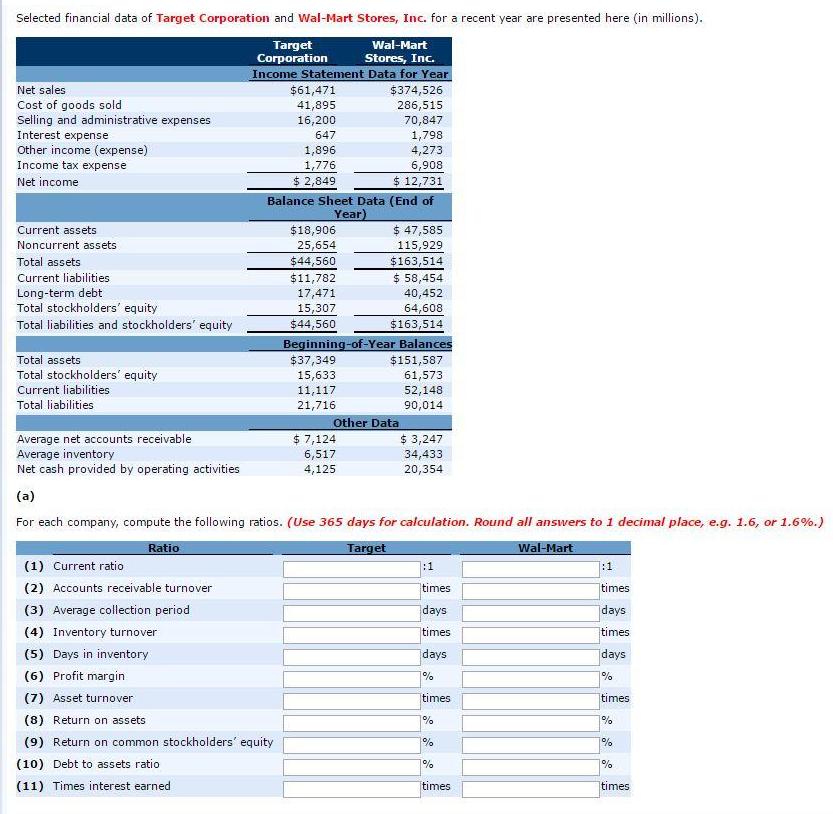

Selected financial data of Target Corporation and Wal-Mart Stores, Inc. for a recent year are presented here (in millions). Target Corporation Wal-Mart Stores, Inc.

Selected financial data of Target Corporation and Wal-Mart Stores, Inc. for a recent year are presented here (in millions). Target Corporation Wal-Mart Stores, Inc. Income Statement Data for Year Net sales Cost of goods sold Selling and administrative expenses $61,471 $374,526 41,895 16,200 286,515 70,847 1,798 Interest expense Other income (expense) 647 1,896 1,776 $ 2,849 4,273 6,908 $ 12,731 Income tax expense Net income Balance Sheet Data (End of Year) Current assets $18,906 $ 47,585 Noncurrent assets 25,654 115,929 Total assets $44,560 $11,782 17,471 15,307 $44,560 $163,514 $ 58,454 Current liabilities Long-term debt Total stockholders' equity 40,452 64,608 $163,514 Total liabilities and stockholders' equity Beginning-of-Year Balances $37,349 Total assets Total stockholders' equity $151,587 61,573 15,633 11,117 21,716 Current liabilities 52,148 90,014 Total liabilities Other Data $ 7,124 $ 3,247 Average net accounts receivable Average inventory Net cash provided by operating activities 6,517 4,125 34,433 20,354 (a) For each company, compute the following ratios. (Use 365 days for calculation. Round all answers to 1 decimal place, e.g. 1.6, or 1.6%.) Target Wal-Mart Ratio (1) Current ratio :1 :1 (2) Accounts receivable turnover times times (3) Average collection period days days (4) Inventory turnover times times (5) Days in inventory days days (6) Profit margin % % (7) Asset turnover times times (8) Return on assets (9) Return on common stockholders' equity % (10) Debt to assets ratio % (11) Times interest earned times times

Step by Step Solution

3.55 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Ratios formula target corp Walmart 1current ratio current assetscurrent liab 189061178216 4758558...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started