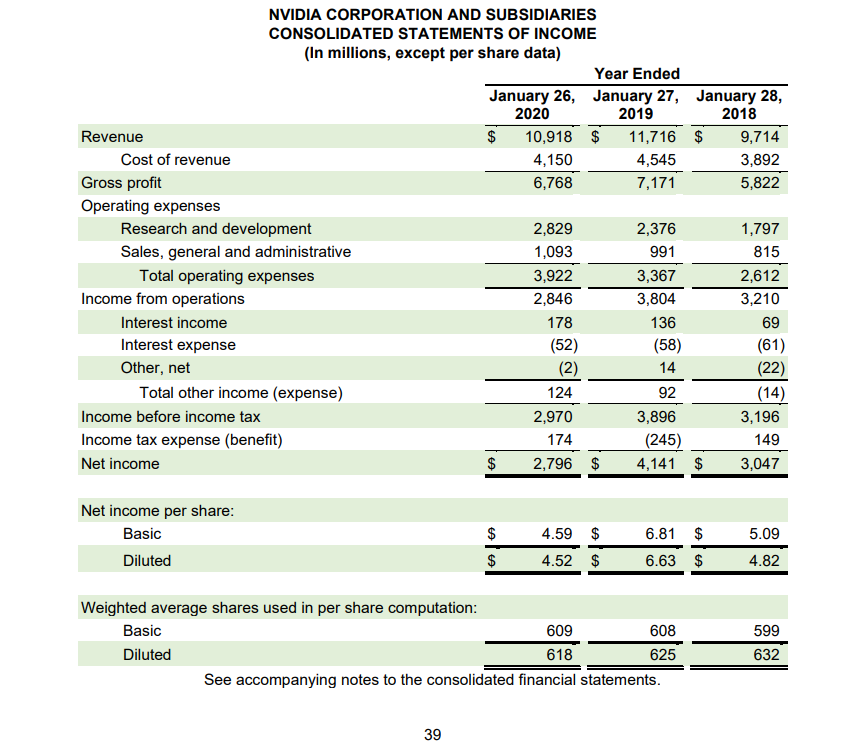

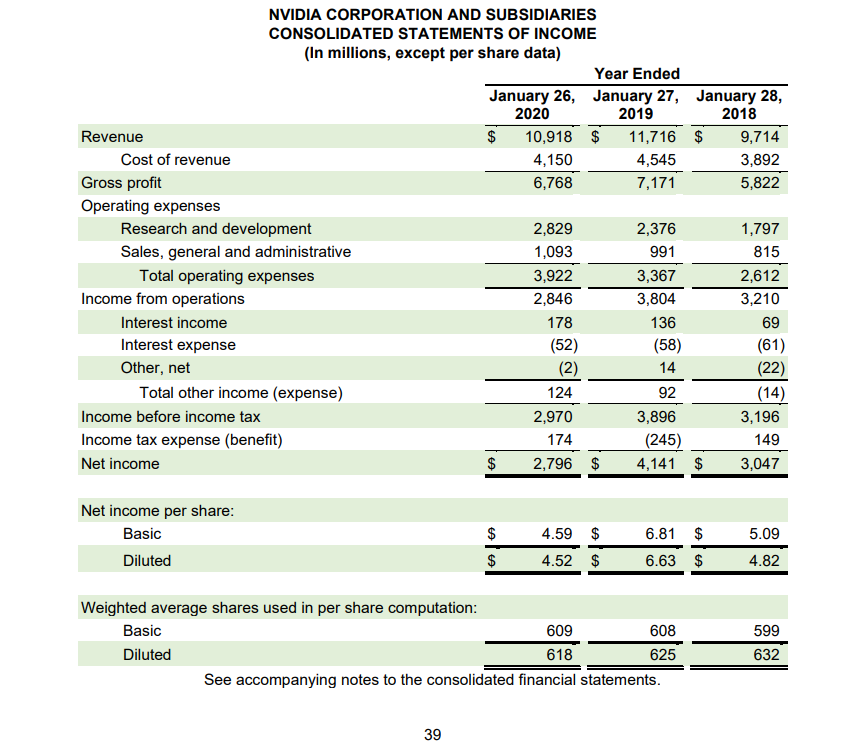

- Income Statement use the income statement from the SEC Form 10-K for the most recent fiscal year.

- State your companys fiscal year end date. If it is not December 31st, why do you believe they chose to use the date they did?

- State the method, single-step or multiple-step, used in the statement. If it is a hybrid, explain.

- Calculate the gross profit ratio for each of the years reported. Briefly evaluate the trend of these results.

