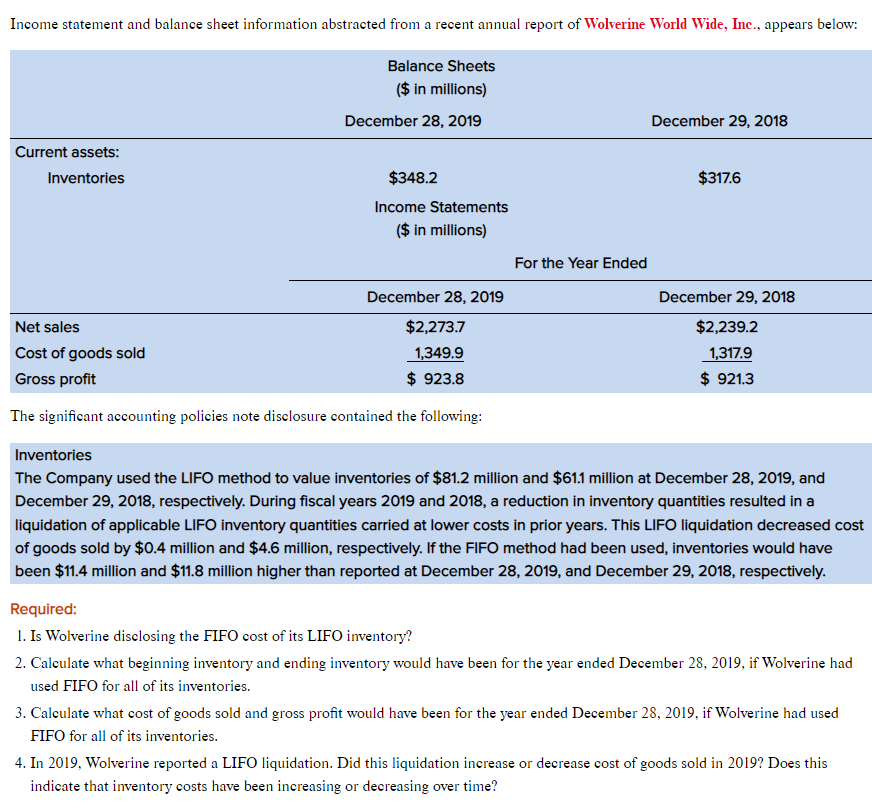

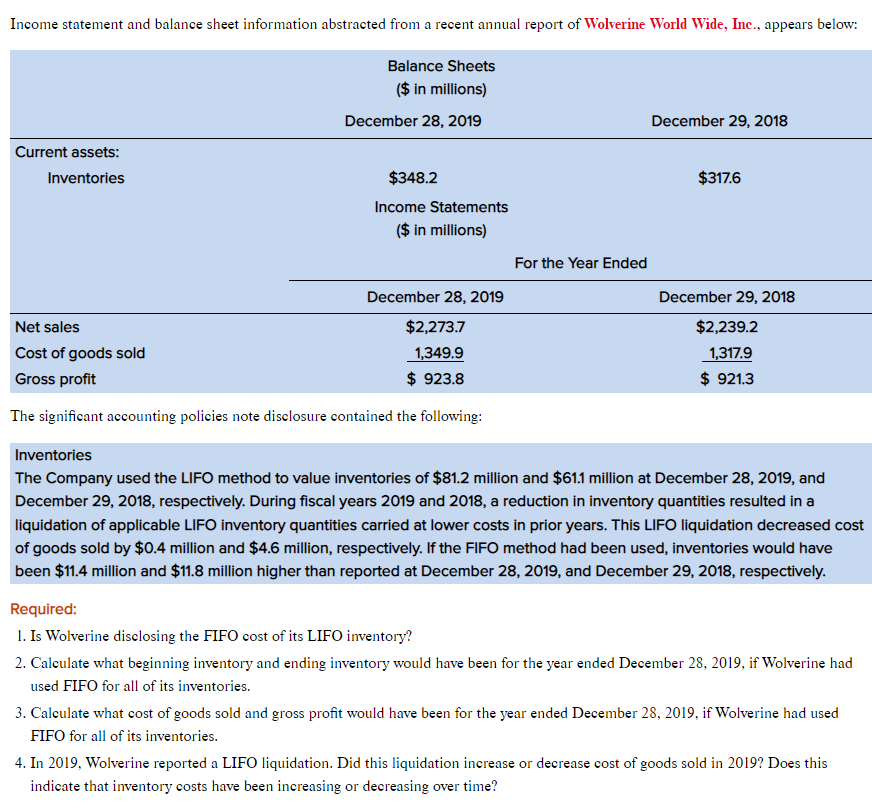

Income statement and balance sheet information abstracted from a recent annual report of Wolverine World Wide, Inc., appears below: The significant accounting policies note disclosure contained the following: Inventories The Company used the LIFO method to value inventories of $81.2 million and $61.1 million at December 28 , 2019, and December 29, 2018, respectively. During fiscal years 2019 and 2018 , a reduction in inventory quantities resulted in a liquidation of applicable LIFO inventory quantities carried at lower costs in prior years. This LIFO liquidation decreased cost of goods sold by $0.4 million and $4.6 million, respectively. If the FIFO method had been used, inventories would have been $11.4 million and $11.8 million higher than reported at December 28,2019 , and December 29, 2018, respectively. Required: 1. Is Wolverine disclosing the FIFO cost of its LIFO inventory? 2. Calculate what beginning inventory and ending inventory would have been for the year ended December 28, 2019, if Wolverine had used FIFO for all of its inventories. 3. Calculate what cost of goods sold and gross profit would have been for the year ended December 28, 2019, if Wolverine had used FIFO for all of its inventories. 4. In 2019, Wolverine reported a LIFO liquidation. Did this liquidation increase or decrease cost of goods sold in 2019? Does this indicate that inventory costs have been increasing or decreasing over time? Income statement and balance sheet information abstracted from a recent annual report of Wolverine World Wide, Inc., appears below: The significant accounting policies note disclosure contained the following: Inventories The Company used the LIFO method to value inventories of $81.2 million and $61.1 million at December 28 , 2019, and December 29, 2018, respectively. During fiscal years 2019 and 2018 , a reduction in inventory quantities resulted in a liquidation of applicable LIFO inventory quantities carried at lower costs in prior years. This LIFO liquidation decreased cost of goods sold by $0.4 million and $4.6 million, respectively. If the FIFO method had been used, inventories would have been $11.4 million and $11.8 million higher than reported at December 28,2019 , and December 29, 2018, respectively. Required: 1. Is Wolverine disclosing the FIFO cost of its LIFO inventory? 2. Calculate what beginning inventory and ending inventory would have been for the year ended December 28, 2019, if Wolverine had used FIFO for all of its inventories. 3. Calculate what cost of goods sold and gross profit would have been for the year ended December 28, 2019, if Wolverine had used FIFO for all of its inventories. 4. In 2019, Wolverine reported a LIFO liquidation. Did this liquidation increase or decrease cost of goods sold in 2019? Does this indicate that inventory costs have been increasing or decreasing over time