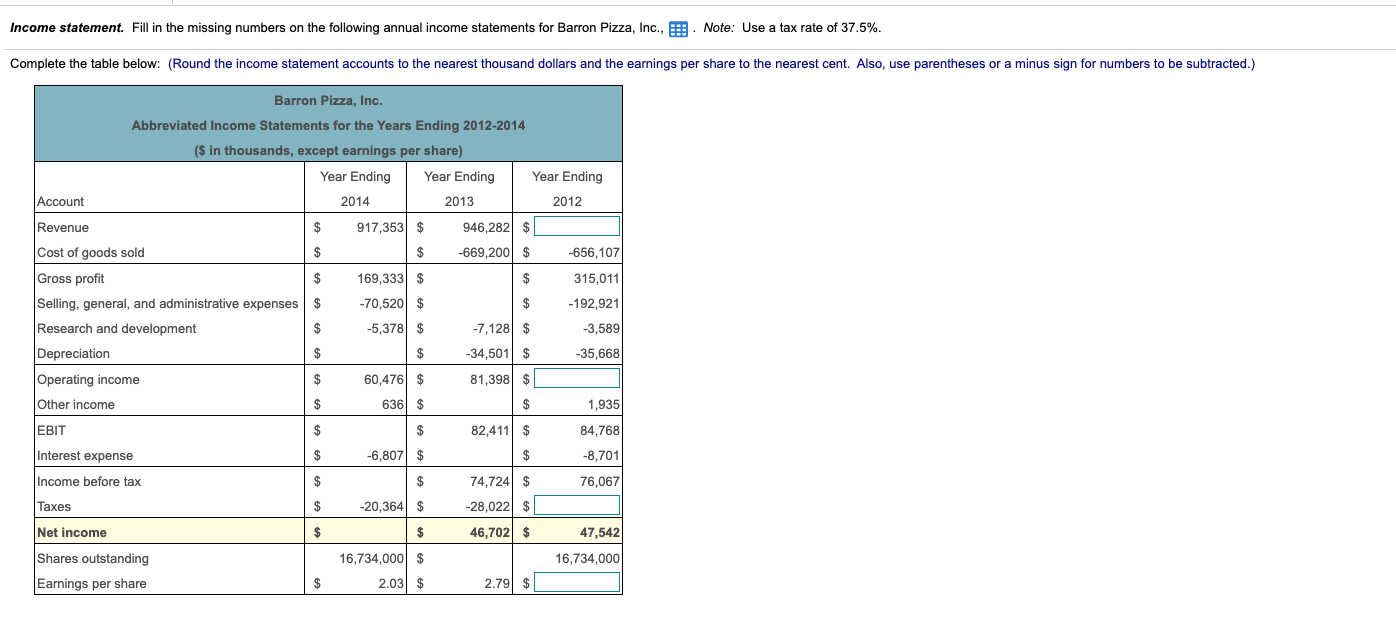

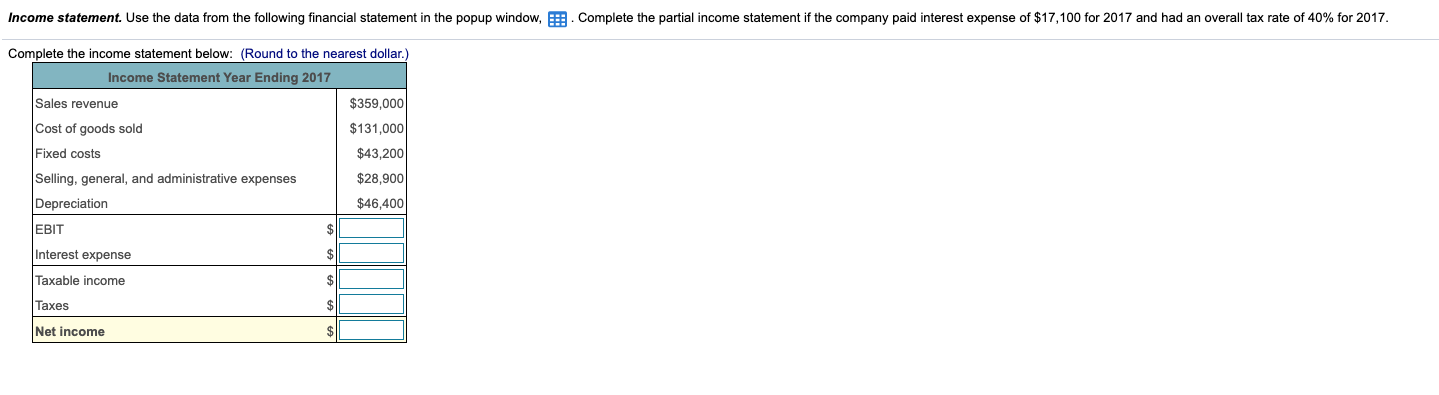

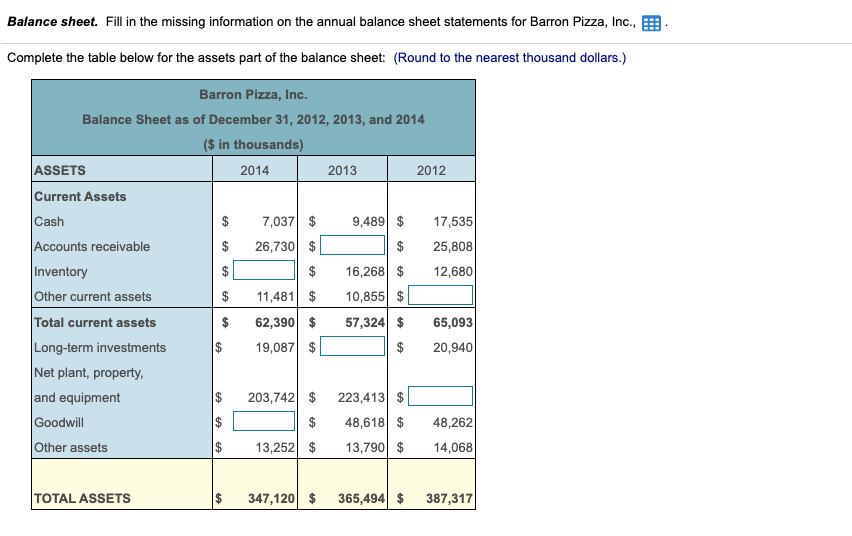

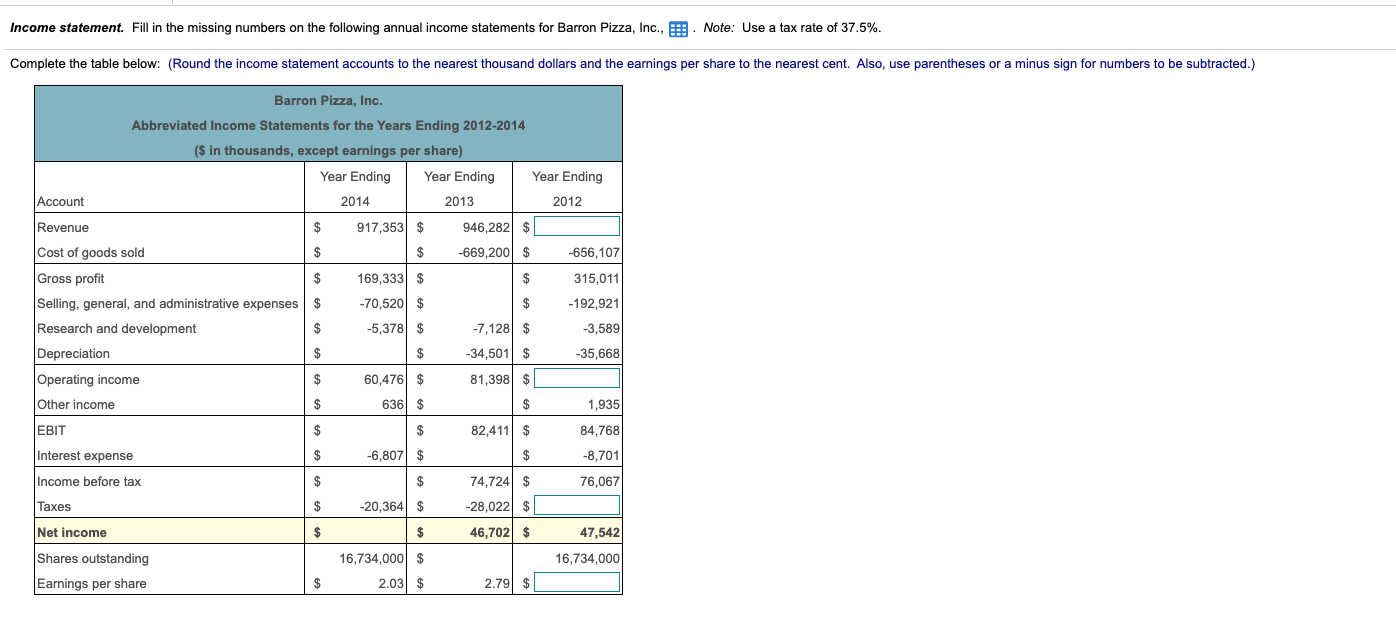

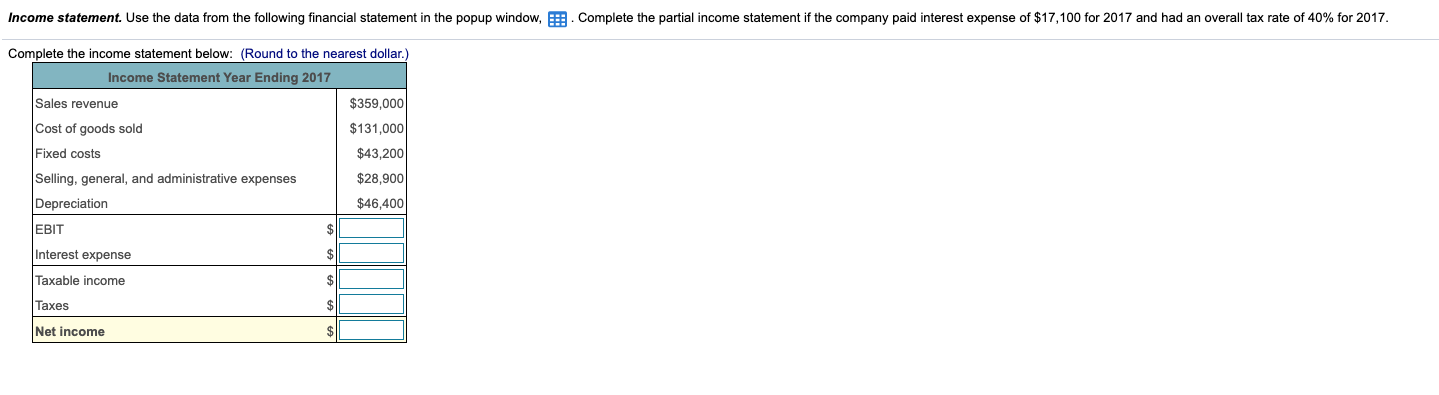

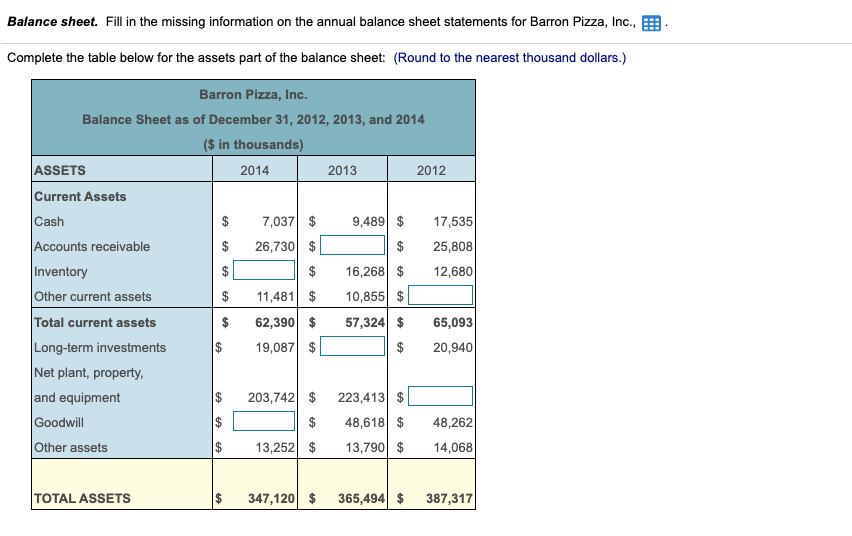

Income statement. Fill in the missing numbers on the following annual income statements for Barron Pizza, Inc., : Note: Use a tax rate of 37.5%. Complete the table below: (Round the income statement accounts to the nearest thousand dollars and the earnings per share to the nearest cent. Also, use parentheses or a minus sign for numbers to be subtracted.) Barron Pizza, Inc. Abbreviated Income Statements