Answered step by step

Verified Expert Solution

Question

1 Approved Answer

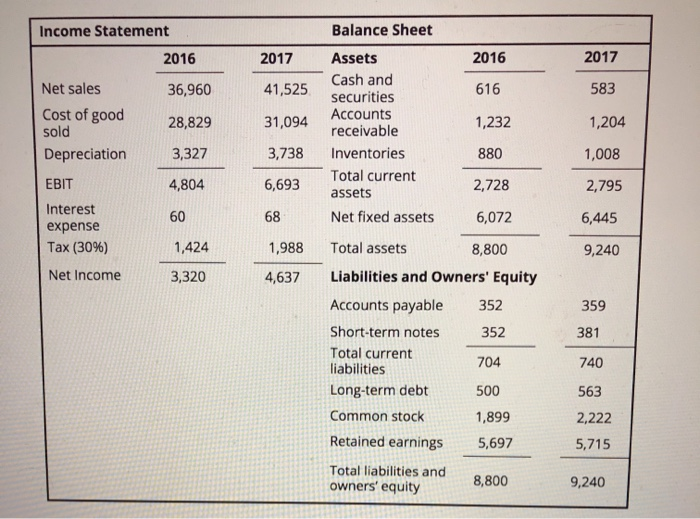

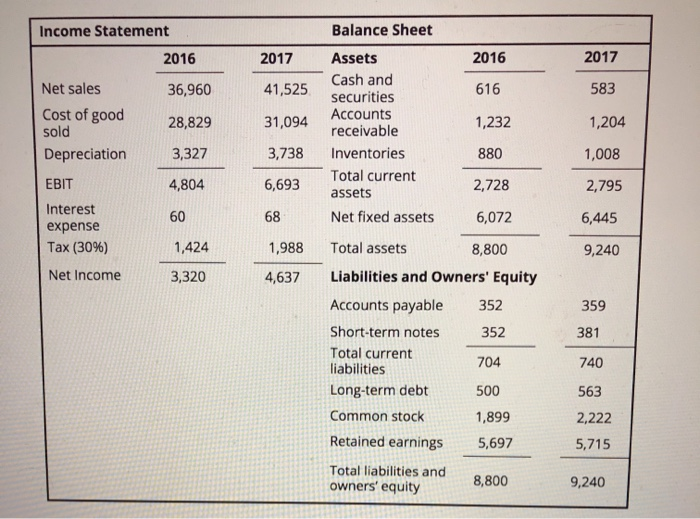

Income Statement Balance Sheet 2016 2017 2016 2017 36,960 41,525 616 583 Net sales Cost of good sold Depreciation 28,829 31,094 1,232 1,204 Assets Cash

Income Statement Balance Sheet 2016 2017 2016 2017 36,960 41,525 616 583 Net sales Cost of good sold Depreciation 28,829 31,094 1,232 1,204 Assets Cash and securities Accounts receivable Inventories Total current assets Net fixed assets 3,327 3,738 880 1,008 EBIT 4,804 6,693 2,728 2,795 60 68 6,072 6,445 Interest expense Tax (30%) 1,424 1,988 9,240 Net Income 3,320 4,637 359 381 Total assets 8,800 Liabilities and Owners' Equity Accounts payable 352 Short-term notes 352 Total current 704 liabilities Long-term debt 500 Common stock 1,899 Retained earnings 5,697 Total liabilities and owners' equity 8,800 740 563 2,222 5,715 9,240 if you were asked to prepare the common size financial statements for SW in using the information above, what would be the percentage point change between 2016 and 2017 on Inventories? 0.91 percentage point increase 0.79 percentage point decrease 0.79 percentage point increase 0.91 percentage point decrease 1.05 percentage point increase

Income Statement Balance Sheet 2016 2017 2016 2017 36,960 41,525 616 583 Net sales Cost of good sold Depreciation 28,829 31,094 1,232 1,204 Assets Cash and securities Accounts receivable Inventories Total current assets Net fixed assets 3,327 3,738 880 1,008 EBIT 4,804 6,693 2,728 2,795 60 68 6,072 6,445 Interest expense Tax (30%) 1,424 1,988 9,240 Net Income 3,320 4,637 359 381 Total assets 8,800 Liabilities and Owners' Equity Accounts payable 352 Short-term notes 352 Total current 704 liabilities Long-term debt 500 Common stock 1,899 Retained earnings 5,697 Total liabilities and owners' equity 8,800 740 563 2,222 5,715 9,240 if you were asked to prepare the common size financial statements for SW in using the information above, what would be the percentage point change between 2016 and 2017 on Inventories? 0.91 percentage point increase 0.79 percentage point decrease 0.79 percentage point increase 0.91 percentage point decrease 1.05 percentage point increase

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started