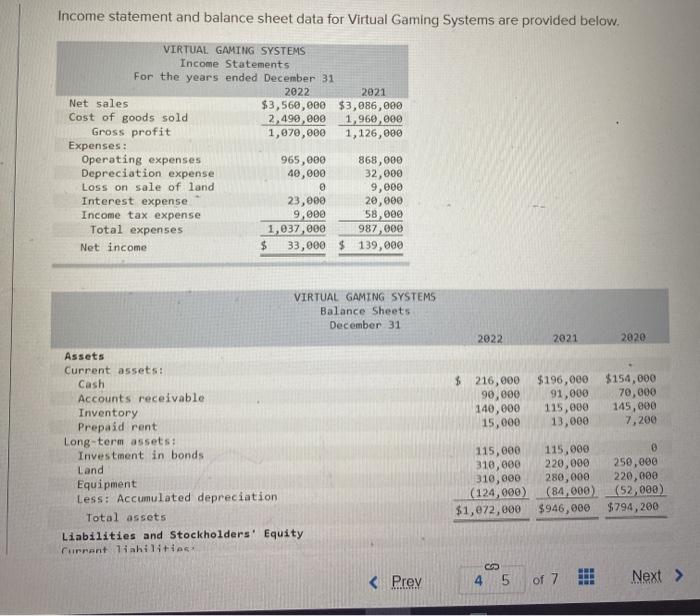

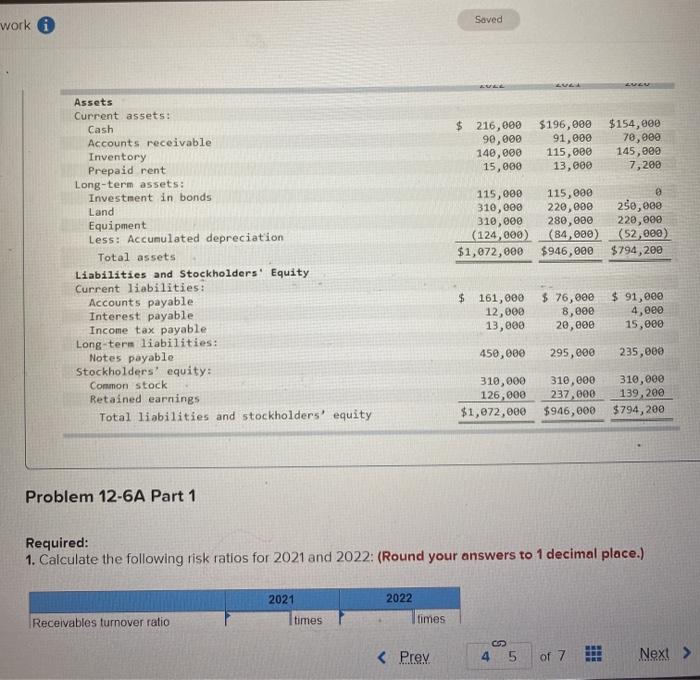

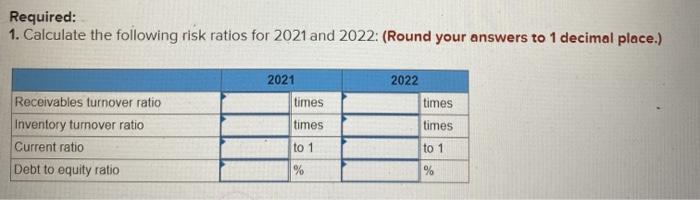

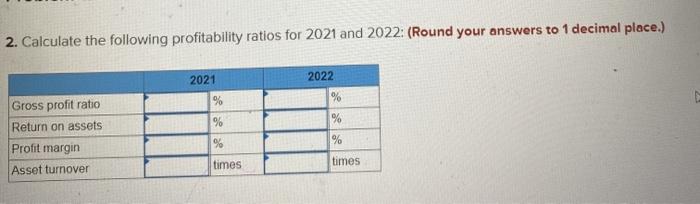

Income statement and balance sheet data for Virtual Gaming Systems are provided below. VIRTUAL GAMING SYSTEMS Income Statements For the years ended December 31 2022 2021 Net sales $3,560,000 $3,086,000 Cost of goods sold 2,490,000 1,960,000 Gross profit 1,070,000 1,126,000 Expenses: Operating expenses 965,000 868,000 Depreciation expense 40,000 32,000 Loss on sale of land 9,000 Interest expense 23,000 20,000 Income tax expense 9,000 58,000 Total expenses 1,037,000 987, e80 Net income $ 33,000 $ 139,000 VIRTUAL GAMING SYSTEMS Balance Sheets December 31 2022 2021 2020 $ 216,000 90,000 140,000 15,000 $196,000 $154,000 91,000 70,000 115,000 145,000 13,000 7,200 Assets Current assets Cash Accounts receivable Inventory Prepaid rent Long-term assets: Investment in bonds Land Equipment Less: Accumulated depreciation Total assets Liabilities and Stockholders' Equity Current liabilities: 115,000 115,000 310,000 220,000 250,000 310,000 280,000 220,000 (124, 000) (84,000) (52,000) $1,072,000 $946,800 $794,200 work Saved LULU $ 216,000 90,000 140,000 15,000 $196,000 91,000 115,000 13,000 $154,800 70,000 145,800 7,200 115,000 115,000 310,000 220,000 310,000 280,000 (124,000) (84,000) $1,072,000 $946,000 250, eee 220,000 (52,000) $794,200 Assets Current assets: Cash Accounts receivable Inventory Prepaid rent Long-term assets: Investment in bonds Land Equipment Less: Accumulated depreciation Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Interest payable Income tax payable Long-term liabilities: Notes payable Stockholders' equity: Common stock Retained earnings Total liabilities and stockholders' equity $ 161,000 12,000 13,000 $ 76,000 8, eee 20,000 $ 91,000 4,000 15,000 450,000 295,000 235,000 310,000 310,000 126,000 237.000 $1,072,000 $946,000 310,000 139,200 $794,200 Problem 12-6A Part 1 Required: 1. Calculate the following risk ratios for 2021 and 2022: (Round your answers to 1 decimal place.) 2021 2022 times Receivables turnover ratio times G2 Required: 1. Calculate the following risk ratios for 2021 and 2022: (Round your answers to 1 decimal place.) 2021 times 2022 times times times Receivables turnover ratio Inventory turnover ratio Current ratio Debt to equity ratio to 1 to 1 % 2. Calculate the following profitability ratios for 2021 and 2022: (Round your answers to 1 decimal place.) 2021 2022 % Gross profit ratio Return on assets % % % % % Profit margin times Asset turnover times