for the Years Ending 2012-2014 ($ in thousands, except earnings per share) Year Ending Year Ending Year Ending Account 2014 2013 2012 Revenue $ 917,353 $ 946,282 $ Cost of goods sold $ $ -669,200 $ -656,107 Gross profit $ 169,333 $ $ 315,011 $ -70,520 $ $ -192,921 $ -5,378 $ -7,128 $ Selling, general, and administrative expenses Research and development Depreciation Operating income -3,589 -35,668 $ $ -34,501 $ $ 60,476 $ 81,398 $ Other income $ 636 $ $ 1,935 |EBIT $ $ 82,411 $ 84,768 $ -6,807 $ $ Interest expense Income before tax -8,701 76,067 $ $ 74,724 $ -28,022 $ Taxes $ -20,364 $ Net income $ $ 46,702 $ 47,542 Shares outstanding 16,734,000 $ 16,734,000 Earnings per share $ 2.03 $ 2.79 $ Income statement. Use the data from the following financial statement in the popup window, B. Complete the partial income statement if the company paid interest expense of $17,100 for 2017 and had an overall tax rate of 40% for 2017. Complete the income statement below: (Round to the nearest dollar. Income Statement Year Ending 2017 Sales revenue $359,000 Cost of goods sold $131,000 Fixed costs $43,200 Selling, general, and administrative expenses $28,900 Depreciation $46,400 EBIT $ Interest expense S Taxable income $ Taxes Net income Balance sheet. Fill in the missing information on the annual balance sheet statements for Barron Pizza, Inc., 5. Complete the table below for the assets part of the balance sheet: (Round to the nearest thousand dollars.) $ Barron Pizza, Inc. Balance Sheet as of December 31, 2012, 2013, and 2014 ($ in thousands) ASSETS 2014 2013 2012 Current Assets Cash 7,037 $ 9,489 $ 17,535 Accounts receivable 26,730 $ 25,808 Inventory 16,268 $ 12,680 Other current assets 11,481 $ 10,855 $ Total current assets 62,390 $ 57,324 $ 65,093 Long-term investments 19,087 $ 20,940 Net plant, property, and equipment 203,742 $ 223,413 $ Goodwill 48,618 $ 48,262 Other assets 13,252 $ 13,790 $ 14,068 $ $ $ $ TOTAL ASSETS $ 347,120 $ 365,494 $ 387,3171