Question

Income Statement For the Year Ended December Sales Cost of goods sold Gross profit Operating expenses Depreciation expense Rent expense Salaries expense Other operating

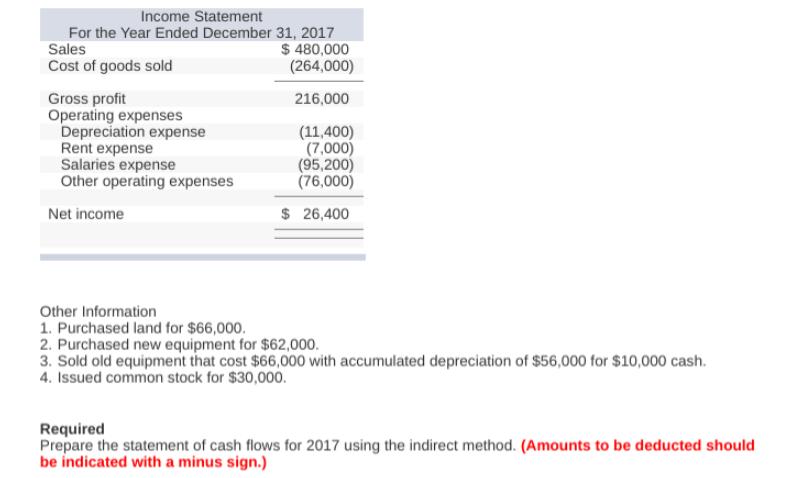

Income Statement For the Year Ended December Sales Cost of goods sold Gross profit Operating expenses Depreciation expense Rent expense Salaries expense Other operating expenses Net income 31, 2017 $ 480,000 (264,000) 216,000 (11,400) (7,000) (95,200) (76,000) $ 26,400 Other Information 1. Purchased land for $66,000. 2. Purchased new equipment for $62,000. 3. Sold old equipment that cost $66,000 with accumulated depreciation of $56,000 for $10,000 cash. 4. Issued common stock for $30,000. Required Prepare the statement of cash flows for 2017 using the indirect method. (Amounts to be deducted should be indicated with a minus sign.)

Step by Step Solution

3.29 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Cash flow statemnt Cashflows from operating activities Net income for ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamental Managerial Accounting Concepts

Authors: Edmonds, Tsay, olds

6th Edition

71220720, 78110890, 9780071220729, 978-0078110894

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App