- Explain whether operating income is increasing or decreasing for the years reporte Explain the difference between operating income and net income. (not in terms of dollars but in terms of meaning)

- Describe the primary source of revenue for this company. What might that say about the ability of this company to do well in the future?

- Explain what basic earnings per share is. Show the approximate computations that the company used to compute this amount.

- In the footnotes, what does the company say about its policy for revenue recognition? Use your words. Dont cut and paste.

- In the footnotes, what does the company say about depreciation expense? What method(s) of depreciation does the company use? What estimates does the company make to compute this expense?

- Convert the income statement to a common sized income statement (in other words, restate everything as a percentage of total revenues. You will need to export the income statement to Excel for this). Based upon the common size income statement, is there anything surprising to you?

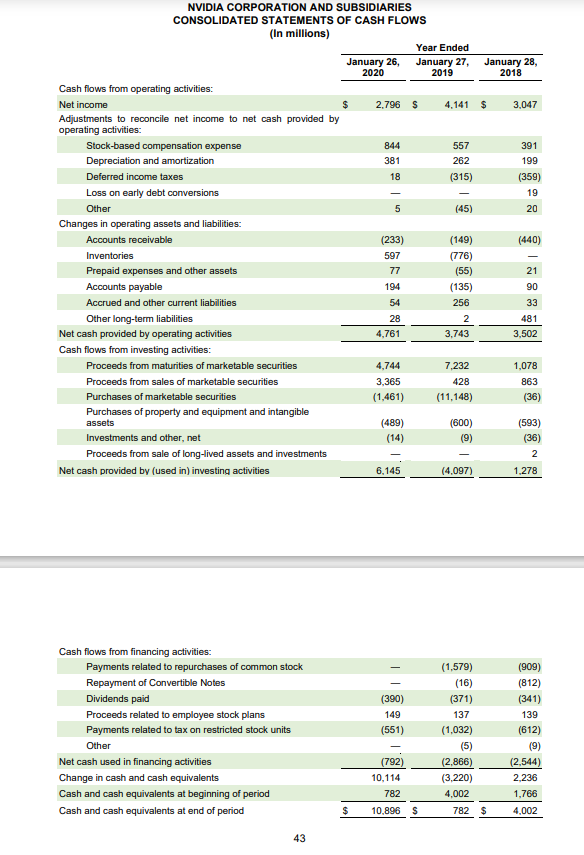

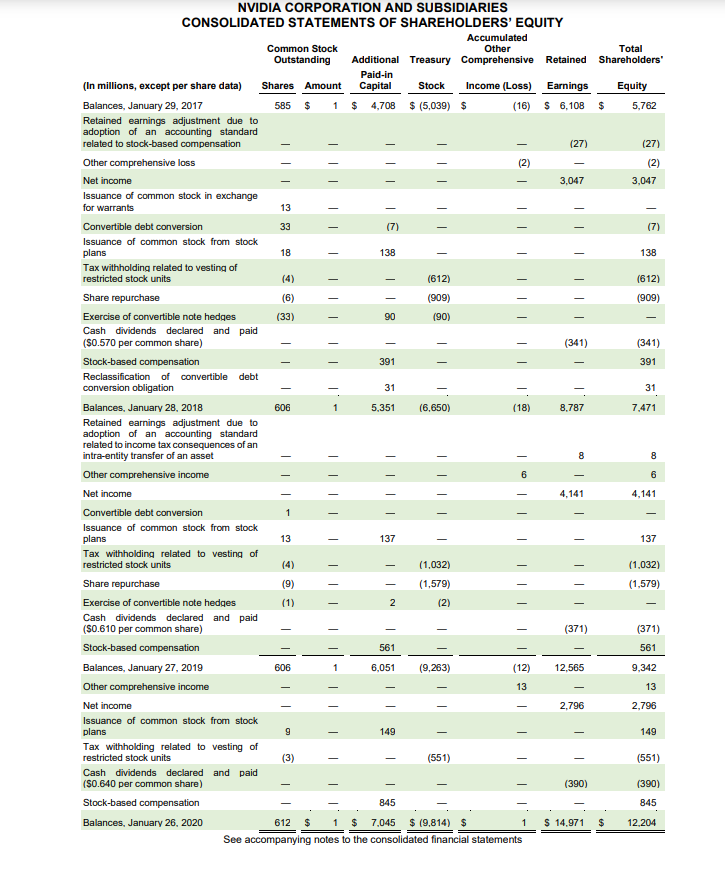

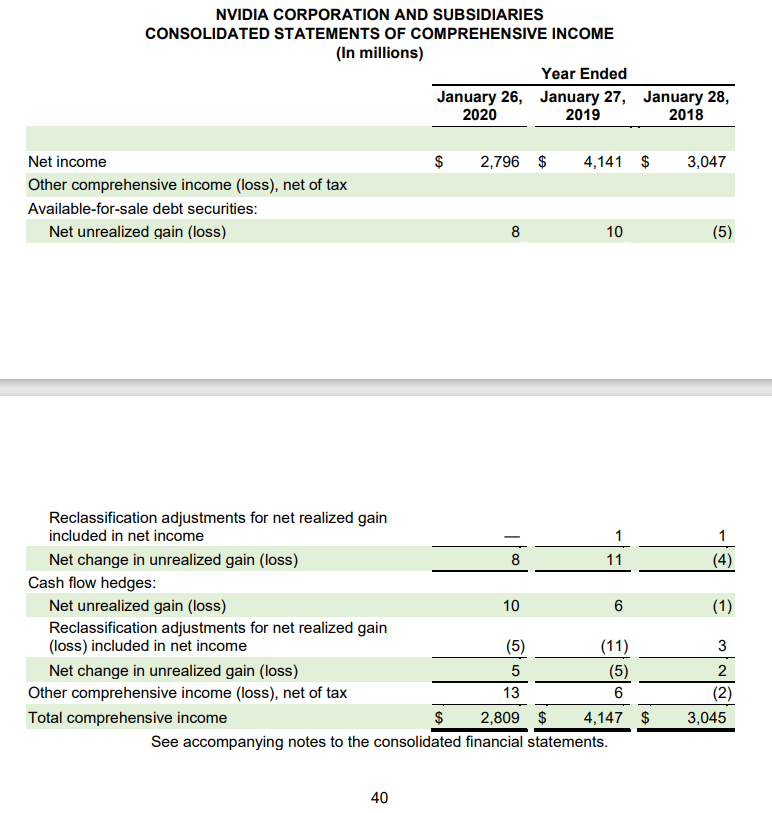

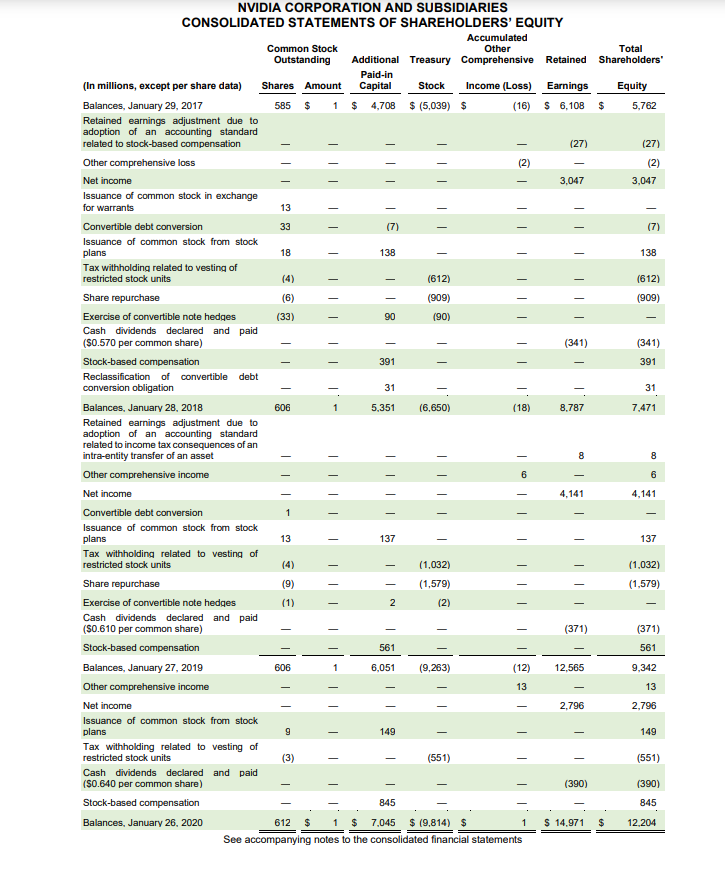

- Statement of stockholders equity

- Describe the primary sections of stockholders equity?

- Identify what caused your companys retained earnings to change during the years of the statement. Discuss the pattern over the period of time.

- Describe any stock issuances this year. Provide what you think the journal entry was.

- Does your company use par value? How do you know?

- Does your company have more than one class of stock? Explain.

- Has the company repurchased any stock? This year? In past years? How do you know?

