Answered step by step

Verified Expert Solution

Question

1 Approved Answer

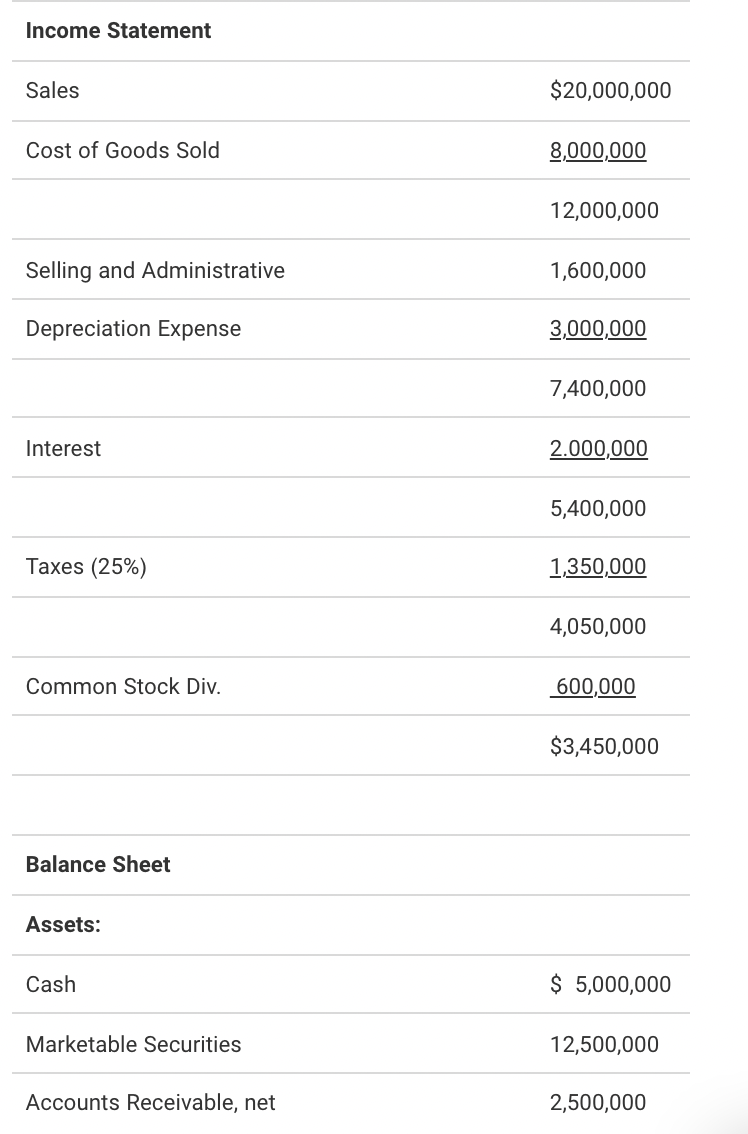

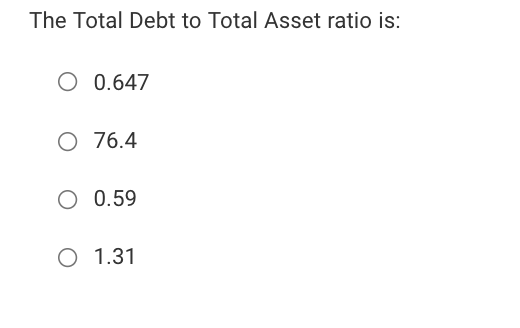

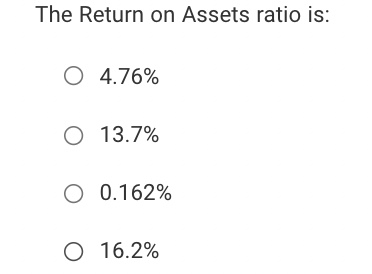

Income Statement Sales $20,000,000 Cost of Goods Sold 8,000,000 12,000,000 Selling and Administrative 1,600,000 Depreciation Expense 3,000,000 7,400,000 Interest 2.000,000 5,400,000 Taxes (25%) 1,350,000 4,050,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started