 5. What is the number of days' sales in inventory for 2016, 2017 and 2018 based on this formula: Number of days' sales in inventory - 365 turnover 6. It is worse for Number of days' sales in inventory to go down over time (True or False)? 7. What is the Accounts Receivable Turnover for 2017 and 2018? a. A/R Tumover -Sales/Average Accounts Receivable 8. What is the Days' sales in receivables for 2017 and 2018? a. Days' Sales in Receivables = 365/A/R Tumover b. The Days sales in receivables is better from 2017 to 2018 (True or false)? 9. What is the fixed asset turnover ratio for 2017 and 2018? a. Fixed Asset Tumover =Sales/Average Fixed Assets 10. The fixed asset turnover ratio is improving from 2017 to 2018 (True or False?) Use the following table to answer questions 11-14 11. What is your total revenue going to be