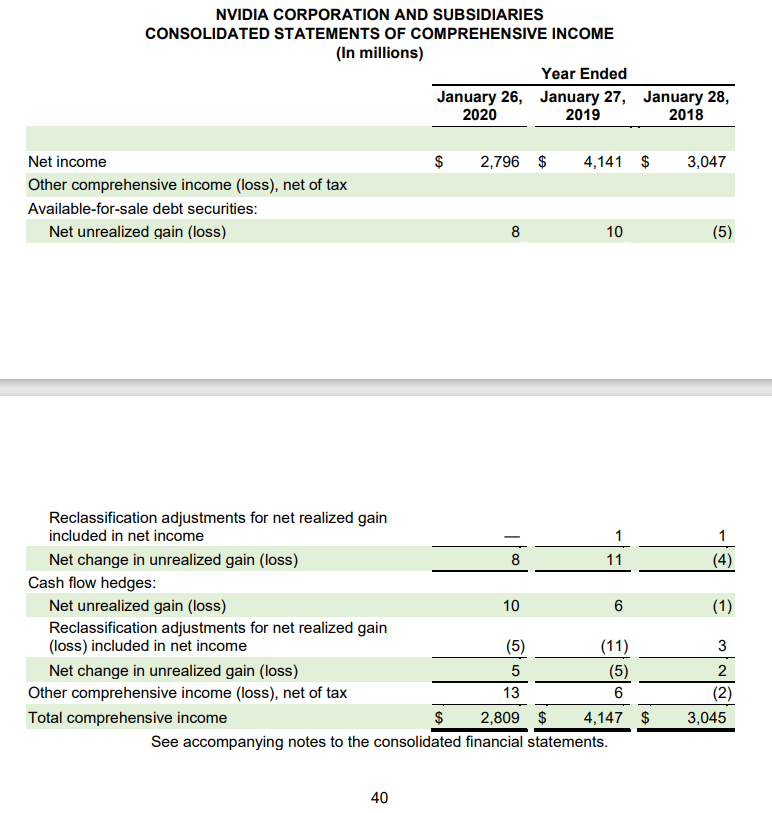

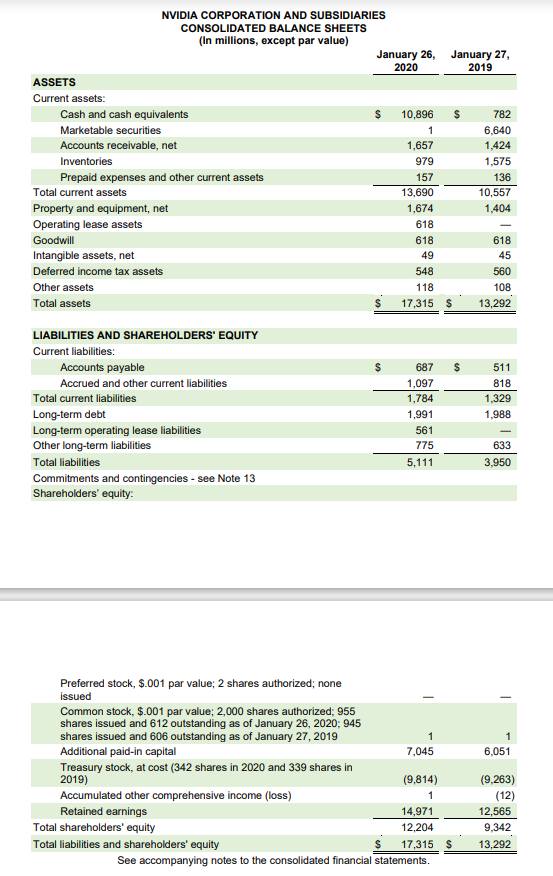

- Balance Sheet

- Describe a cash equivalent. What is your companys cash equivalent and how much is it?

- Compute the current ratio. What does this say about your company?

- How does your company measure accounts receivable? How do they account for Bad Debt?

- Read the footnotes related to inventories. What method does your company use to report inventories? If they were to use a different method, what impact do you think it would have on the balance sheet and income statement. Explain.

- What types of investments does your company own?

- What types of capital assets (PPE) does your company recognize on the balance sheet?

- Does your company have any intangible assets? What are they? How are they valued on the balance sheet? Are they amortized and if so over what period of time? If not, why not?

- How many shares of common stock are authorized, issued? Outstanding?

- What is the percentage of current assets to total assets for the most recent year?

- What is the percentage of current liabilities to total assets for the current year?

- What is the percentage of total liabilities to total assets for the most recent year?

- What is the percentage of stockholders equity to total assets?

- In your opinion, does the company have too much debt?

