Question

Income Statement and Balance Sheet Fort Worth Corporation began business in January 2017 as a commercial carpet-cleaning and drying service. Shares of stock were issued

Income Statement and Balance Sheet

Fort Worth Corporation began business in January 2017 as a commercial carpet-cleaning and drying service. Shares of stock were issued to the owners in exchange for cash. Equipment was purchased by making a down payment in cash and signing a note payable for the balance. Services are performed for local restaurants and office buildings on open account, and customers are given 15 days to pay their accounts. Rent for office and storage facilities is paid at the beginning of each month. Salaries and wages are paid at the end of the month. The following amounts are from the records of Fort Worth Corporation at the end of its first month of operations: Accounts receivable $24,750

Equipment $62,000

Capital stock $80,000

Notes payable $30,000

Cash $51,450

Rent expense $3,600

Cleaning revenue $45,900

Retained earnings ?

Dividends $5,500

Salary and wage expense $8,600

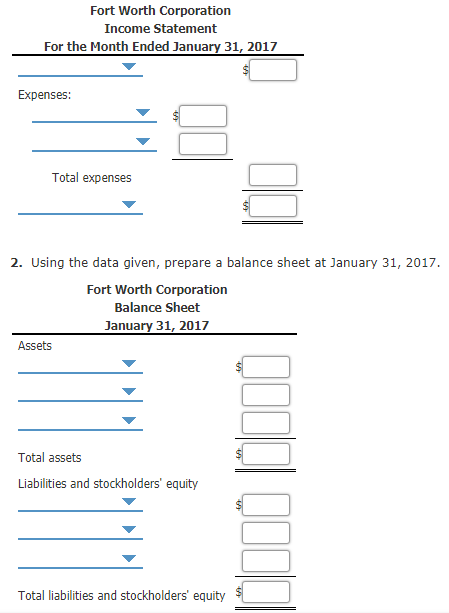

Question1) Using the data given, prepare an income statement for the month ended January 31, 2017.

Question 2) Using the data given, prepare a balance sheet at January 31, 2017.

Question 3) What information would you need about Notes Payable to fully assess Fort Worths long-term viability?

| a. | When is it due? |

| b. | What is the interest rate? |

| c. | Is interest paid periodically or only at maturity? |

| d. | Have any assets been offered as collateral for the loan? |

| e. | All of the above. |

Structure of statements is given below:

1.Using the data given, prepare an income statement for the month ended January 31, 2017.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started