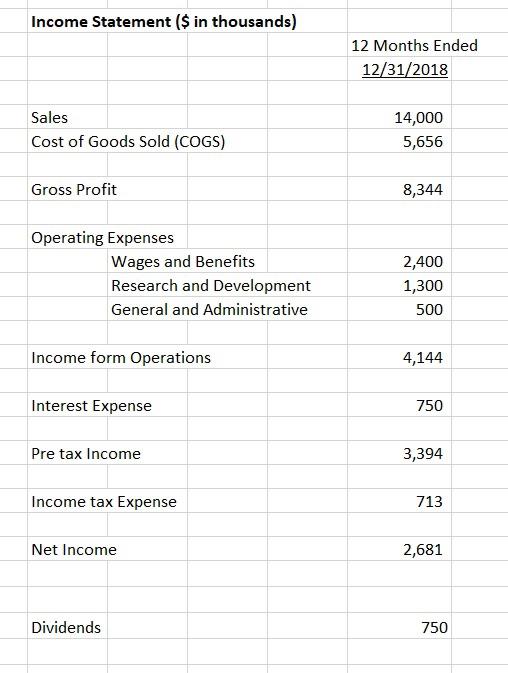

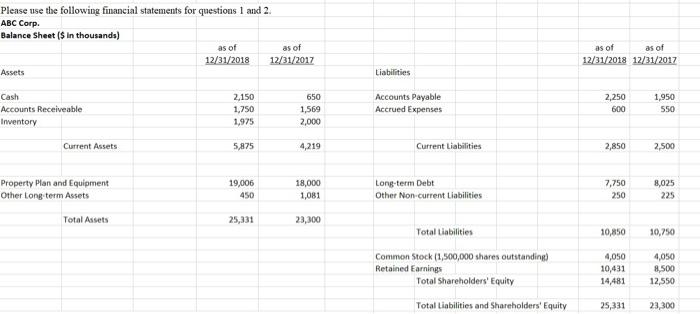

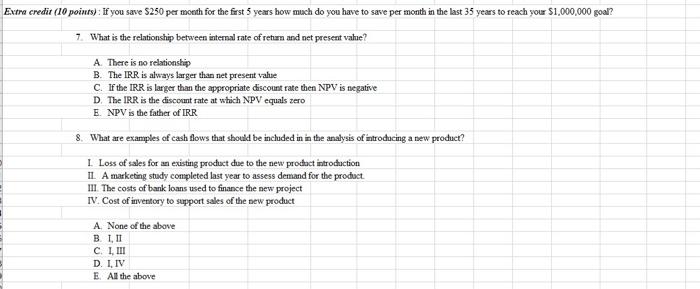

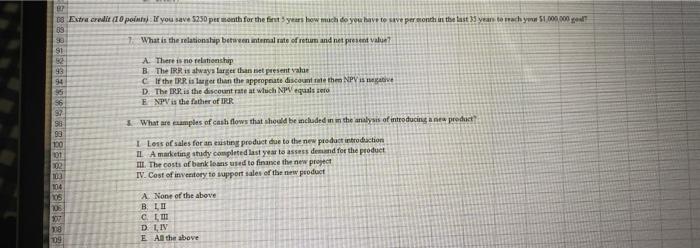

Income Statement ($ in thousands) 12 Months Ended 12/31/2018 Sales Cost of Goods Sold (COGS) 14,000 5,656 Gross Profit 8,344 Operating Expenses Wages and Benefits Research and Development General and Administrative 2,400 1,300 500 Income form Operations 4,144 Interest Expense 750 Pre tax Income 3,394 Income tax Expense 713 Net Income 2,681 Dividends 750 Please use the following financial statements for questions 1 and 2. ABC Corp. Balance Sheet ($ In thousands) as of as of 12/31/2018 12/31/2017 Assets as of as of 12/31/2018 12/31/2017 Liabilities Cash Accounts Receiveable Inventory 2,150 1,750 1.975 650 1,569 2,000 Accounts Payable Accrued Expenses 2,250 600 1,950 550 Current Assets 5,875 4,219 Current Liabilities 2,850 2,500 Property Plan and Equipment Other tongterm Assets 19,006 450 18,000 1,081 Long-term Debt Other Non-current Liabilities 7,750 250 8,025 225 Total Assets 25,331 23,300 Total Liabilities 10,850 10,750 Common Stock (1,500,000 shares outstanding) Retained Earnings Total Shareholders' Equity 4,050 10,431 14,481 4,050 8,500 12,550 Total Liabilities and Shareholders' Equity 25,331 23,300 Extra credit (10 points): If you save $250 per month for the first 5 years how much do you have to save per month in the last 35 years to reach your $1,000,000 goal? 7. What is the relationship between internal rate of return and net present value? A. There is no relationship B. The IRR is always larger than net present value C. If the IRR is larger than the appropriate discount rate then NPV is negative D. The IRR is the discount rate at which NPV equals zero E. NPV is the father of IRR 8. What are examples of cash flows that should be included in in the analysis of introducing a new product? I Loss of sales for an existing product due to the new product introduction IL A marketing study completed last year to assess demand for the product III The costs of bank loans used to finance the new project IV. Cost of inventory to support sales of the new product A None of the above B.1.11 C. I, III D. I. IV E All the above Extra credit (10 points): If you save $250 per month for the first 5 years how much do you have to save per month in the last 35 years to reach your $1,000,000 goal? 7. What is the relationship between internal rate of return and net present value? A. There is no relationship B. The IRR is always larger than net present value C. If the IRR is larger than the appropriate discount rate then NPV is negative D. The IRR is the discount rate at which NPV equals zero E. NPV is the father of IRR 8. What are examples of cash flows that should be included in in the analysis of introducing a new product? I Loss of sales for an existing product due to the new product introduction IL A marketing study completed last year to assess demand for the product III The costs of bank loans used to finance the new project IV. Cost of inventory to support sales of the new product A None of the above B.1.11 C. I, III D. I. IV E All the above 0 Extracredit 10 pontol you save $250 per month for the first years how much do you have to save per month in the last 25 years to trachywun 51,000.00 09 93 What is the relationship between antamal rate of return and net present Value? SH A. There is no relationship 93 B The IRR sabways larger than met present value 94 If the RR is then the appropriate discount at the NPV is te D. The IRR is the discount rate at which NPV equals sero 56 E NPV is the father of IRR 97 S8 What are cumples of cash flows that should be included in the analysis of introducing a new product ga 100 1 Loss of sales for an esting product due to the new product introduction 01 IL A marketing study completed last year to assess demand for the product 02 III. The costs of bank loans used to finance the new project 103 IV. Cost of inventory to support sales of the new product 104 os A None of the above 08 BLU CL 18 D. LIV 109 E All the above