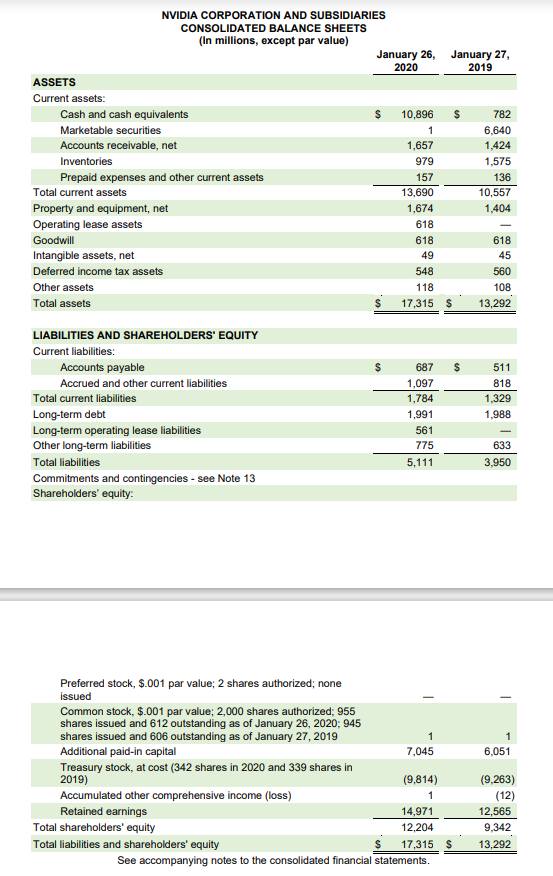

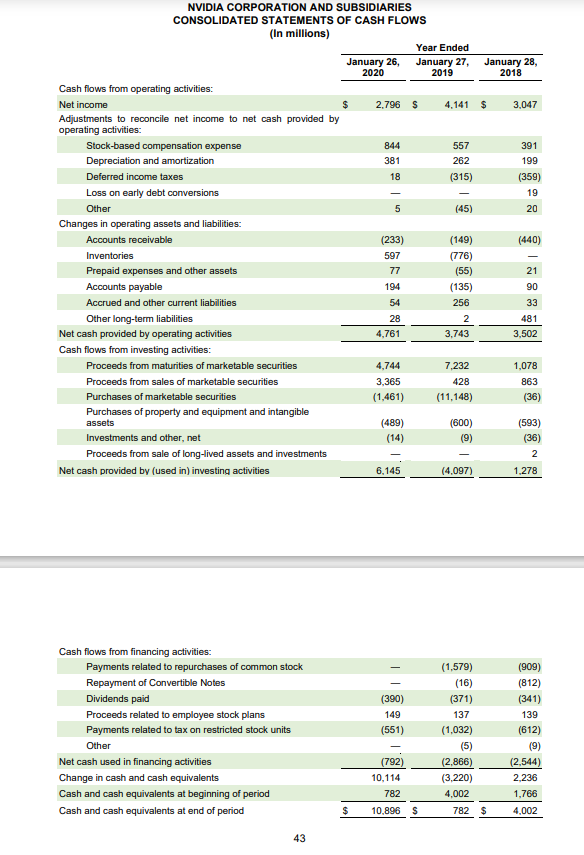

- Cash flow statement

- Does your company prepare a direct or indirect cash flow statement for operating activities?

- In your opinion, which is more important income statement or cash flow statement?

- Describe the three primary sections of this statement.

- Where is the source of most of your companys cash? What does this say about the companys financial health?

- What is the primary use of your companys cash? What does this say about the companys priorities?

NVIDIA CORPORATION AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF INCOME (In millions, except per share data) Year Ended January 26, January 27, January 28, 2020 2019 2018 Revenue $ 10,918 $ 11,716 $ 9,714 Cost of revenue 4,150 4,545 3,892 Gross profit 6,768 7,171 5,822 Operating expenses Research and development 2,829 2,376 1,797 Sales, general and administrative 1,093 991 815 Total operating expenses 3,922 3,367 2,612 Income from operations 2,846 3,804 3,210 Interest income 178 136 Interest expense (52) (58) (61) Other, net (2) 14 (22) Total other income (expense) 124 92 (14) Income before income tax 2,970 3,896 3,196 Income tax expense (benefit) 174 (245) 149 Net income $ 2,796 $ 4,141 $ 3,047 69 Net income per share: Basic Diluted $ $ 4.59 $ 6.81 $ 5.09 4.52 $ 6.63 $ 4.82 599 Weighted average shares used in per share computation: Basic 609 608 Diluted 618 625 See accompanying notes to the consolidated financial statements. 632 39 NVIDIA CORPORATION AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (In millions) Year Ended January 26, January 27, January 28, 2020 2019 2018 $ 2,796 $ 4,141 $ 3,047 Net income Other comprehensive income (loss), net of tax Available-for-sale debt securities: Net unrealized gain (loss) 8 10 (5) 1 (4) (1) Reclassification adjustments for net realized gain included in net income Net change in unrealized gain (loss) 8 11 Cash flow hedges: Net unrealized gain (loss) 10 6 Reclassification adjustments for net realized gain (loss) included in net income (5) (11) Net change in unrealized gain (loss) 5 (5) Other comprehensive income (loss), net of tax 13 6 Total comprehensive income $ 2,809 $ 4,147 $ See accompanying notes to the consolidated financial statements. 3 2 (2) 3,045 40 NVIDIA CORPORATION AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (In millions, except par value) January 26, January 27, 2020 2019 ASSETS Current assets: Cash and cash equivalents $ 10,896 $ 782 Marketable securities 1 6,640 Accounts receivable, net 1,657 1,424 Inventories 979 1,575 Prepaid expenses and other current assets 157 136 Total current assets 13,690 10,557 Property and equipment, net 1,674 1,404 Operating lease assets 618 Goodwill 618 618 Intangible assets, net 49 45 Deferred income tax assets 548 560 Other assets 118 108 Total assets 17,315 $ 13,292 $ LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities: Accounts payable Accrued and other current liabilities Total current liabilities Long-term debt Long-term operating lease liabilities Other long-term liabilities Total liabilities Commitments and contingencies - see Note 13 Shareholders' equity: 687 1,097 1,784 1,991 561 775 5,111 511 818 1,329 1,988 633 3.950 6,051 Preferred stock, $.001 par value; 2 shares authorized; none issued Common stock, $.001 par value; 2,000 shares authorized: 955 shares issued and 612 outstanding as of January 26, 2020; 945 shares issued and 606 outstanding as of January 27, 2019 Additional paid-in capital 7,045 Treasury stock, at cost (342 shares in 2020 and 339 shares in 2019) (9,814) Accumulated other comprehensive income (loss) 1 Retained earnings 14,971 Total shareholders' equity 12,204 Total liabilities and shareholders' equity 17,315 S See accompanying notes to the consolidated financial statements. (9,263) (12) 12,565 9,342 13,292 January 28, 2018 $ 3,047 391 199 (359) 19 20 NVIDIA CORPORATION AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF CASH FLOWS (In millions) Year Ended January 26, January 27, 2020 2019 Cash flows from operating activities: Net income $ 2.796 S 4,141 Adjustments to reconcile net income to net cash provided by operating activities: Stock-based compensation expense 844 557 Depreciation and amortization 381 262 Deferred income taxes 18 (315) Loss on early debt conversions Other 5 (45) Changes in operating assets and liabilities: Accounts receivable (233) (149) Inventories 597 (776) Prepaid expenses and other assets 77 (55) Accounts payable 194 (135) Accrued and other current liabilities 54 256 Other long-term liabilities 28 2 Net cash provided by operating activities 4,761 3,743 Cash flows from investing activities: Proceeds from maturities of marketable securities 4,744 7,232 Proceeds from sales of marketable securities 3,365 428 Purchases of marketable securities (1.461) (11,148) Purchases of property and equipment and intangible assets (489) (600) Investments and other, net (14) (9) Proceeds from sale of long-lived assets and investments Net cash provided by (used in) investing activities 6.145 (4.097) (440) 21 90 33 481 3,502 1,078 863 (36) (593) (36) 2 1.278 - Cash flows from financing activities: Payments related to repurchases of common stock Repayment of Convertible Notes Dividends paid Proceeds related to employee stock plans Payments related to tax on restricted stock units Other Net cash used in financing activities Change in cash and cash equivalents Cash and cash equivalents at beginning of period Cash and cash equivalents at end of period (390) 149 (551) (1,579) (16) (371) 137 (1,032) (5) (2.866) (3,220) 4.002 782 $ (909) (812) (341) 139 (612) (9) (2,544) 2,236 1,766 4.002 (792) 10,114 782 $ 10.896 $ 43 | | | | | 18 - - - - - (612) - | | | | - - 1 NVIDIA CORPORATION AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY Accumulated Common Stock Other Total Outstanding Additional Treasury Comprehensive Retained Shareholders' Paid in (In millions, except per share data) Shares Amount Capital Stock Income (Loss) Earnings Equity Balances, January 29, 2017 585 $ 1 $ 4,708 $ (5,039) $ (16) $ 6,108 $ 5,762 Retained earnings adjustment due to adoption of an accounting standard related to stock-based compensation (27) (27) Other comprehensive loss (2) (2) Net income 3,047 3,047 Issuance of common stock in exchange for warrants 13 Convertible debt conversion 33 (7) (7) Issuance of common stock from stock plans 138 138 Tax withholding related to vesting of restricted stock units (612) Share repurchase (6) (909) (909) Exercise of convertible note hedges (33) 90 (90) Cash dividends declared and paid (50.570 per common share) (341) (341) Stock-based compensation 391 391 Reclassification of convertible debt conversion obligation 31 31 Balances, January 28, 2018 606 5,351 (6.650) (18) 8,787 7,471 Retained earnings adjustment due to adoption of an accounting standard related to income tax consequences of an intra-entity transfer of an asset Other comprehensive income 6 6 Net income 4,141 4,141 Convertible debt conversion 1 Issuance of common stock from stock plans 13 137 137 Tax withholding related to vesting of restricted stock units (1.032) (1.032) Share repurchase (9) (1,579) (1,579) Exercise of convertible note hedges (1) 2 (2) Cash dividends declared and paid ($0.610 per common share) (371) (371) Stock-based compensation 561 561 Balances, January 27, 2019 606 6,051 (9,263) (12) 12,565 9,342 Other comprehensive income 13 13 Net income 2,796 2,796 Issuance of common stock from stock plans 149 149 Tax withholding related to vesting of restricted stock units (3) (551) (551) Cash dividends declared and paid (S0.640 per common share) (390) (390) Stock-based compensation 845 Balances, January 26, 2020 612 $ 1 $ 7.045 $ (9,814) $ S 14.971 $ 12,204 See accompanying notes to the consolidated financial statements 8 8 - - | | - - 1 9 (3) - 845 1 NVIDIA CORPORATION AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF INCOME (In millions, except per share data) Year Ended January 26, January 27, January 28, 2020 2019 2018 Revenue $ 10,918 $ 11,716 $ 9,714 Cost of revenue 4,150 4,545 3,892 Gross profit 6,768 7,171 5,822 Operating expenses Research and development 2,829 2,376 1,797 Sales, general and administrative 1,093 991 815 Total operating expenses 3,922 3,367 2,612 Income from operations 2,846 3,804 3,210 Interest income 178 136 Interest expense (52) (58) (61) Other, net (2) 14 (22) Total other income (expense) 124 92 (14) Income before income tax 2,970 3,896 3,196 Income tax expense (benefit) 174 (245) 149 Net income $ 2,796 $ 4,141 $ 3,047 69 Net income per share: Basic Diluted $ $ 4.59 $ 6.81 $ 5.09 4.52 $ 6.63 $ 4.82 599 Weighted average shares used in per share computation: Basic 609 608 Diluted 618 625 See accompanying notes to the consolidated financial statements. 632 39 NVIDIA CORPORATION AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (In millions) Year Ended January 26, January 27, January 28, 2020 2019 2018 $ 2,796 $ 4,141 $ 3,047 Net income Other comprehensive income (loss), net of tax Available-for-sale debt securities: Net unrealized gain (loss) 8 10 (5) 1 (4) (1) Reclassification adjustments for net realized gain included in net income Net change in unrealized gain (loss) 8 11 Cash flow hedges: Net unrealized gain (loss) 10 6 Reclassification adjustments for net realized gain (loss) included in net income (5) (11) Net change in unrealized gain (loss) 5 (5) Other comprehensive income (loss), net of tax 13 6 Total comprehensive income $ 2,809 $ 4,147 $ See accompanying notes to the consolidated financial statements. 3 2 (2) 3,045 40 NVIDIA CORPORATION AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (In millions, except par value) January 26, January 27, 2020 2019 ASSETS Current assets: Cash and cash equivalents $ 10,896 $ 782 Marketable securities 1 6,640 Accounts receivable, net 1,657 1,424 Inventories 979 1,575 Prepaid expenses and other current assets 157 136 Total current assets 13,690 10,557 Property and equipment, net 1,674 1,404 Operating lease assets 618 Goodwill 618 618 Intangible assets, net 49 45 Deferred income tax assets 548 560 Other assets 118 108 Total assets 17,315 $ 13,292 $ LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities: Accounts payable Accrued and other current liabilities Total current liabilities Long-term debt Long-term operating lease liabilities Other long-term liabilities Total liabilities Commitments and contingencies - see Note 13 Shareholders' equity: 687 1,097 1,784 1,991 561 775 5,111 511 818 1,329 1,988 633 3.950 6,051 Preferred stock, $.001 par value; 2 shares authorized; none issued Common stock, $.001 par value; 2,000 shares authorized: 955 shares issued and 612 outstanding as of January 26, 2020; 945 shares issued and 606 outstanding as of January 27, 2019 Additional paid-in capital 7,045 Treasury stock, at cost (342 shares in 2020 and 339 shares in 2019) (9,814) Accumulated other comprehensive income (loss) 1 Retained earnings 14,971 Total shareholders' equity 12,204 Total liabilities and shareholders' equity 17,315 S See accompanying notes to the consolidated financial statements. (9,263) (12) 12,565 9,342 13,292 January 28, 2018 $ 3,047 391 199 (359) 19 20 NVIDIA CORPORATION AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF CASH FLOWS (In millions) Year Ended January 26, January 27, 2020 2019 Cash flows from operating activities: Net income $ 2.796 S 4,141 Adjustments to reconcile net income to net cash provided by operating activities: Stock-based compensation expense 844 557 Depreciation and amortization 381 262 Deferred income taxes 18 (315) Loss on early debt conversions Other 5 (45) Changes in operating assets and liabilities: Accounts receivable (233) (149) Inventories 597 (776) Prepaid expenses and other assets 77 (55) Accounts payable 194 (135) Accrued and other current liabilities 54 256 Other long-term liabilities 28 2 Net cash provided by operating activities 4,761 3,743 Cash flows from investing activities: Proceeds from maturities of marketable securities 4,744 7,232 Proceeds from sales of marketable securities 3,365 428 Purchases of marketable securities (1.461) (11,148) Purchases of property and equipment and intangible assets (489) (600) Investments and other, net (14) (9) Proceeds from sale of long-lived assets and investments Net cash provided by (used in) investing activities 6.145 (4.097) (440) 21 90 33 481 3,502 1,078 863 (36) (593) (36) 2 1.278 - Cash flows from financing activities: Payments related to repurchases of common stock Repayment of Convertible Notes Dividends paid Proceeds related to employee stock plans Payments related to tax on restricted stock units Other Net cash used in financing activities Change in cash and cash equivalents Cash and cash equivalents at beginning of period Cash and cash equivalents at end of period (390) 149 (551) (1,579) (16) (371) 137 (1,032) (5) (2.866) (3,220) 4.002 782 $ (909) (812) (341) 139 (612) (9) (2,544) 2,236 1,766 4.002 (792) 10,114 782 $ 10.896 $ 43 | | | | | 18 - - - - - (612) - | | | | - - 1 NVIDIA CORPORATION AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY Accumulated Common Stock Other Total Outstanding Additional Treasury Comprehensive Retained Shareholders' Paid in (In millions, except per share data) Shares Amount Capital Stock Income (Loss) Earnings Equity Balances, January 29, 2017 585 $ 1 $ 4,708 $ (5,039) $ (16) $ 6,108 $ 5,762 Retained earnings adjustment due to adoption of an accounting standard related to stock-based compensation (27) (27) Other comprehensive loss (2) (2) Net income 3,047 3,047 Issuance of common stock in exchange for warrants 13 Convertible debt conversion 33 (7) (7) Issuance of common stock from stock plans 138 138 Tax withholding related to vesting of restricted stock units (612) Share repurchase (6) (909) (909) Exercise of convertible note hedges (33) 90 (90) Cash dividends declared and paid (50.570 per common share) (341) (341) Stock-based compensation 391 391 Reclassification of convertible debt conversion obligation 31 31 Balances, January 28, 2018 606 5,351 (6.650) (18) 8,787 7,471 Retained earnings adjustment due to adoption of an accounting standard related to income tax consequences of an intra-entity transfer of an asset Other comprehensive income 6 6 Net income 4,141 4,141 Convertible debt conversion 1 Issuance of common stock from stock plans 13 137 137 Tax withholding related to vesting of restricted stock units (1.032) (1.032) Share repurchase (9) (1,579) (1,579) Exercise of convertible note hedges (1) 2 (2) Cash dividends declared and paid ($0.610 per common share) (371) (371) Stock-based compensation 561 561 Balances, January 27, 2019 606 6,051 (9,263) (12) 12,565 9,342 Other comprehensive income 13 13 Net income 2,796 2,796 Issuance of common stock from stock plans 149 149 Tax withholding related to vesting of restricted stock units (3) (551) (551) Cash dividends declared and paid (S0.640 per common share) (390) (390) Stock-based compensation 845 Balances, January 26, 2020 612 $ 1 $ 7.045 $ (9,814) $ S 14.971 $ 12,204 See accompanying notes to the consolidated financial statements 8 8 - - | | - - 1 9 (3) - 845 1